Gold price edges slightly higher with eyes on Fed's policy decision

- Gold price hovers above $2,300 ahead of the Fed’s policy announcement.

- The Fed is expected to support keeping interest rates at their current levels for a longer period.

- Higher Manufacturing Price Paid would boost expectations for the Fed delaying rate cuts.

Gold price (XAU/USD) rebounds slightly above $2,300 in Wednesday’s early New York session as the United States ISM has reported a weak Manufacturing PMI report. The Manufacturing PMI falls below the 50.0 threshold to 49.2 from the estimates of 50.0 and the prior reading of 50.3. New Business inflows also contracted after expanding for two straight months. Generally, weak New Orders are driven by customers redeeming backlog and poor demand, which exhibits the consequences of higher interest rates by the Federal Reserve (Fed). Though the impact of weak Manufacturing PMI would be minimal on firm bets leaned towards the Fed keeping interest rates higher as the Price Paid rose sharply above 60.0.

In this context, 10-year US Treasury yields edge down to 4.65%. The US Dollar Index (DXY), which tracks the US Dollar’s value against six major currencies and is negatively correlated to the Gold price, falls slightly from a two-week high of around 106.50. Earlier, the US Dollar rebounded strongly after paring last week's losses, driven by weak growth in Q1 Gross Domestic Product (GDP) that raised concerns over the country’s economic outlook.

The broader appeal of the precious metal is still uncertain amid speculation that the Fed will opt for maintaining a restrictive interest rate environment for a longer period due to inflation remaining persistently higher than expected in the first quarter of the year.

In the early American session, the US ADP released the Employment Change for April, which surprisingly turned out upbeat. The ADP agency showed that US private employers hired 192K job-seekers, higher than the prior reading of 184K. Investors forecasted a slight decline to 175K.

Daily digest market movers: Gold price reverses intraday losses after weak US Manufacturing PMI

- Gold price finds support near the crucial support of $2,285. The near-term bias remains bearish on expectations that the Federal Reserve will maintain a hawkish guidance on interest rates in its monetary policy meeting after keeping interest rates steady in the range of 5.25%-5.50% for the sixth straight time.

- A slew of hotter-than-expected inflation readings so far this year indicate that the disinflation process has stalled. It suggests that the Fed should keep interest rates high for a longer period until policymakers gain confidence that price pressures will sustainably return to the desired rate of 2%. Also, the strong US Q1 Employment Cost Index is another indication that price pressures remained hot in the January-March period. The index is generally driven by a strong wage growth environment in which labor demand remains strong, which rose by 1.2% in the first quarter, against the consensus of 1.0% and the prior reading of 0.9%.

- Prospects of interest rates remaining higher bode poorly for Gold as it increases the opportunity cost of holding an investment in it. Meanwhile, investors are keen to know about rate-cut timing and the current status of the Fed’s three rate-cut projections, indicated by March’s dot plot. The CME FedWatch tool shows that traders see the Fed begin reducing interest rates from the September meeting.

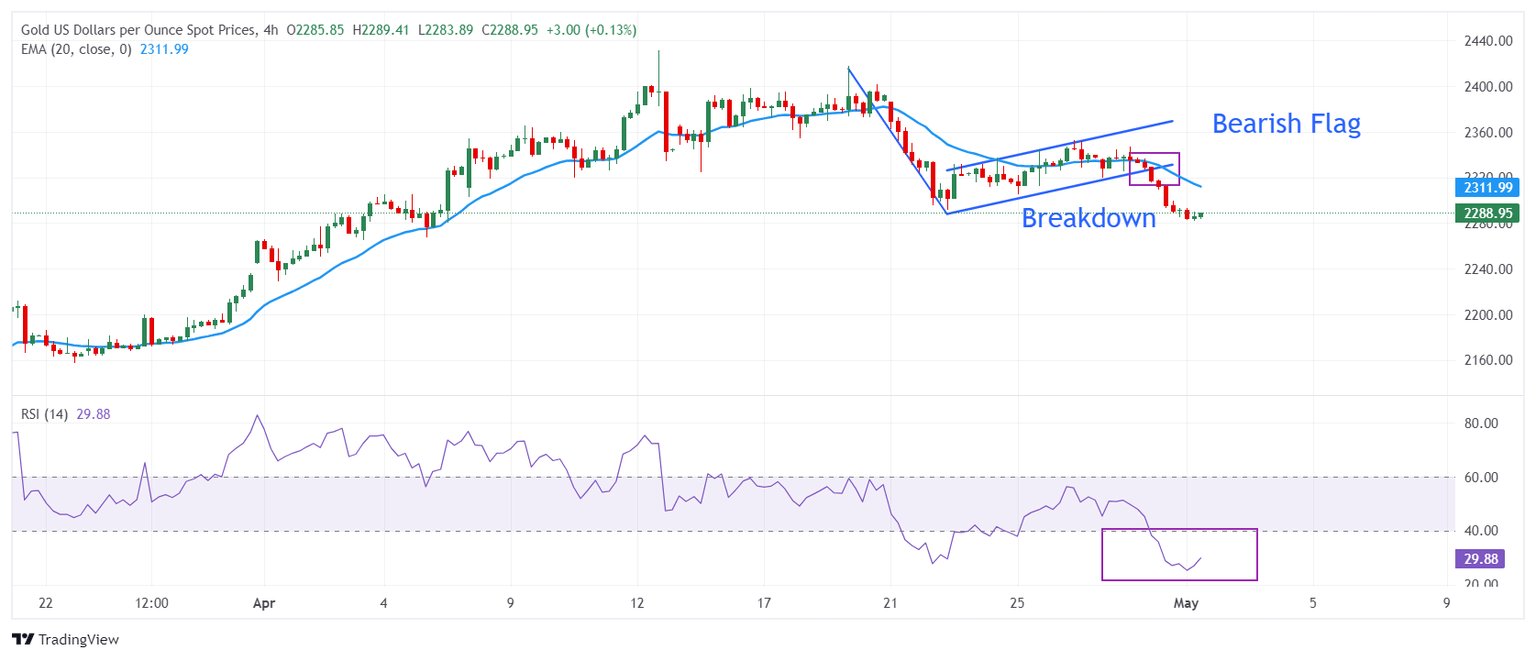

Technical Analysis: Gold price trades close to $2,300

Gold reported steep losses after a breakdown of the Bearish Flag formation in the four-hour time frame. The Bearish Flag formation demonstrates a consolidation move after a sharp correction, generally following the ongoing trend. The near-term outlook is bearish as the Gold price is trading below the 20-period Exponential Moving Average (EMA), which is at $2,312.

On the downside, March 23 high at $2,223 will be the major support for the Gold price. The 14-period Relative Strength Index (RSI) oscillates in the bearish range of 20.00-40.00, suggesting that momentum has leaned towards bears.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.