Gold Price Forecast: A test of $1800 or $1750 on the FOMC decision?

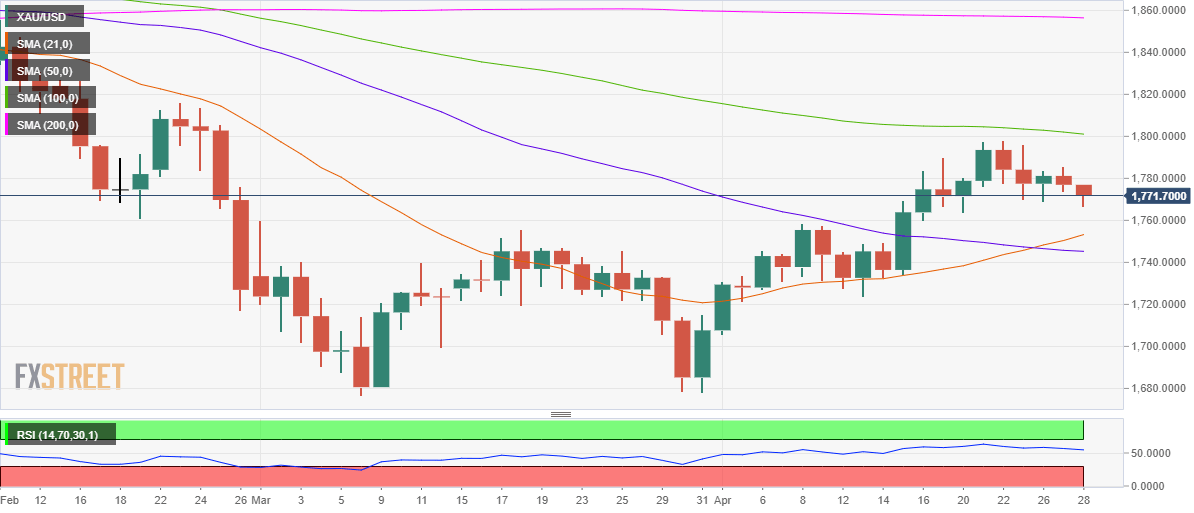

Gold (XAU/USD) dropped on Tuesday but held within its recent trading range between $1800-$1765, as the US Treasury yields surged and pushed the US dollar higher alongside. Better-than-expected US CB Consumer Confidence data and expectations of President Joe Biden’s fiscal stimulus fuelled a fresh rally in the returns on the US debt. Meanwhile, mixed performance on the US stocks amid pre-Fed caution and earnings reports lifted the US dollar’s safe-haven appeal, which added to gold’s decline. Read more...

Gold Price Analysis: XAU/USD to retry the topside towards the $1876 mark – Commerzbank

Gold (XAU/USD) is extending Tuesday’s decline towards $1760 as the yellow metal is so far thwarted by the 55-day moving average at $1800.63. Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, expects gold to retry the upside as the $1730/23 zone is held off.

“Gold’s up move has faltered at the 55-day ma at $1800.64 for now. More worrying is the fact that the Elliott wave counts have turned more negative and are implying a retracement towards the $1730/23 zone. Provided it holds there we should retry the topside once again.” Read more...

Gold Price Analysis: XAU/USD drops to over one-week lows ahead of FOMC

Gold dropped to one-and-half-week lows during the mid-European session, albeit recovered a bit thereafter. The commodity was last seen trading around the $1,769 region, still down over 0.60% for the day.

The previous metal added to the previous day's modest losses and witnessed some follow-through selling for the second consecutive session on Wednesday. The downfall was sponsored by a goodish pickup in the US dollar demand, which tends to drive flows away from the dollar-denominated commodity. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.