Gold price gains 1.50% after reciprocal tariffs are making a comeback

- Gold price pops on Thursday after two days of firm selling pressure.

- US President Trump pours cold water on earlier de-escalating statements, China may receive a new tariff rate in the next two to three weeks.

- Markets are back to square one with equities on the back foot and safe-haven Gold being bid.

Gold price (XAU/USD) recovers from a two-day decline and traders around $3,335 at the time of writing on Thursday after two days of firm selling pressure since it topped at $3,500 on Tuesday. United States (US) President Donald Trump released more comments from the Oval Office late Wednesday, signaling that China may receive a new tariff rate in the next “two to three weeks” while countries that are currently in the negotiation phase might see reciprocal tariffs come in if negotiations are not going the way Trump wants, Bloomberg reports. Meanwhile China has responded by saying it will not come to the negotiation table if first the tariffs are not lifted, before negotiations can even take place.

Meanwhile, US Treasury Secretary Scott Bessent said on Wednesday that President Trump’s earlier comments were not an offer to take down US tariffs on China on a unilateral basis. When asked if there was no unilateral offer from the president to de-escalate, Bessent said “not at all”, Bloomberg reports. The Treasury Secretary said that the administration is looking at multiple factors, not just tariffs, but including non-tariff barriers and government subsidies for China.

Daily digest market movers: China strong talks

- China has called on the US to “completely cancel all unilateral tariff measures” if it wants trade talks, the Financial Times reports on Thursday.

- The Swiss National Bank (SNB) has reported that its Gold holdings allowed the central bank to report a profit for the first quarter. The SNB notched up a gain of 6.7 billion Swiss Francs (CHF) from January through March, the central bank said in a statement on Thursday, Bloomberg reports.

- Gold futures in Shanghai followed the recent sell-off in Gold and priced the largest intraday drop since 2013. Chinese investors rushed to take profit on the assumption that a China-US trade deal was imminent after comments from US President Donald Trump on Tuesday and Wednesday.

- Several trading firms are still signaling healthy buying taking place in Gold. “The temporary reprieve from Trump has fizzled out,” said Priyanka Sachdeva, a Singapore-based analyst at Philip Nova Pte. “Investors who missed the dip-buying wagon earlier in April drove the rise today.”, Bloomberg reports.

Gold Price Technical Analysis: Not as planned

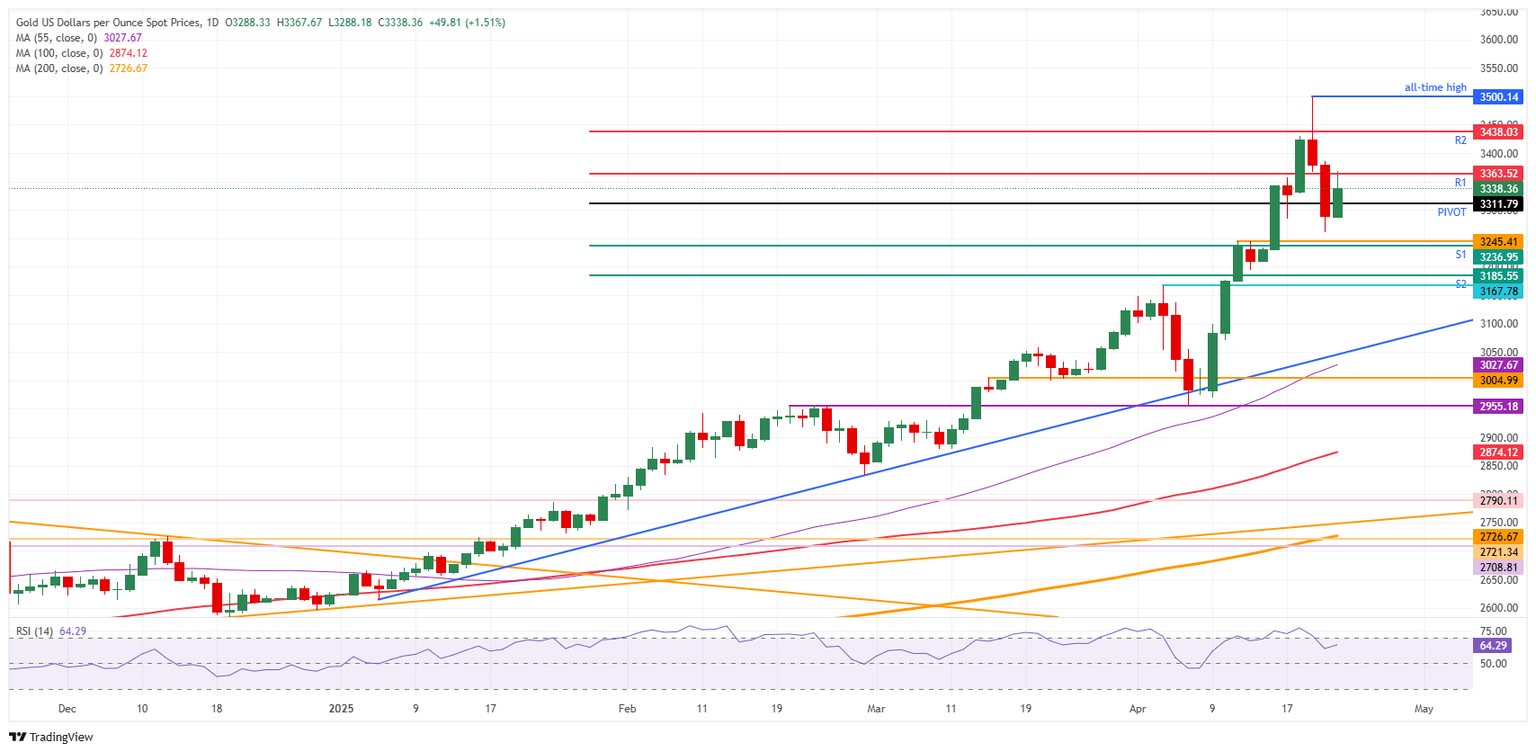

Bullion is seeing a slight recovery on Thursday and trades again above $3,300 after a quite harsh correction. Technical traders, though, might not be that rejoicing when looking at the daily price action, with Gold rejected on the topside at $3,367 earlier in the day, which roughly coincides with the daily R1 resistance at $3,363.

Looking at technical levels, the daily Pivot Point at $3,311 has already been recovered in early Asian trading, with the R1 intraday resistance already tested and rejected at $3,363. Further up, Gold price could extend the rally to the R2 resistance at $3,438.

On the downside, a floor is being formed near $3,245 (April 11 high) as an important technical pivotal level, with the S1 support at $3,236 just underneath it. In case that area does not hold, the S2 support at $3,185 and the technical pivotal level at $3,167 (April 3 high) should hold any downside pressure.

XAU/USD: Daily Chart

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

BRANDED CONTENT

Not all brokers provide the same benefits for Gold trading, making it essential to compare key features. Knowing each broker’s strengths will help you find the ideal fit for your trading strategy. Explore our detailed guide on the best Gold brokers.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.