Gold fails to capitalize on falling yields amidst US Dollar rebound

- Gold prices see second day of decline, falling to $2,159 after peaking at an all-time high of $2,223.

- The Federal Reserve's dovish stance on interest rates keeps US yields down, except for US Dollar.

- Odds for Fed rate cut in June remain above 70% via CME FedWatch Tool.

Gold prices drop for the second consecutive day on Friday after hitting an all-time high of $2,223 on Thursday. Renewed demand for the Greenback amid falling US Treasury bond yields surprised traders and weighed on the yellow metal. At the time of writing, XAU/USD trades at $2,159, losing 0.90%.

The Federal Reserve's March meeting emphasized the need for policymakers to lower interest rates despite the latest two inflation reports suggesting that it´s reaccelerating. This sponsored XAU/USD’s leg up to new all-time highs, but it was short-lived.

On Thursday, traders booked profits, triggering a decline of $36 as the yellow metal finished the day with losses of 0.22%.

US Treasury yields failed to climb even though the Greenback is on a two-day rally. It gained 0.47% and was up at 104.45 late in Friday’s North American session. The lack of economic data on the calendar has kept the markets slightly calm ahead of the weekend.

Daily digest market movers: Gold price dips despite falling US yields

- Jerome Powell emphasized that the Fed had made progress on tempering inflation. Despite printing two straight months of higher prices, that hasn’t changed the Fed’s outlook for price stability.

- Fed policymakers kept the Dot Plot unchanged for 2024. Still, the 2025 Dot Plot was revised up from 3.6% to 3.9%.

- For 2024, the Federal Open Market Committee (FOMC) forecasts that the economy will grow 2.1%, up from 1.4%, while the Unemployment Rate will remain at 4%.

- Inflation figures in the United States, measured by the Fed’s favorite gauge for inflation, the Personal Consumption Expenditures (PCE), are now the focus. They are expected to be at 2.4%, while core PCE is projected at 2.6%, up from 2.4%.

- During the March 18 to 22 week, the US docket revealed that the jobs market is solid. However, the economy faces challenges like the slowdown revealed by S&P Global PMIs data. However, the housing market has been mildly recovering, and Housing Starts, Building Permits and Existing Home sales improved.

- According to the CME FedWatch Tool, expectations for a June rate cut stand at 75%.

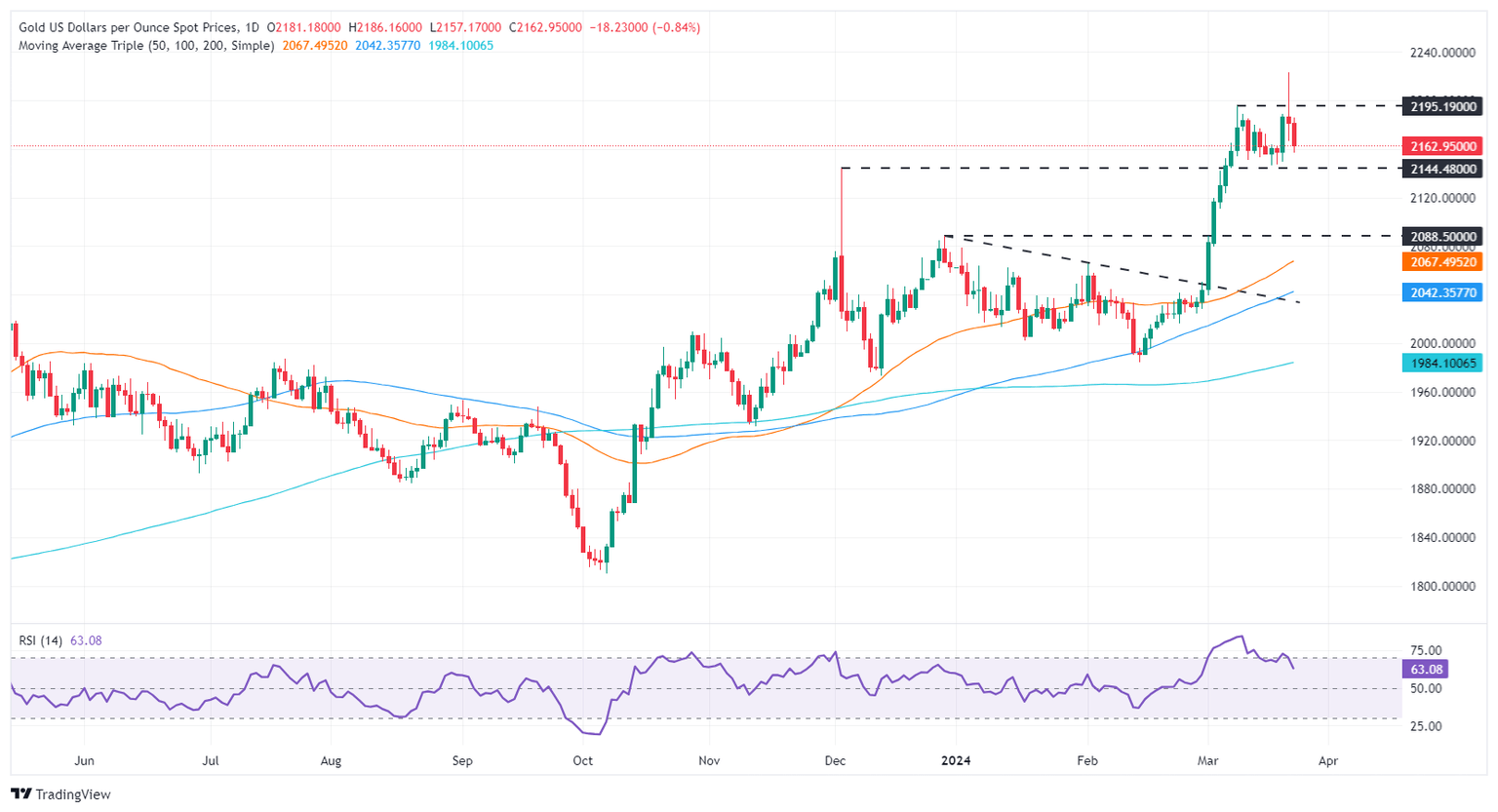

Technical analysis: Gold traders' failure at $2,200 exposes $2,180 mark

From a technical standpoint, XAU/USD is consolidating above $2,150, hoovering around that area for the last eleven days. Nevertheless, if sellers stepped in, dragging Gold prices below the aforementioned barrier, a fall toward the December 28 high-turned-support at $2,088 is on the cards. However, on its way down, key support levels must be broken, like the December 4 high, which turned support at $2,146, before challenging the $2,100 figure.

On the flip side, if buyers push prices toward $2,200, that will expose the current all-time high at $2,223 before aiming toward $2,250.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.