Gold price plummets on hotter US inflation data

- Gold price falls sharply on stubborn US inflation data.

- The US Dollar refreshes its almost two-month high as stubborn US inflation data push back Fed rate-cut hopes.

- Annual core inflation data grew at a steady pace of 3.9%.

Gold price (XAU/USD) faces a sell-off as the United States Bureau of Labor Statistics (BLS) has reported stubborn Consumer Price Index (CPI) data for January. The inflation data has turned out hotter than expected despite the Federal Reserve (Fed) holding interest rates in the range of 5.25%-5.50% for longer.

Monthly headline inflation grew at a higher pace of 0.3% versus. expectations and the former reading of 0.2%. The core CPI that excludes volatile food and Oil prices rose by 0.4% against the consensus and the prior reading of 0.3%. On an annual basis, the headline CPI decelerated to 3.1% from 3.4% in December, while market participants projected a slower growth rate of 2.9%.The core CPI grew steadily at 3.9% against expectations of 3.7%.

Stubborn inflation data generally builds a negative bias for Gold as it makes it more likely interest rates will remain restricted, escalating the opportunity cost of holding Gold, which is non-yielding.

The Fed is expected to push back expectations of aggressive rate cuts in 2024, believing that achieving its dual mandate (2% core inflation and full employment) remains out of sight. Labor demand in the US has remained robust and the scale of economic activities is improving significantly despite higher interest rates. And, now, hot inflation data is expected to keep interest rates on a restrictive trajectory.

Meanwhile, the US Dollar has refreshed its almost two-month high above 104.70. Investors infuse more liquidity in the US Dollar in a case of accelerating inflation data, as this would allow the Fed to maintain the hawkish interest rate stance.

Daily Digest Market Movers: Gold price dives while US Dollar soars

- Gold price faces an intense sell-off as higher price pressures have increased the opportunity cost of holding non-yielding assets.

- A stubborn US inflation report has trimmed bets in favor of a rate-cut decision in the Fed's May monetary policy meeting.

- The CME Fedwatch tool shows that, bets supporting a rate-cut by 25 basis points have significantly dropped to 32% from 48% after stick inflation data.

- Investors are not expecting a rate-cut decision by the Fed in March as Fed Chair Jerome Powell ruled out expectations in its latest monetary policy statement.

- Fed policymakers have emphasized keeping interest rates in the restrictive trajectory amid less conviction over inflation declining towards the 2% target.

- This week, the volatility is expected to remain high as the US Census Bureau will report the Retail Sales data for January, which will throw some light on the scale of consumer spending.

- According to the consensus, sales at retail stores were contracted by 0.1% after expanding by 0.6% in December.

- Meanwhile, the precious metal has surrendered gains inspired by escalating Middle East tensions after stubborn price pressure data.

- Iran-backed Yemeni Houthis continue to attack commercial ships traveling in the Red Sea, connected to the United States and the United Kingdom.

- The foreign inflows for non-yielding assets, such as Gold, increase in times of geopolitical uncertainty.

