Gold Price Analysis: XAU/USD seesaws below $1,800, immediate rising wedge keeps sellers hopeful

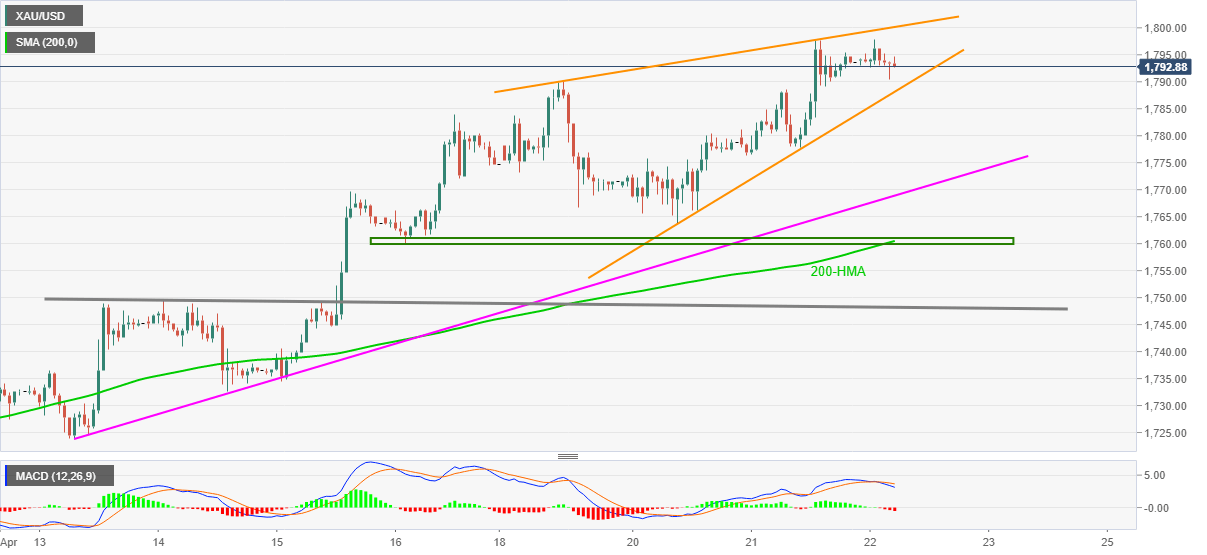

Gold reverses the latest pullback moves from multi-day top while taking rounds to $1,794 ahead of Thursday’s European session. Even so, the yellow metal stays inside a bearish chart pattern, rising wedge, on the hourly formation.

Not only the bearish formation but the downbeat MACD conditions and the commodity’s indecisive moves around the two-month high also back the odds of the pullback. Read more...

Gold Price Analysis: XAU/USD slides to fresh session lows, closer to $1,780 level

Gold extended its steady intraday descent and dropped to fresh daily lows, around the $1,782 region during the mid-European session.

The precious metal witnessed a modest pullback from the vicinity of the $1,800 mark and has now eroded a major part of the previous day's positive move to the highest level since late February. A goodish intraday bounce in the US Treasury bond yields was seen as a key factor that prompted traders to lighten their bullish bets around the non-yielding yellow metal. Read more...

Gold Price Analysis: XAU/USD set to rally past $1800 fueled by falling yields

Gold bulls took a breather above $1790 as the yellow metal awaits a strong catalyst to break through the key $1800 barrier. As FXStreet’s Dhwani Mehta notes, falling Treasury yields and DXY remain a key driver for gold’s upside.

The sell-off in the Treasury yields could deepen if the market mood worsens on a likely cautious outlook on the economy from the European Central Bank (ECB). The ECB is widely expected to maintain its current monetary policy settings when they meet later in the European session today. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.