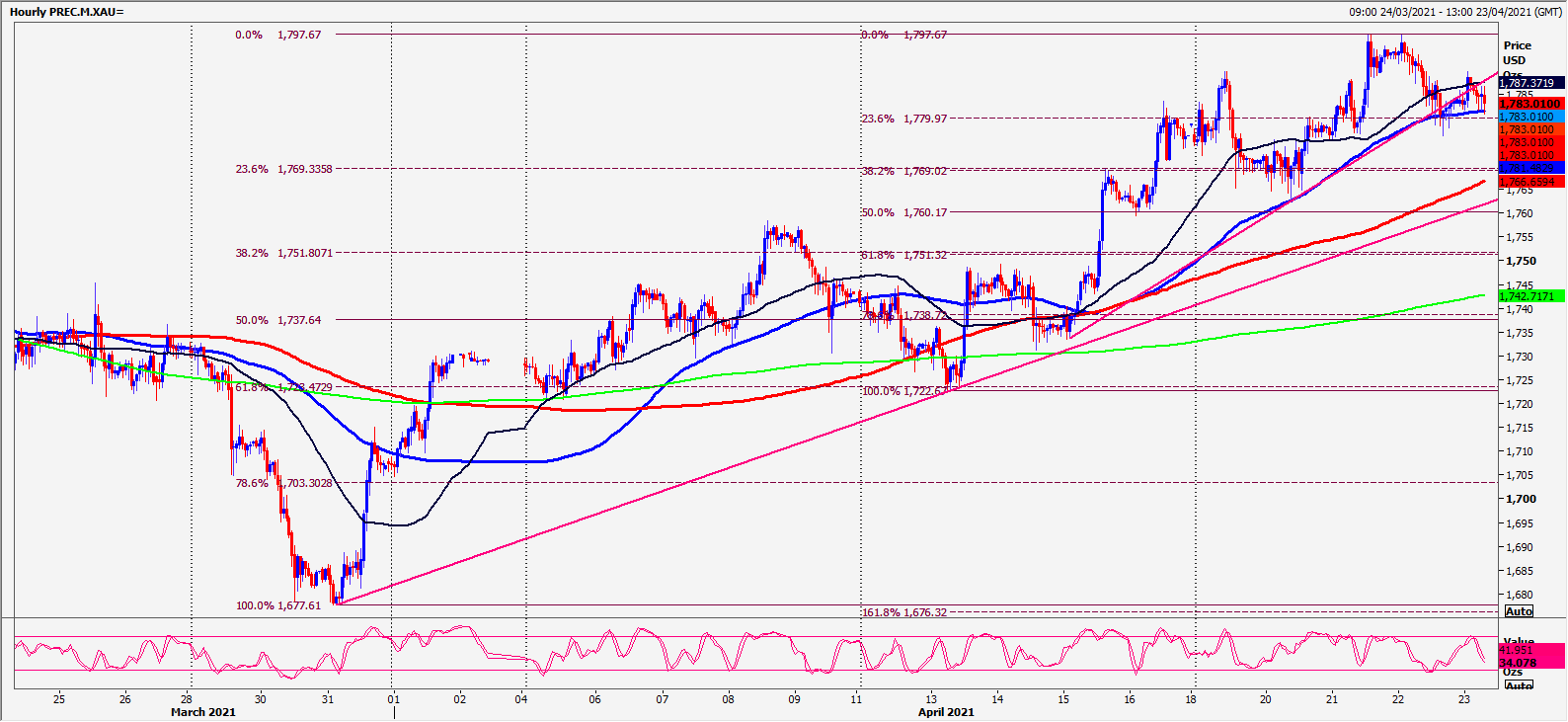

Gold: A break above 1806 signals further gains to 1815

Gold holding strong support at 1781/78 targets 1788/90 with minor resistance at1794/96 but eventually we should test strong 100-day moving average resistance at1803/05. A high for the week could be seen here so it is worth profit taking on longs. However, a break above 1806 signals further gains to 1815.

Good support at 1781/78 again today. Longs need stops below 1775. Next downside target & buying opportunity at 1765/61. Longs need stops below 1757. Silver holding strong support at 2610/00 targets 2650/60, perhaps as far as 2685/95 into next week. A break above 2705 is the next buy signal. Read more...

