Gold price edges lower amid Fed’s hawkish remarks

Most recent article: Gold slumps on hawkish FOMC minutes, hurt rate cut hopes

- Gold price gives up gains on Wednesday on the modest USD recovery.

- The Fed’s hawkish comments and stronger US data support USD, weighing on the precious metal.

- Gold traders will focus on Fed’s Beige Book and member Williams’ speech later on Wednesday.

Gold price (XAU/USD) snaps the three-day winning streak on Wednesday amid the modest rebound of the Greenback. Additionally, the hawkish remarks from several Federal Reserve (Fed) officials and stronger-than-expected US economic data diminish expectations of the Fed rate cut in September. This, in turn, boosts the US Dollar (USD) and weighs on the USD-denominated gold price. On the other hand, geopolitical tensions and uncertainty could drive the safe-haven assets for gold. The growing demand from the central bank will continue to underpin higher gold prices in the near term.

Gold traders will keep an eye on the Fed’s Beige Book and the Fed’s John Williams speech on Wednesday. The release of the US Core Personal Consumption Expenditures Price Index (Core PCE) will take centre stage on Friday, which is estimated to show an increase of 0.3% MoM and 2.8% YoY in April. Any signs of stickier inflation in the US could trigger the possibility of delaying the Fed rate cut, exerting some selling pressure on the yellow metal as higher interest rates will increase gold's opportunity costs.

Daily Digest Market Movers: Gold price faces some pressure from hawkish Fedspeak

- Israeli Prime Minister Benjamin Netanyahu has vowed to continue the war against Hamas amid international condemnation of an air strike that killed at least 45 people in Rafah on Sunday, per the BBC.

- The World Gold Council reported that global physically-backed gold exchange-traded funds (ETFs) witnessed a net outflow of 11.3 metric tonnes last week.

- UBS analysts expect gold prices to reach $2,500 an ounce by September and hit $2,600 an ounce by year-end. The forecast is higher than the initial estimates of $2,400 and $2,500 per ounce, respectively.

- Consumer Confidence improved slightly in May, the Conference Board reported on Tuesday. The figure rose to 102.0 in May from 97.0 in April, beating the estimation of 95.9.

- Fed Governor Michelle Bowman said on Tuesday that she would have supported either waiting to start slowing the quantitative tightening pace or a more moderate tapering process than announced earlier this month.

- Fed Minneapolis President Neel Kashkari said that the central bank should wait for significant progress on inflation before cutting interest rates, adding that he expected no more than two rate cuts in 2024.

