Gold price slumps as risk-aversion wanes, amid Middle East ceasefire

- Gold sees significant sell-off on developments in the Middle East.

- Markets viewed Scott Bessent's appointment as Treasury Secretary positively.

- Possible ceasefire between Israel and Lebanon keeps Gold heavy.

Gold price (XAU/USD) plummeted during Monday’s North American session as news from a ceasefire between Lebanon and Israel crossed the wires, exacerbating appetite for riskier assets. This, along with the nomination of Scott Bessent as the Treasury Secretary for Trump’s administration, weighed on the yellow metal. The XAU/USD trades at $2,620, down over 3%.

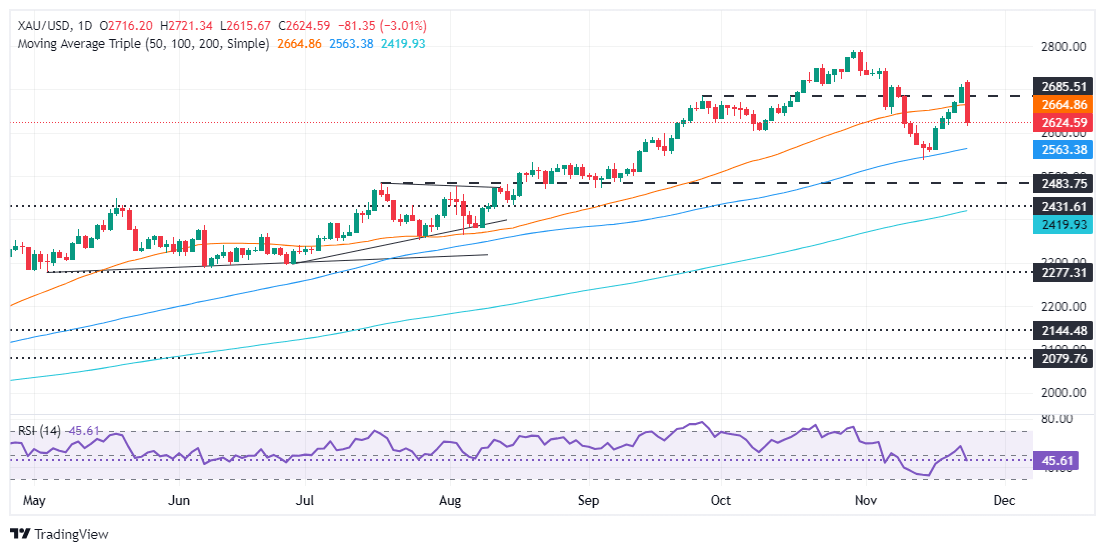

Improvement in risk appetite is the driver of Gold’s price action. The non-yielding metal has fallen below the 50-day Simple Moving Average (SMA) of $2,664, opening the door for further downside.

Market players cheered Bessent’s appointment. UBS Commodity Analyst Giovanni Staunovo commented, “Some market participants see him as less negative about a trade war, considering his comments on a phased approach for implementing tariffs.”

According to Joaquin Monfort, an analyst at FX Street, Bessent advocates for the “three-threes” policy. The policy suggests he would try to reduce the US deficit by 3% of annual Gross Domestic Product (GDP), achieve a 3% annual GDP rate, and raise US Crude Oil production by 3 million bpd.

A recent report revealed by Axios revealed that Israel and Lebanon are close to agreeing to terms to end the Israel-Hezbollah conflict, which lifted Gold prices to record highs.

Bullion traders are also eyeing the release of the Consumer Confidence data, the latest Federal Open Market Committee (FOMC) Meeting Minutes, Initial Jobless Claims, and the Fed’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) Price Index.

Daily digest market movers: Gold plummets to five-day low beneath $2,650

- Gold prices recovered as US real yields collapsed 14 basis points to 1.925% from 2.068%.

- The US Dollar Index tumbles over 0.64%, down to 106.80.

- Traders trimmed the chances for a 25 bps rate cut at the December meeting. The CME FedWatch Tool sees a 56% probability of lowering rates, down from a 58% chance two days ago.

- According to Chicago Board of Trade data via the December fed funds futures contract, investors are pricing in a 22-basis-point rate cut by the Federal Reserve by the end of 2024.

Technical outlook: Gold price sellers step in, pushing prices under $2,630

Gold's price rally halted on Monday as sellers pushed XAU/USD beneath the $2,700 figure, prolonging its drop below $2,630. If bears clear the latter, the next support would be $2,600. If surpassed, a move to the 100-day SMA of $2,562 is on the cards, immediately followed by the November 14 swing low of $2,536.

If buyers recover the 50-day SMA, they could challenge $2,700. Once surpassed, the next stop would be $2,750, ahead of the all-time high at $2,790.

Oscillators like the Relative Strength Index (RSI) have shifted bearishly, indicating sellers are in charge.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.