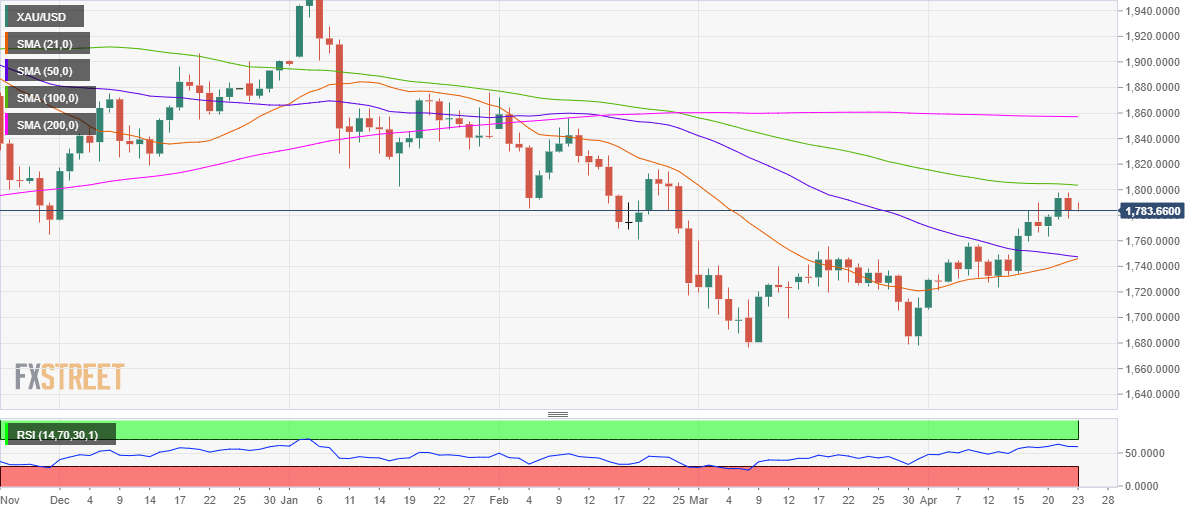

Gold Price Forecast: Upside bias remains intact amid bullish technical setup

Gold (XAU/USD) sellers returned on Thursday and downed the prices by 1% to $1777 levels. Gold snapped a two-day winning streak and fell from near the $1798 region after reports that US President Joe Biden is proposing a capital gains tax hike for the wealthy to fund its social pan, which triggered risk aversion across the board. Investors scurried to safety in the US dollar as the US stocks tumbled alongside the Treasury yields, weighing on the USD-sensitive gold. However, the surging covid cases globally and the fall in the US rates helped put a floor under the yellow metal. Read more...

Gold Price Analysis: XAU/USD eases from tops, downside remains cushioned

Gold surrendered its modest intraday gains and refreshed daily lows, around the $1,781 region during the early European session, albeit lacked follow-through selling.

A combination of factors failed to assist the precious metal to capitalize on its early uptick, instead prompted some fresh selling around the $1,790 region. Bearish traders might now be looking to extend the previous day's retracement slide from the vicinity of the $1,800 round-figure mark, or near two-month tops. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stabilizes near 1.0400 after upbeat US data

EUR/USD consolidates daily recovery gains near 1.0400 following the release of upbeat United States data. Q3 GDP was upwardly revised to 3.1% from 2.8% previously, while weekly unemployment claims improved to 220K in the week ending December 13.

GBP/USD extends slide approaches 1.2500 after BoE rate decision

GBP/USD stays on the back foot and break lower, nearing 1.2500 after the Bank of England (BoE) monetary policy decisions. The BoE maintained the bank rate at 4.75% as expected, but the accompanying statement leaned to dovish, while three out of nine MPC members opted for a cut.

Gold approaches recent lows around $2,580

Gold resumes its decline after the early advance and trades below $2,600 early in the American session. Stronger than anticipated US data and recent central banks' outcomes fuel demand for the US Dollar. XAU/USD nears its weekly low at $2,582.93.

Bitcoin slightly recovers after sharp sell-off following Fed rate cut decision

Bitcoin (BTC) recovers slightly, trading around $102,000 on Thursday after dropping 5.5% the previous day. Whales, corporations, and institutional investors saw an opportunity to take advantage of the recent dips and added more BTC to their holdings.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.