Gold pushes higher on increased safe-haven demand as Middle East conflict intensifies

- Gold rises on increased safe-haven demand as the conflict in the Middle East deepens.

- Israel steps up bombing of Beirut and is poised to launch a retaliatory attack on Iran after a bomb explodes near Netanyahu’s house.

- XAU/USD continues trending higher as it pushes deeper into territory above $2,700.

Gold (XAU/USD) is already up half a percent to trade in the $2,730s on Monday during the European session after rising over 1.0% on Friday. The precious metal is gaining on a mixture of increased safe-haven demand due to the intensifying conflict in the Middle East and moves by the People’s Bank of China (PBoC) to further ease credit conditions by cutting interest rates.

The PBoC’s move to lower its one-year and five-year prime loan borrowing rates not only has the effect of increasing Gold’s attractiveness as a non-interest-paying asset, but also suggests the potential of more demand for Gold from Chinese investors and private buyers, who already make up the largest market for the commodity in the world.

Gold rises as Middle East tensions reach boiling point

Gold rallies as investor demand for safety increases due to the deepening conflict in the Middle East. Israel has stepped up its bombardment of Beirut by destroying several economic targets in an attempt to wipe out the bank that provides Hezbollah with its funding. The bank, which also serves a large Shiite population of muslims in Lebanon, is the main conduit for donations to Hezbollah, including $50 million a year from Iran, according to Bloomberg News. By destroying it, Israel not only hopes to remove the organization’s principal source of funding but also ferment discord amongst Hezbollah and the Shiite Lebanese community.

Further, Israel’s retaliatory attack on Iran is back on the table after an Iranian drone penetrated Israeli air-defense systems and exploded near the Israeli Prime Minister Benjamin Netanyahu’s private residence. Following the attack, Netanyahu convened several emergency meetings to discuss preparations for Israel’s delayed attack on Iran.

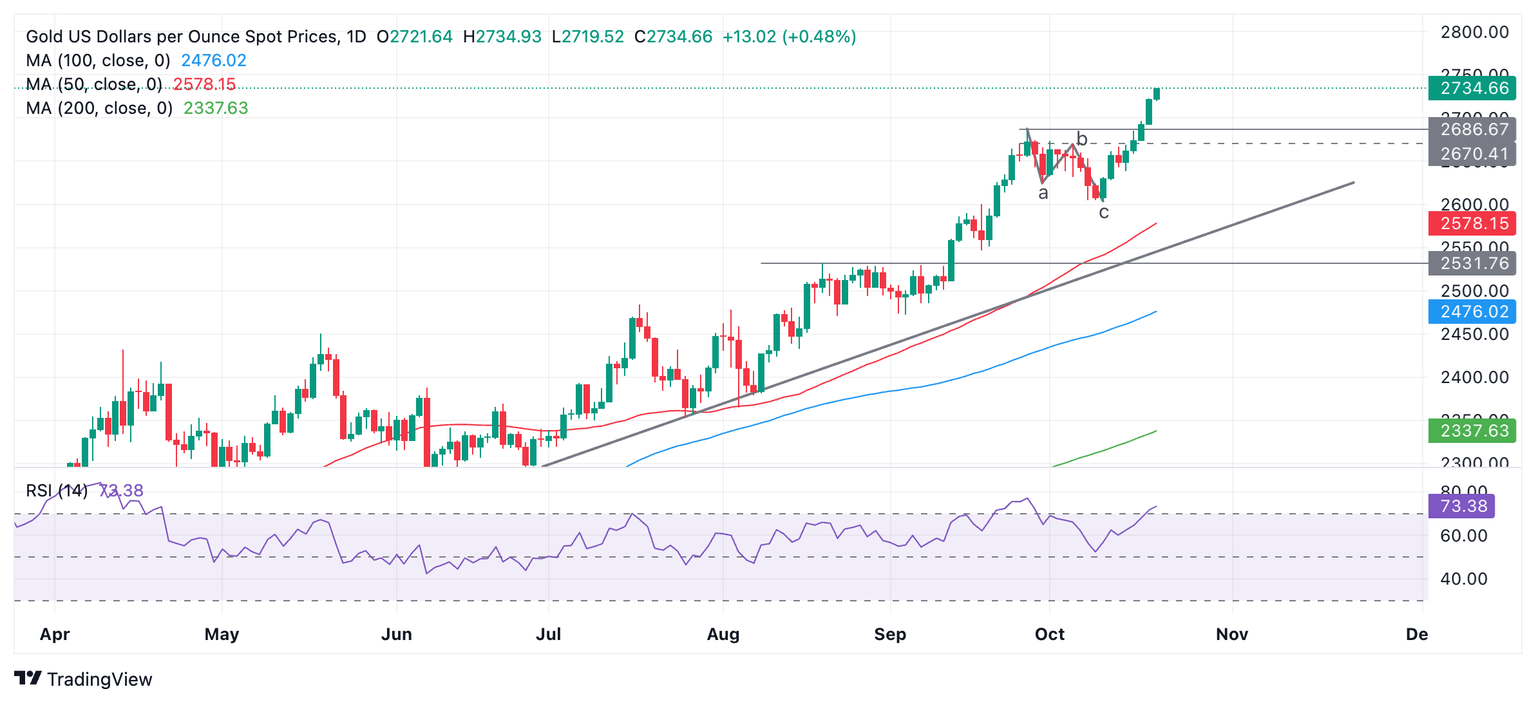

Technical Analysis: Gold approaches next target as trend extends

Gold is rising in a steady uptrend on all time frames (short, medium and long) and after breaching the $2,700 mark it is now on its way to the next target at $2,750.

XAU/USD Daily Chart

The Relative Strength Index (RSI) is overbought, however, advising long-holders not to add to their positions because of an increased risk of a pullback. Should RSI close back in neutral territory, it will be a sign for long-holders to close their positions and open shorts as a deeper correction may evolve. Support lies at $2,700 (key level) and $2,685 (September high).

Gold’s strong overall uptrend, however, suggests that any corrections are likely to be short-lived, and afterward the broader bull trend will probably resume.

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.