Gold Futures: Extra downside in the pipeline

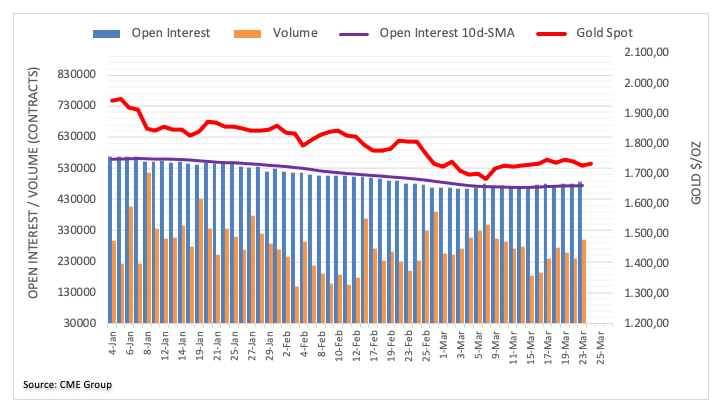

Open interest in Gold futures markets rose by nearly 6K contracts on Tuesday according to flash data from CME Group. In the same line, volume reversed two consecutive daily pullbacks and increased by around 60.7K contracts.

Tuesday’s negative price action in Gold prices was on the back of rising open interest and volume, all indicative that further losses remain probable in the very near-term. Against that, the so far 2021 lows in the $1,680 zone per ounce troy emerge as the next support of relevance. Read more...

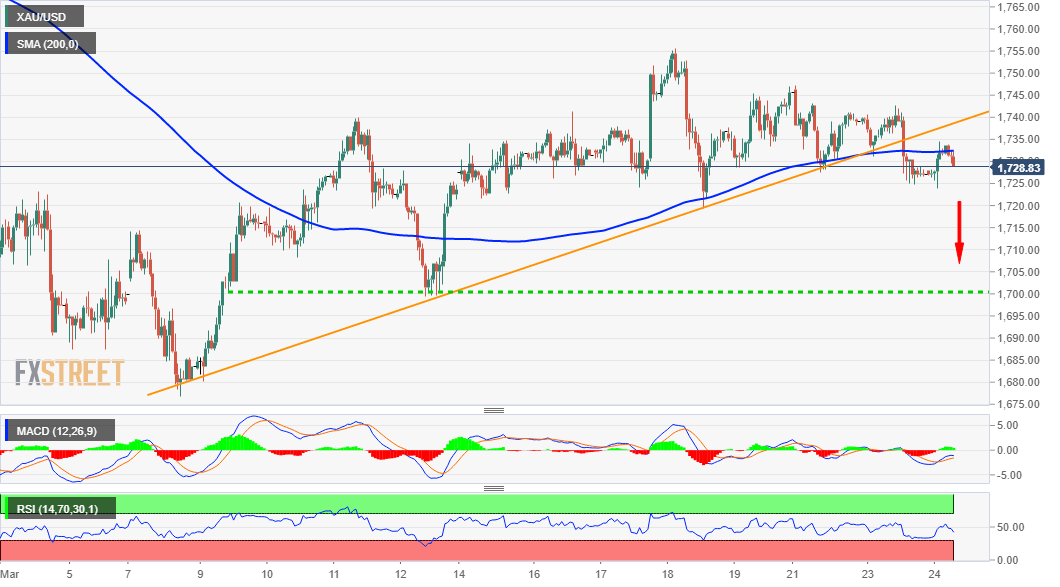

Gold Price Analysis: XAU/USD not out of the woods yet, slide to $1700 remains on the cards

Gold struggled to capitalize on the Asian session bounce from weekly lows and was last seen trading with only modest gains, around the $1730 region.

The prevalent risk-off mood extended some support to the safe-haven XAU/USD. This, along with some follow-through slide in the US Treasury bond yields, further benefitted the non-yielding yellow metal. However, the underlying bullish sentiment around the US dollar capped any meaningful upside for the dollar-denominated commodity. Read more...

Gold Price Analysis: XAU/USD struggles for direction, stuck in a range around $1730 area

Gold held on to its modest intraday gains through the mid-European session, albeit lacked any follow-through buying. The commodity was last seen trading near the $1730 region, up 0.20% for the day.

Following an early dip to weekly lows, the precious metal managed to regain some positive traction and recovered a part of the previous day's losses. The early uptick was supported by the ongoing decline in the US Treasury bond yields, which tends to benefit the non-yielding yellow metal. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD keeps the red near 0.6200 after Chinese inflation data

AUD/USD keeps losses near the 0.6200 mark following mixed Australian data and as expected China's inflation numbers. The RBA's dovish shift and China's economic woes add to the weight on the Aussie as risk sentiment remains tepid. Fedspeak eyed.

USD/JPY: Bears attack 158.00 on strong Japanese wage growth data

USD/JPY drifts lower to test 158.00 early Thursday after data showed that base salaries for Japanese workers increased at the fastest pace in 32 years. The data backs the case for the BoJ to raise interest rates, which, along with the cautious market mood, benefits the safe-haven Yen and drags the pair away from a multi-month top.

Gold price retreats toward $2,650 despite risk aversion

Gold price is retreating from near a monthly high of $2,670 in Thursday's Asian trading. Resurgent haven demand for the US Dollar amid risk aversion weigh on Gold price even as US Treausry bond yields extend pullback. Focus shifts to Fedspeak amid holiday-thinned trading.

Has Bitcoin topped for the cycle? Here's what key metrics suggest

Bitcoin experienced a 2% decline on Wednesday as the cryptocurrency market grapples with recent losses. On-chain data has indicated a shift in the accumulation of the leading cryptocurrency, suggesting that holders are increasingly selling their assets.

Bitcoin edges below $96,000, wiping over leveraged traders

Bitcoin's price continues to edge lower, trading below the $96,000 level on Wednesday after declining more than 5% the previous day. The recent price decline has triggered a wave of liquidations across the crypto market, resulting in $694.11 million in total liquidations in the last 24 hours.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.