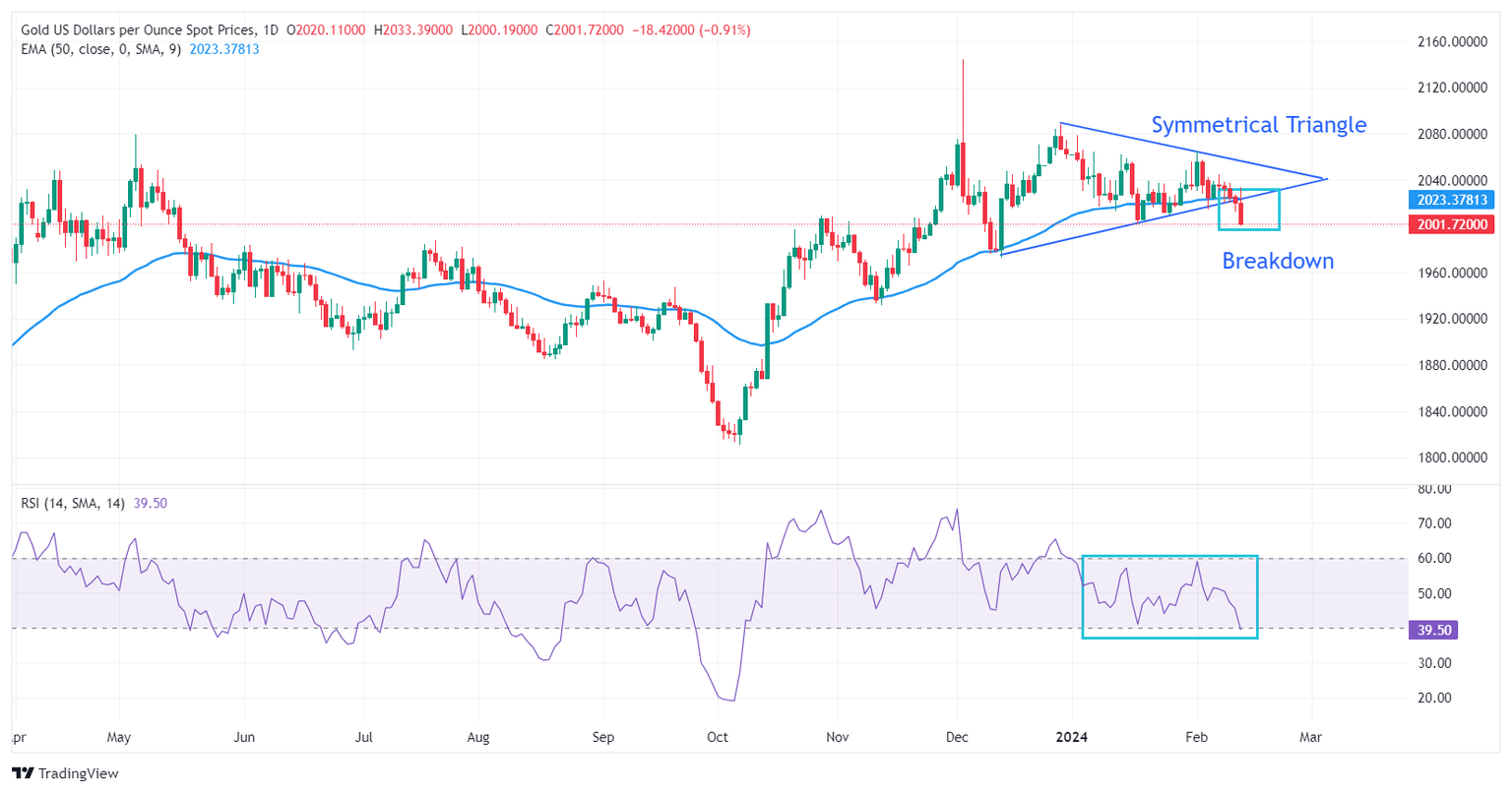

Technical Analysis: Gold price skids below 2,000

Gold price has been dumped by investors after stubborn US inflation data. The Gold price has delivered a breakdown of the Symmetrical Triangle chart pattern formed on a daily timeframe. The upward-sloping border of the aforementioned chart pattern is plotted from the December 13 low at $1,973, while the downward-sloping trendline border of the same pattern from the December 28 high is at $2,088. A breakdown of the Symmetrical Triangle formation results in wider ticks and heavy volume to the downside.

Fed FAQs

What does the Federal Reserve do, how does it impact the US Dollar?

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money.

When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

How often does the Fed hold monetary policy meetings?

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions.

The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

What is Quantitative Easing (QE) and how does it impact USD?

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

What is Quantitative Tightening (QT) and how does it impact the US Dollar?

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.