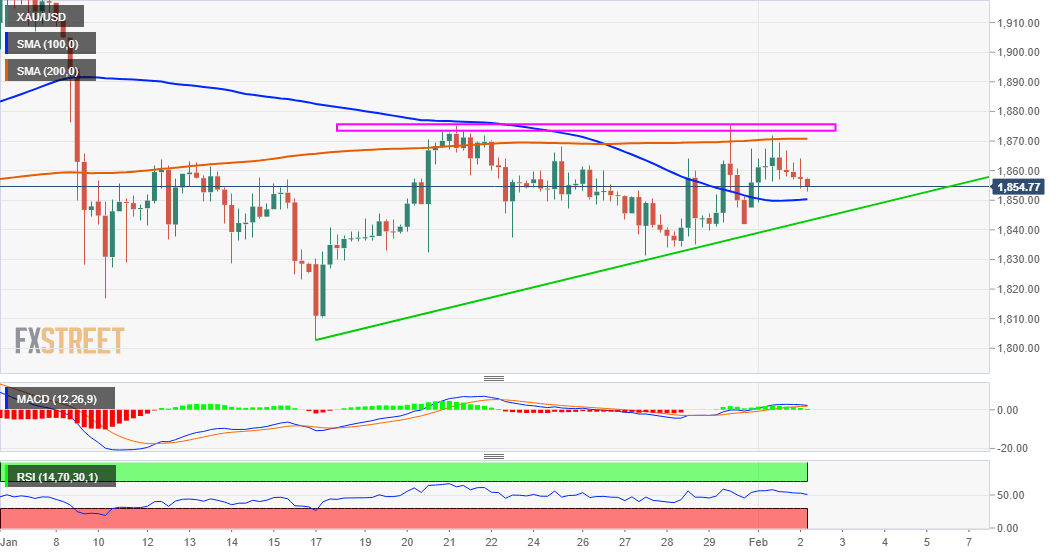

Gold Price Forecast: XAU/USD falters near $1875-76 resistance zone

Gold struggled to capitalize on the weekly bullish gap opening on Monday and remained capped near the $1875-76 resistance zone. The retail-inspired pressure on hedge funds shifted to silver and the spillover effect provided a modest lift to the commodity. That said, a combination of factors kept a lid on any further gains. A solid rebound in the equity markets held bulls from placing any aggressive bets around the safe-haven precious metal. Apart from this, a broad-based US dollar strength further weighed on the dollar-denominated commodity.

The greenback was back in demand amid doubts over the timing and size of the US fiscal stimulus measures. In fact, a group of Republican senators urged the US President Joe Biden to cut the price tag for his proposed economic stimulus package and discussed a $618 billion alternative plan. Read more...

Gold Price Analysis: XAU/USD to push toward $1900 on a break above $1875

Gold (XAU/USD) struggled to capitalize on the weekly bullish gap opening on Monday and remained capped near the $1875-76 resistance zone. A modest uptick in the US bond yields prompted some fresh selling around the yellow metal on Tuesday but concerns about COVID-19 vaccine supplies might help limit any further losses for the commodity, FXStreet’s Haresh Menghani reports.

“Concerns about the delay in COVID-19 vaccine supplies helped limit the downside. Moving ahead, the broader market risk sentiment will play a key role in influencing the intraday movement for the commodity. This, along with the US bond yields and the USD price dynamics, will also be looked upon for some meaningful trading opportunities.” Read more...

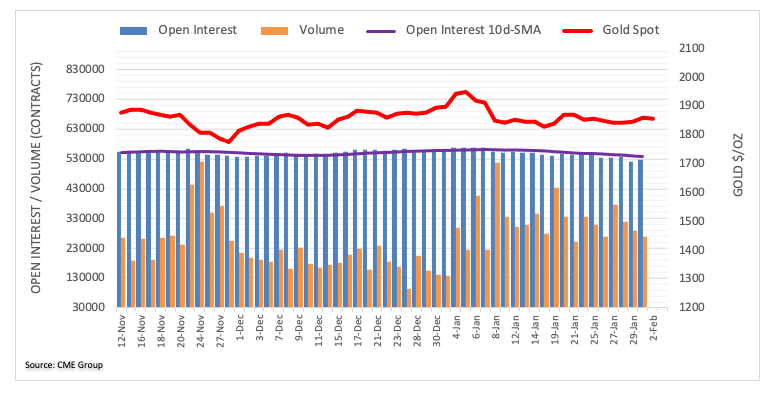

Gold Futures: Extra gains on the table

Traders added nearly 8K contracts to their open interest positions in gold futures markets at the beginning of the week, according to preliminary readings from CME Group. Volume, instead, extended the downtrend and dropped by around 21.3K contracts.

Monday’s positive price action in gold was amidst rising open interest, which remains supportive of extra gains in the very near-term. Against this, the precious metal still targets the 100-day SMA in the $1,880 level per ounce in the short-term horizon. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD keeps the red near 0.6200 after Chinese inflation data

AUD/USD keeps losses near the 0.6200 mark following mixed Australian data and as expected China's inflation numbers. The RBA's dovish shift and China's economic woes add to the weight on the Aussie as risk sentiment remains tepid. Fedspeak eyed.

USD/JPY: Bears attack 158.00 on strong Japanese wage growth data

USD/JPY drifts lower to test 158.00 early Thursday after data showed that base salaries for Japanese workers increased at the fastest pace in 32 years. The data backs the case for the BoJ to raise interest rates, which, along with the cautious market mood, benefits the safe-haven Yen and drags the pair away from a multi-month top.

Gold price retreats toward $2,650 despite risk aversion

Gold price is retreating from near a monthly high of $2,670 in Thursday's Asian trading. Resurgent haven demand for the US Dollar amid risk aversion weigh on Gold price even as US Treausry bond yields extend pullback. Focus shifts to Fedspeak amid holiday-thinned trading.

Has Bitcoin topped for the cycle? Here's what key metrics suggest

Bitcoin experienced a 2% decline on Wednesday as the cryptocurrency market grapples with recent losses. On-chain data has indicated a shift in the accumulation of the leading cryptocurrency, suggesting that holders are increasingly selling their assets.

Bitcoin edges below $96,000, wiping over leveraged traders

Bitcoin's price continues to edge lower, trading below the $96,000 level on Wednesday after declining more than 5% the previous day. The recent price decline has triggered a wave of liquidations across the crypto market, resulting in $694.11 million in total liquidations in the last 24 hours.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.