Gold Price News and Forecast: XAU/USD traders are cautious

Gold Price Forecast: Range play likely to extend below $1800, focus shifts to Fed

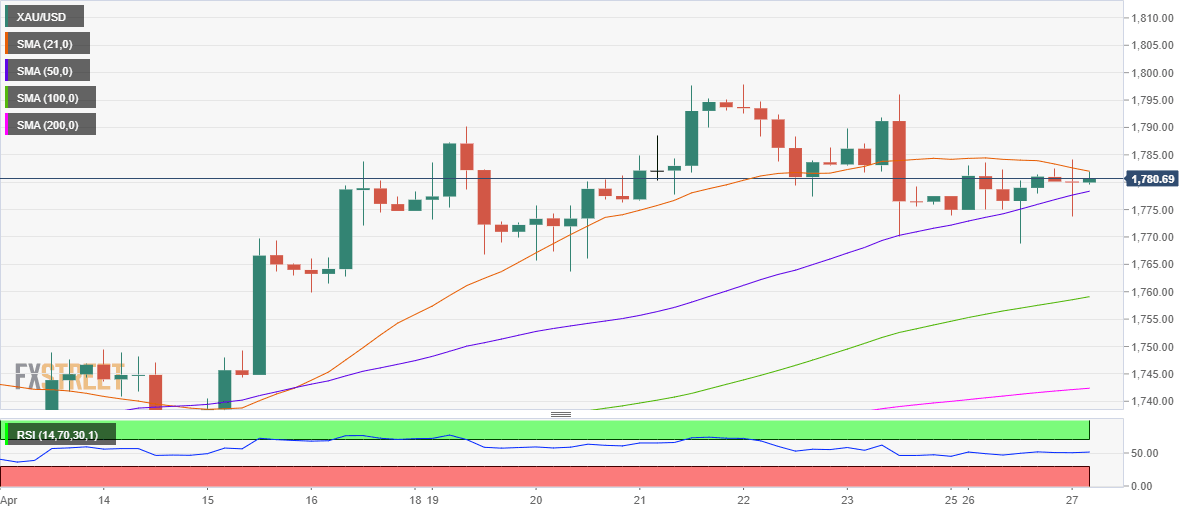

Gold (XAU/USD) rebounded on Monday after finding support just under $1770, tracking the late decline in the US dollar across the board after Wall Street indices closed at record highs. Earlier in the day, gold slipped as weaker US Durable Goods data lifted the safe-haven demand for the greenback while an uptick in the Treasury yields also drove the buck higher. Expectations of improving global economic outlook in the coming quarters were marred by concerns over surging covid cases in India, Japan and Brazil. Meanwhile, investors digested the latest updates on US President Joe Biden’s $2.25 trillion infrastructure spending plans. Read more...

Gold traders are cautious

The precious metal gold price is losing its mojo as traders are hesitant to place any big bets ahead of the Fed meeting. The Federal Reserve is expected to announce its monetary policy decision tomorrow, and market players are widely expecting no change in their monetary policy. However, what traders are concerned about is the pace of their asset purchase program, as there is some evidence of those purchases losing some momentum.

Another factor that is also likely to influence the gold price is the outlook of the US economy presented by the Chairman of the Federal Reserve, Jerome Powell. It is likely that we may see some hint of bullish views in the Chairman’s view because if we look at the new orders’ data, they saw a solid increase in March, and this gives further evidence that economic growth is accelerating in the US. Read more...

Gold Price Analysis: XAU/USD remains depressed below $1,780, downside seems limited

Gold reversed an intraday dip to the $1,774 area and moved back closer to daily tops during the early European session, albeit lacked follow-through. The commodity was last seen hovering around the $1,778 region, down 0.15% for the day.

A combination of factors failed to assist the precious metal to capitalize on the overnight bounce from multi-day lows, around the $1,768 region. That said, the downside remains cushioned, at least for the time being, as investors await the latest monetary policy update by the FOMC on Wednesday before placing aggressive bets. Read more...

Author

FXStreet Team

FXStreet