Gold Price Analysis: XAU/USD struggles for direction, flat-lined above $1,780 level

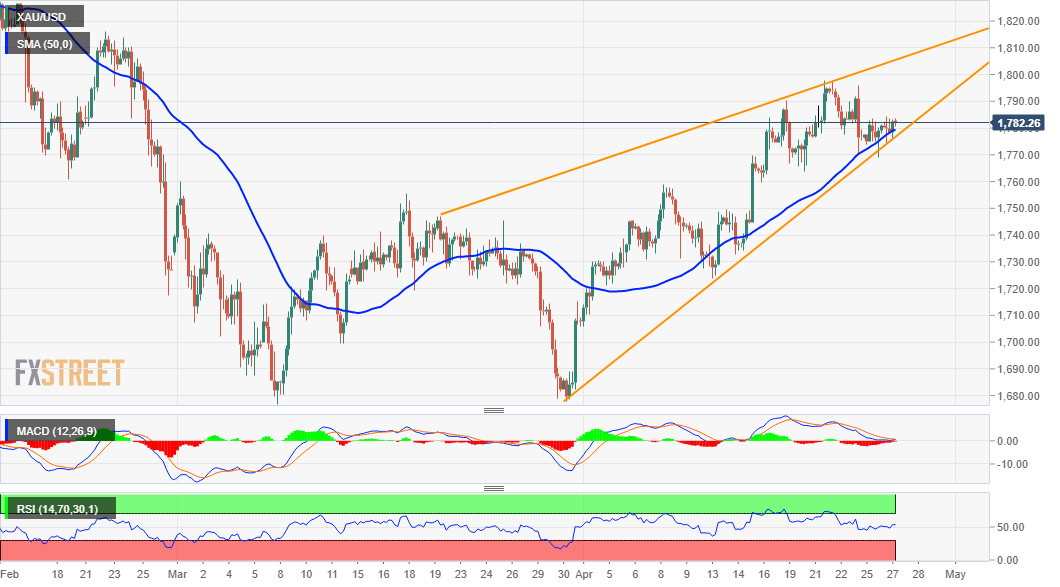

Gold reversed an intraday dip to the $1,774 area and is currently placed near the top end of its daily trading range, around the $1,782-83 region.

Worries that surging COVID-19 infections in some countries could derail the global economic recovery continued lending some support to the safe-haven XAU/USD. Apart from this, the emergence of some fresh selling around the US dollar further benefitted the dollar-denominated commodity. However, a modest pickup in the US Treasury bond yields kept a lid on any further gains for the non-yielding yellow metal. Read more...

Gold Price Analysis: XAU/USD to move downward over the next couple of years – OCBC

Aside from rising supply, commodity prices face a number of other headwinds over the next year including the prospect of a stronger US dollar and higher US Treasury yields. Against this backdrop, strategists at Capital Economics expect that the price of gold will fall.

We have become more negative on the outlook for the price of gold. The gold price has already fallen a long way from its 2020 peak in tandem with higher real yields in the US. Admittedly, real yields have fallen back a bit in recent weeks, and imports of gold in China and India have picked up. Read more...

Gold Price Analysis: XAU/USD to rise above $1800 on US T-bond yields moving below 1.55% – OCBC

Gold fell 0.4% on Friday to $1777.20 and questions remain if it can break above the $1800 resistance, having tried that multiple times last week to no avail. It may take US 10Y Treasuries moving below 1.55% to push gold above $1800, in the opinion of strategists at OCBC Bank.

“Gold has tried to break the $1800 level on multiple occasions last week but have found a lack of conviction from gold bulls in doing so.” Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds steady above 1.0550 on modest USD weakness

EUR/USD struggles to gather recovery momentum but clings to modest daily gains above 1.0550 in the second half of the day on Monday. Although the US Dollar corrects lower following the previous week's rally, the cautious market mood makes it hard for the pair to push higher.

GBP/USD stabilizes above 1.2600 following previous week's drop

GBP/USD defends minor bids above 1.2600 in the American session on Monday, while the negative shift seen in risk sentiment caps the pair's upside. The Bank of England Monetary Policy Hearings and UK inflation data this week could influence Pound Sterling's valuation.

Gold benefits from escalating geopolitical tensions, rises above $2,600

After suffering large losses in the previous week, Gold gathers recovery momentum and trades in positive territory above $2,600 on Monday. In the absence of high-tier data releases, escalating geopolitical tensions help XAU/USD hold its ground.

Bonk holds near record-high as traders cheer hefty token burn

Bonk (BONK) price extends its gains on Monday after surging more than 100% last week and reaching a new all-time high on Sunday. This rally was fueled by the announcement on Friday that BONK would burn 1 trillion tokens by Christmas.

The week ahead: Powell stumps the US stock rally as Bitcoin surges, as we wait Nvidia earnings, UK CPI

The mood music is shifting for the Trump trade. Stocks fell sharply at the end of last week, led by big tech. The S&P 500 was down by more than 2% last week, its weakest performance in 2 months, while the Nasdaq was lower by 3%. The market has now given back half of the post-Trump election win gains.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.