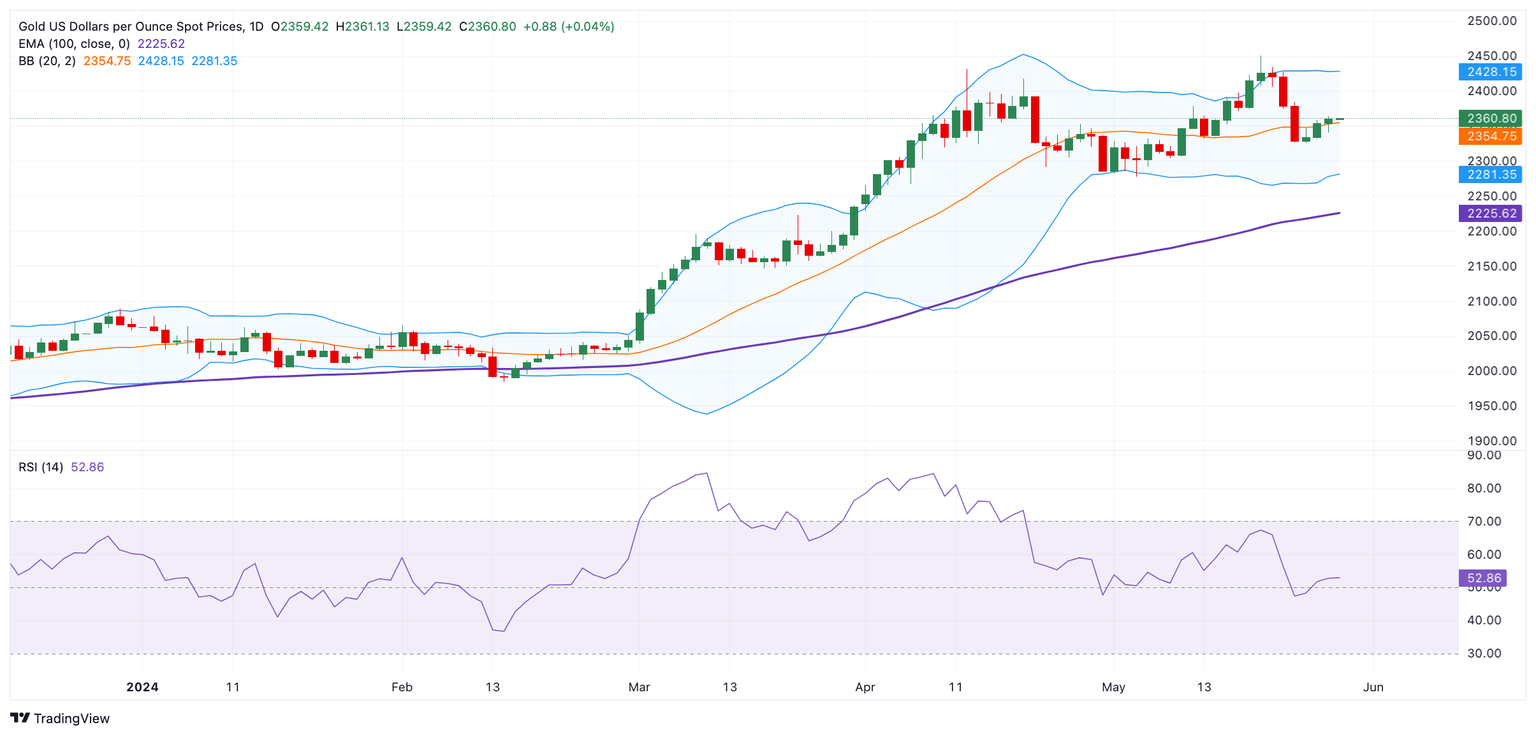

Technical analysis: Gold price stays bullish in the longer term

The gold price trades with mild losses on the day. Technically, the bullish outlook of the precious metal remains intact as it holds above the key 100-day Exponential Moving Average (EMA) on the 1-hour chart. However, the neutral level of the 14-day Relative Strength Index (RSI) around the 50-midline indicated that further consolidation or directionlessness looks favourable for the time being.

The first upside target will emerge at the upper boundary of the Bollinger Band at $2,427. Sustained yellow metal rallies might pave the way to the all-time high of $2,450. The bullish breakout above this level will see a rally to the $2,500 psychological figure.

On the flip side, a low of May 24 at $2,325 acts as an initial support level for XAU/USD. The next contention level is seen at the $2,300 round mark. Any follow-through selling below this level will expose the lower limit of the Bollinger Band at $2,277, followed by the 100-day EMA of $2,222.

US Dollar price today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.05% | 0.08% | 0.11% | -0.02% | 0.02% | 0.16% | 0.02% | |

| EUR | -0.07% | 0.03% | 0.07% | -0.06% | -0.03% | 0.12% | -0.03% | |

| GBP | -0.07% | -0.01% | 0.04% | -0.11% | -0.06% | 0.09% | -0.04% | |

| CAD | -0.12% | -0.05% | -0.03% | -0.15% | -0.09% | 0.04% | -0.09% | |

| AUD | 0.01% | 0.06% | 0.11% | 0.13% | 0.04% | 0.18% | 0.07% | |

| JPY | -0.02% | 0.04% | 0.06% | 0.09% | -0.03% | 0.14% | 0.00% | |

| NZD | -0.16% | -0.11% | -0.09% | -0.04% | -0.18% | -0.13% | -0.16% | |

| CHF | -0.04% | 0.03% | 0.06% | 0.09% | -0.06% | -0.01% | 0.13% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.