Gold Price News and Forecast: XAU/USD pullback from $1,900 highlights immediate rising wedge

Gold Price Forecast: XAU/USD downed by US dollar comeback after Presidential election debate

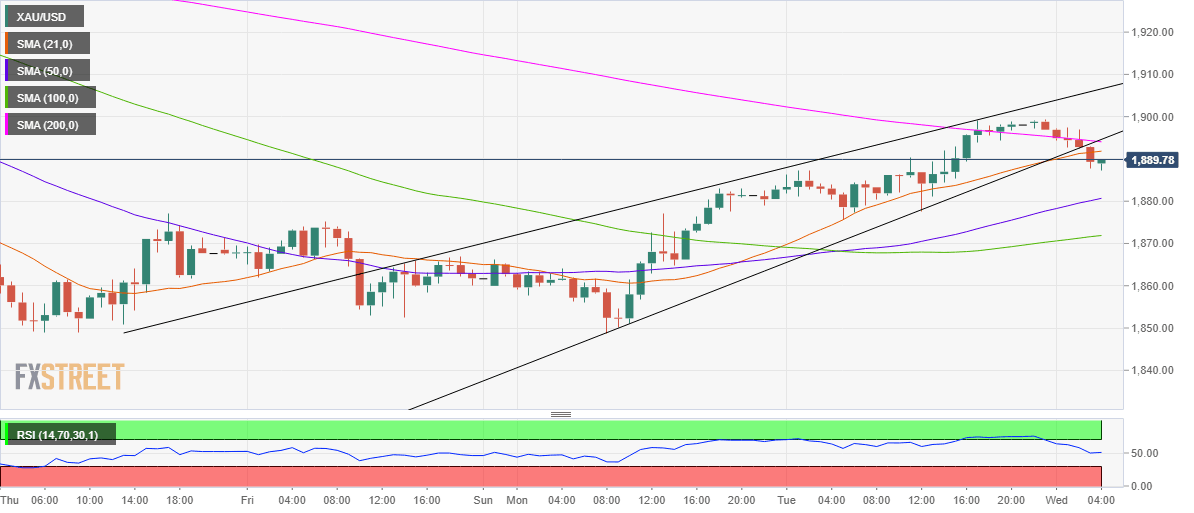

Gold (XAU/USD) extended its recovery rally from two-month lows on Tuesday, only to face rejection at $1900 but settled near daily highs. The main catalyst behind gold’s rise was the extended corrective declines in the US dollar from two-month highs amid cautious optimism. Expectations over a likely US coronavirus relief bill and solid Chinese economic data buoyed the sentiment, although investors remained cautious amid the coronavirus resurgence and ahead of the first US Presidential election debate.

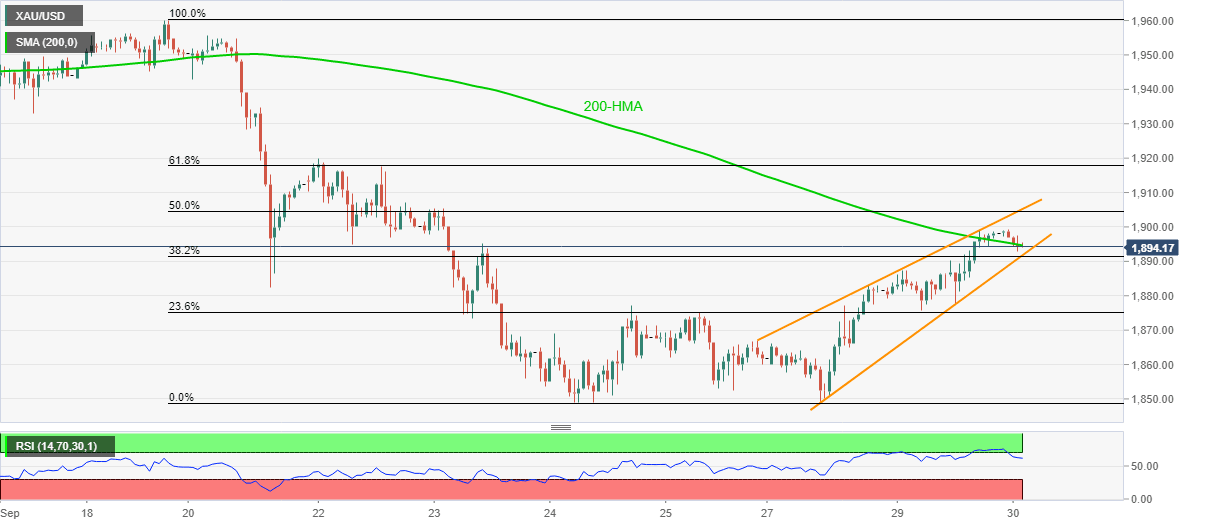

Gold Price Analysis: XAU/USD pullback from $1,900 highlights immediate rising wedge

Gold prices bounce off an intraday low of $1,892.72 to $1,896.70 amid Wednesday’s Asian session. The yellow metal recently dropped after the US presidential debate questioned market sentiment. Technically, a three-day-old rising wedge formation on the hourly chart keeps sellers hopeful even as 200-HMA probes immediate downside.

Author

FXStreet Team

FXStreet