Gold prices skyrocketed as Powell’s words boosted the yellow metal

- Gold prices rose over 0.40% after the Federal Reserve announced that it would hold interest rates steady and slow down its balance sheet reduction.

- Fed Chairman Jerome Powell emphasizes a cautious approach, stating rate cuts are off the table until inflation consistently moves towards the 2% target.

- Powell’s comments during the press conference highlight a "meeting by meeting" approach to future monetary policy decisions.

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction. In addition, Fed Chair Jerome Powell failed to provide forward guidance regarding lowering interest rates during the rest of the year.

The XAU/USD trades at $2,323, up by more than 0.40% as Fed Chairman Jerome Powell takes the stance. He said it wouldn’t be appropriate to cut rates until they have confidence that inflation is trending toward its 2% goal, adding that this year's inflation data “has not given us that greater confidence.”

During his press conference, Fed Chair Jerome Powell said they would decide monetary policy “meeting by meeting,” while adding that slowing the pace of balance sheet runoff “will ensure a smooth transition for money markets.”

He added the Fed’s belief that monetary policy is sufficiently restrictive to curb inflation and disregarded the potential of hiking rates when he asked.

Earlier, the Federal Reserve opted to maintain the federal funds rate at 5.25%-5.50%. In their statement noted that the risks associated with achieving the Fed's dual mandate, which focuses on employment and inflation, have become more balanced over the past year. Despite acknowledging progress on inflation, they also recognized that recent data suggest this progress has stalled.

Additionally, Fed policymakers announced a significant change to their balance sheet policies. Starting in June, they will reduce their monthly reduction of holdings in US Treasury securities from $60 billion to $25 billion, signaling a shift in their approach to balance sheet normalization.

Daily digest market movers: Gold price stays firm amid steady US Dollar, falling US yields

- Gold price climbs as US Treasury bond yields drop. The US 10-year Treasury bond yield has fallen three basis points (bps) to 4.653%, boosting the golden metal. At the same time, the Greenback, as measured by the US Dollar Index (DXY), is virtually unchanged, down 0.03% at 106.20.

- US manufacturing business activity showed mixed results recently. The S&P Global Manufacturing PMI registered at 50.0, which was above expectations but lower than the previous month's 51.9, indicating a stabilization in manufacturing activity.

- Contrarily, the ISM Manufacturing PMI indicated a contraction in the sector with a reading of 49.2, falling short of the expected 50.0 and down from March's expansionary figure of 50.3.

- April’s ADP Employment Change reported an increase of 192,000 jobs, surpassing estimates of 175,000 but still below the upwardly revised March figure of 208,000. Additionally, the JOLTS Job Openings for March dropped to 8.488 million, marking the lowest level of job openings reported, down from 8.813 million.

- The US economy continues to print mixed readings. Last week, the Gross Domestic Product (GDP) missed the mark. Still, inflationary data linked to the first quarter of 2024 sounded the alarm that the price trend is shifting to the upside, which might prevent the Fed from easing policy sooner than expected.

- On May 3, the US Bureau of Labor Statistics (BLS) is expected to reveal April’s Nonfarm Payrolls figures, which are expected to come at 243K, below March’s 303K. The Unemployment Rate is estimated to stay at 3.8%, while Average Hourly Earnings would likely remain unchanged at 0.3% MoM.

- Data from the Chicago Board of Trade (CBOT) suggests that traders expect the fed funds rate to finish 2024 at 5.100%, up from 5.080% on Tuesday.

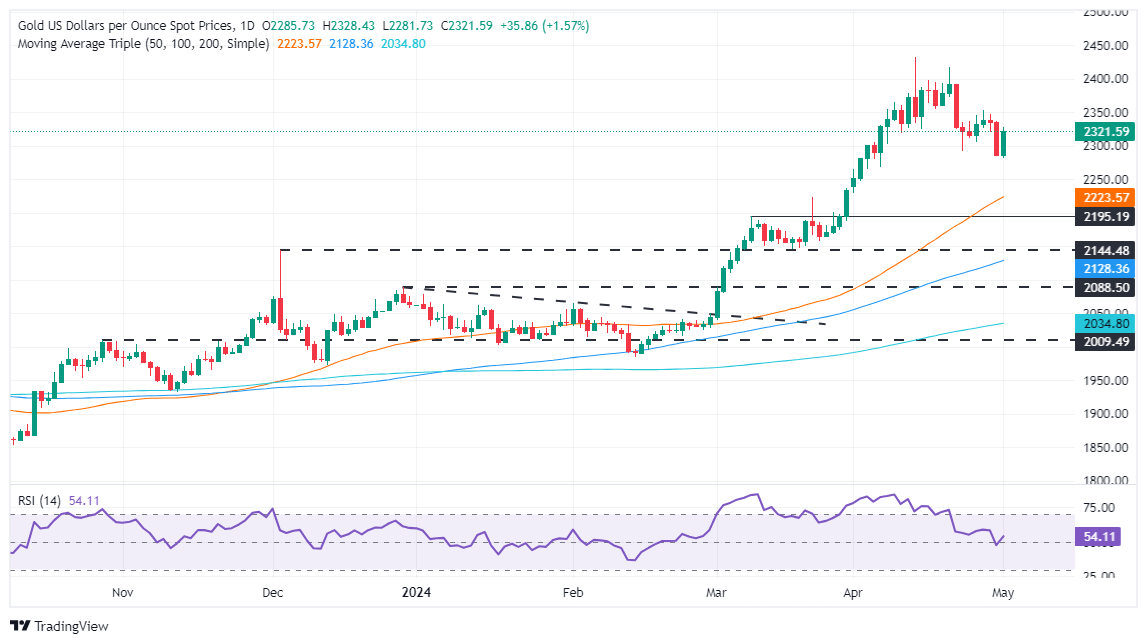

Technical analysis: Gold price climbs and stabilizes above $2,300

Gold price uptrend remains intact, and once traders lifted the golden metal spot price above $2,300 that could open the door for further gains. If buyers push prices above the April 26 high of $2,352, that could open the door to challenging $2,400. Further upside is seen at the April 19 high at $2,417 and the all-time high of $2,431.

Otherwise, if Gold tumbles below $2,300 that could open the door for a pullback. Once sellers push prices below the April 23 daily low of $2,291, subsequent losses are expected. The next support would be $2,223, followed by $2,200.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.