Gold plunges amid trade war worries, lower US yields

- XAU/USD traders book profits as US Treasury yields decline further.

- Trump’s tariff threats on Mexico and Canada fuel market uncertainty.

- Weak US Consumer Confidence, layoffs raise stagflation fears.

Gold prices plummeted on Tuesday during the North American session as traders booked profits amid falling US Treasury bond yields. The Greenback also extended its losses as traders remained uneasy about United States (US) President Donald Trump's changing trade policies. XAU/USD trades at $2,905 after hitting a daily low of $2,888.

Uncertainty about US President Donald Trump's use of tariffs as a negotiation tool keeps traders risk-averse. On Monday, Trump hinted that tariffs on Mexican and Canadian imports will start next week, despite efforts made by both nations to fight fentanyl and illegal migration.

Data-wise, the Conference Board (CB) revealed that Consumer Confidence deteriorated. The report depicted Americans' pessimism due to the current controversial policies of the Trump administration. Additionally, unprecedented layoffs of federal workers are keeping consumers on the sidelines.

This report and last week’s University of Michigan (UoM) Consumer Sentiment fueled concerns about a stagflationary scenario in the United States.

This week, the US economic docket will feature Federal Reserve (Fed) speakers, Durable Goods Orders, the second reading of Q4 GDP, and the release of the Fed’s preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index.

Daily digest market movers: Gold and US Treasury yields plunge

- The CB Consumer Confidence dropped to an eight-month low from 104.1 to 98.3 in February. It was the sharpest pace of deterioration in three and a half years. Consumers' inflation expectations average over 12 months jumped from 5.2% to 6%, revealed the Conference Board.

- Richmond Fed President Thomas Barkin revealed that he’s taking a wait-and-see approach to adjusting interest rates until it becomes clear that inflation is moving lower to the Fed’s 2% goal.

- Money markets had priced in that the Federal Reserve (Fed) would ease policy by 58 basis points (bps), up from 40 bps last week, revealed data from Prime Market Terminal.

- The US 10-year Treasury note yield plunges ten basis points (bps) to 4.294% capping Bullion prices fall. US real yields, as measured by the yield in the US 10-year Treasury Inflation-Protected Securities (TIPS), edge lower six and a half bps to 1.907%.

- Last week, Goldman Sachs upwardly revised Gold price projections to $3,100 by the end of 2025.

- Money market fed funds futures are pricing in 50 basis points of easing by the Fed in 2025.

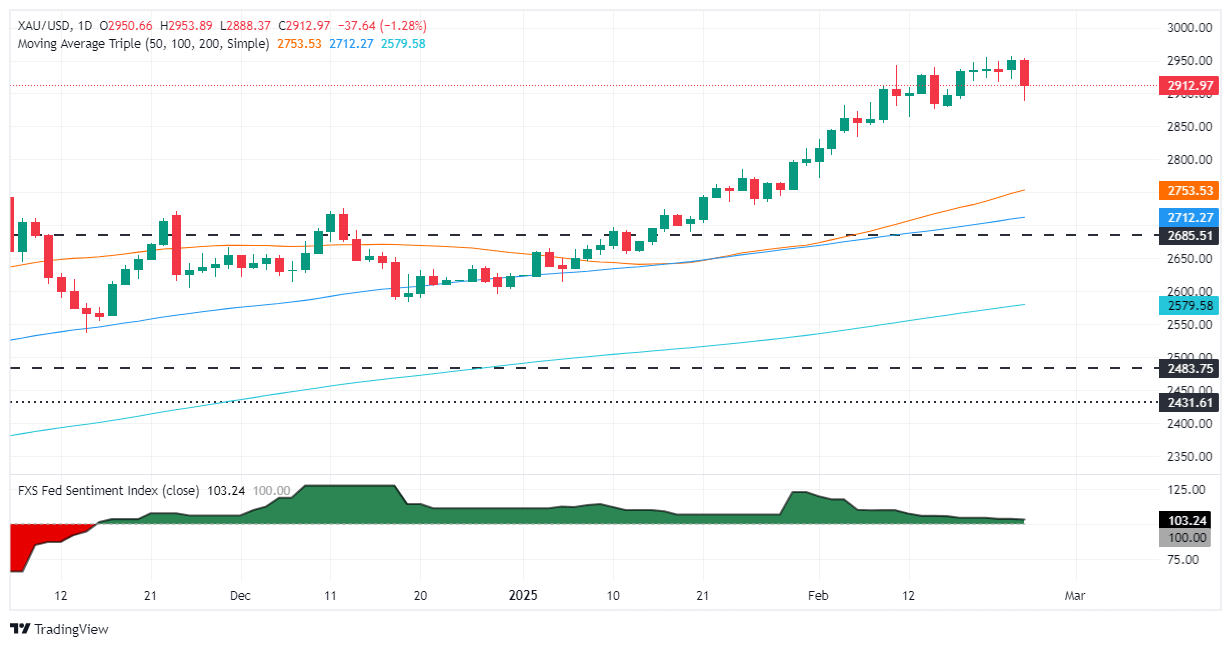

XAU/USD technical outlook: Gold price retraces towards $2,900

Gold prices fell on Tuesday, exposing the precious metal to heavy selling pressure, yet bears seem not to have the strength to achieve a daily close of XAU/USD below $2,900. If sellers achieve that outcome, the February 14 daily low of $2,877 will be exposed, followed by the February 12 swing low of $2,864. Despite this, the uptrend remains intact unless Gold falls below $2,800.

Conversely, if Bullion rises past the year-to-date (YTD) high of $2,956, the next resistance would be $3,000.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.