Gold marches higher as weak jobless claims, increase Fed rate cut speculation

- Gold rebounds above $2,330, fueled by drop in US Treasury yields, weaker Greenback.

- Unemployment claims increase, which pressures Fed to achieve its dual mandate goals and possibly cut rates sooner.

- Fed officials reflect mixed views on economy's health and monetary policy direction.

Gold price resumed its uptrend on Thursday and climbed more than 1% as US Treasury yields dropped, undermining the Greenback's appetite. Labor market data from the United States (US) was softer, increasing the chances for a rate cut by the Federal Reserve (Fed) despite dealing with inflationary pressure.

The XAU/USD trades above the $2,330 area after bouncing off daily lows at $2,306. On Thursday, the US Bureau of Labor Statistics (BLS) revealed the number of Americans filing for unemployment benefits increased above estimates and the previous report, an indication the economy is losing strength. This might influence the Fed in future monetary policy decisions after acknowledging that they are focused on their dual mandate — full employment and inflation.

Meanwhile, a slew of Fed officials had crossed the newswires during the week. Meanwhile, a slew of Fed officials had crossed the newswires during the week. Recently, San Francisco Fed President Mary Daly said that lowering inflation to the Fed’s target would be a bumpy ride, adding the last three months of data, leave policymakers uncertain on the future of inflation

On Monday, Richmond Fed President Thomas Barkin commented that recent data has been “disappointing,” adding that the job is not done. Elsewhere, New York Fed President John Williams noted that consumers are still spending, adding that the economy remains healthy despite growing more slowly.

On Tuesday, Neel Kashkari of the Minneapolis Fed noted that the most likely scenario is to hold interest rates where they are in 2024, adding that inflation progress has stalled. Yesterday, it was Boston Fed President Susan Collins' turn. She stated that she’s optimistic that inflation could be brought to the 2% goal, adding that current monetary policy is well-positioned and “moderately restrictive.”

Daily digest market movers: Gold strengthens as US data increases Fed rate cut hopes

- Gold prices fell amid lower US Treasury yields and a strong US Dollar. The US 10-year Treasury note is yielding 4.457%, down four basis points (bps) from its opening level. The US Dollar Index (DXY), which tracks the Greenback's performance against six other currencies, dives 0.25% to 105.25.

- US Department of Labor reported that Initial Jobless Claims for the week ending May 4 rose to 231K, exceeding the estimates of 210K and showing an increase from the previous week's figure of 209K. The uptick in jobless claims suggests a cooling US labor market.

- Softer-than-expected labor market figures, as shown by last month’s US employment report and unemployment claims data, may exert pressure on the Fed. Officials recognized that the risks to achieving the Fed's dual mandate of fostering maximum employment and price stability have become more balanced over the past year.

- Gold has advanced more than 12% so far in 2024, courtesy of expectations that major central banks will begin to reduce rates. Renewed fears that the Middle East conflict could resume between Israel and Hamas can sponsor a leg up in XAU/USD prices.

- According to Reuters, the People’s Bank of China (PBoC) continued to accumulate Gold for the 18th straight month, adding 60,000 troy ounces to its reserves amid higher prices.

- After the data release, Fed rate cut probabilities increased from around 33 basis points (bps) to 38 bps points of rate cuts toward the end of 2024.

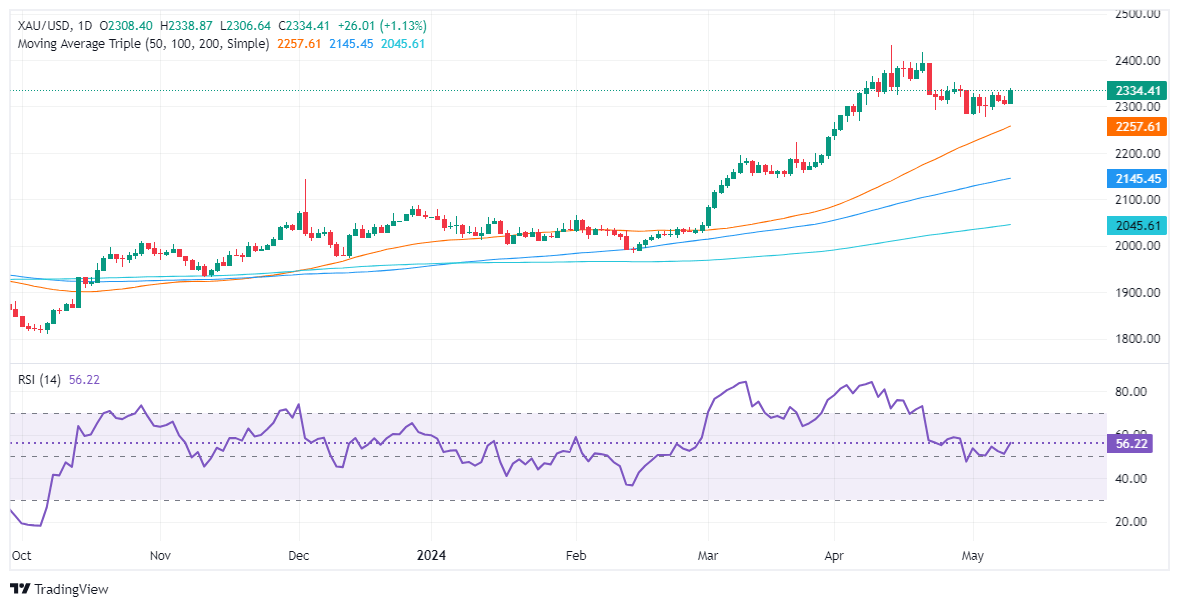

Technical analysis: Gold price resumes its uptrend, climbs above $2,330

Gold remains bullishly biased, even though it retreated some 6% from its all-time high of $2,431, hit on April 12. Momentum shows that buyers are gathering steam, which is visible in the Relative Strength Index (RSI) shifting bullish since the start of May.

That said, XAU/USD buyers need to clear the April 26 high, the latest cycle high at $2,352. Once surpassed, that would expose the $2,400 figure. A breach of the latter will accelerate the rally toward April’s 19 high at $2,417 before challenging the all-time high of $2,431.

Conversely, further losses are seen if Gold slides beneath the $2,300 mark. The next support would be the 50-day Simple Moving Average (SMA) at $2,249.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.