Gold dives from record high as US data dazzles ahead of US NFP

- Gold dips from all-time high amid strong US jobs data and steady core inflation.

- Investors remain risk-averse ahead of November 5 US election, polls show a narrow race between Trump and Harris.

- Nonfarm Payrolls and Fed’s upcoming rate decision keep traders cautious.

Gold price retreated from all-time high on Thursday as traders failed to capitalize on falling US Treasury bond yields. Nevertheless, the precious metal is set to end the month with gains of over 4% and to remain above the $2,700 threshold.

The XAU/USD trades at $2745, down 1.49%. The US 10-year Treasury bond yield dropped almost two basis points to 4.284%.

Risk aversion is the name of the game ahead of the US Presidential Election on November 5. Meanwhile, the release of the Federal Reserve’s preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index, alongside a strong jobs report, weighed on the precious metal price.

In the meantime, the latest opinion polls show that the race for the White House is narrowing between the Republican candidate, former US President Donald Trump, and the Democratic candidate, Vice President Kamala Harris.

US data from the Bureau of Economic Analysis (BEA) showed that headline inflation dipped. However, the core Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred inflation gauge, remained unchanged in October compared to September's level.

The US Department of Labor revealed that the number of Americans filing for unemployment benefits in the week ending October 26 dipped to its lowest level in five months.

Geopolitical tensions remain high in the Middle East, even though US Secretary of State Anthony Blinken stated “good progress” towards a ceasefire in Lebanon. Meanwhile, the Israeli military revealed the movement of ballistic missiles in Iran, hinting that a truce is far from being reached.

Bullion traders await the Nonfarm Payrolls report and have priced in a 95% chance of the Fed cutting interest rates by 25 basis points next week.

Daily Digest Market Movers: Gold price retreats amid goodish US data

- The US Dollar Index (DXY), which tracks the Dollar's value against a basket of six currencies, dropped 0.18% at 104.08.

- The US headline PCE decreased from 2.3% to 2.1% year-over-year (YoY), moving closer to the Fed’s 2% target. However, the Core PCE, which excludes volatile items, remained unchanged at 2.7% YoY, slightly above forecasts of 2.6%.

- US Initial Jobless Claims for the week ending October 26 fell from 228K to 216K, coming in below the forecast of 230K.

- Data from the Chicago Board of Trade, based on the December fed funds rate futures contract, indicates that investors estimate 49 basis points (bps) of Fed easing by the end of the year.

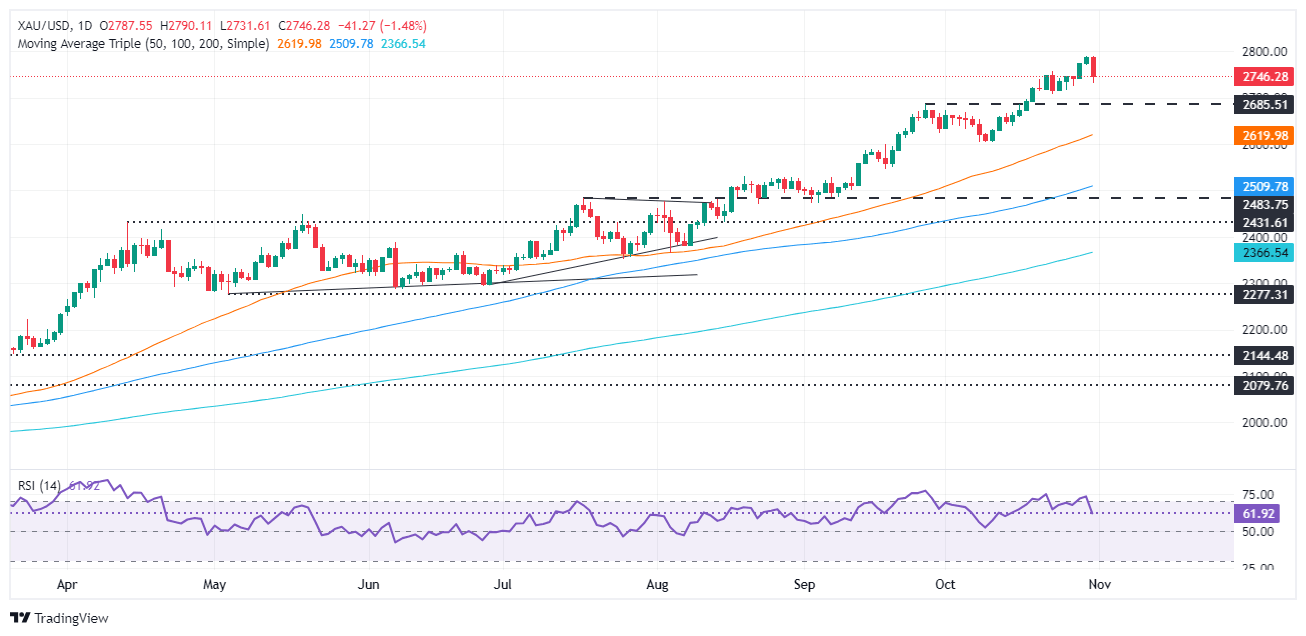

XAU/USD Technical Outlook: Gold price retreats below $2,750 as bulls take a breather

Gold retreated from record highs, yet it remains bullishly biased. If XAU/USD bulls keep the spot price above $2,700, look for further gains once it clears the psychological $2,750 figure, ahead of the all-time high at $2,790. A breach of the latter, and the $2,800 threshold is up for grabs.

On the other hand, if sellers move in and push prices below $2,708 where the October 23 daily low lies, it will expose the $2,700 mark. Up next is the September 26 swing high, which turned support at $2,685, followed by the 50-day Simple Moving Average (SMA) at $2,603.

Momentum suggests the non-yielding metal could consolidate as the Relative Strength Index (RSI) remains bullish. This means that buyers are gathering momentum.

Economic Indicator

Core Personal Consumption Expenditures - Price Index (MoM)

The Core Personal Consumption Expenditures (PCE), released by the US Bureau of Economic Analysis on a monthly basis, measures the changes in the prices of goods and services purchased by consumers in the United States (US). The PCE Price Index is also the Federal Reserve’s (Fed) preferred gauge of inflation. The MoM figure compares the prices of goods in the reference month to the previous month.The core reading excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures. Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Last release: Thu Oct 31, 2024 12:30

Frequency: Monthly

Actual: 0.3%

Consensus: 0.3%

Previous: 0.1%

Source: US Bureau of Economic Analysis

After publishing the GDP report, the US Bureau of Economic Analysis releases the Personal Consumption Expenditures (PCE) Price Index data alongside the monthly changes in Personal Spending and Personal Income. FOMC policymakers use the annual Core PCE Price Index, which excludes volatile food and energy prices, as their primary gauge of inflation. A stronger-than-expected reading could help the USD outperform its rivals as it would hint at a possible hawkish shift in the Fed’s forward guidance and vice versa.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.