Gold Price Analysis: Down 0.40% in Asia, $1,980 is key support

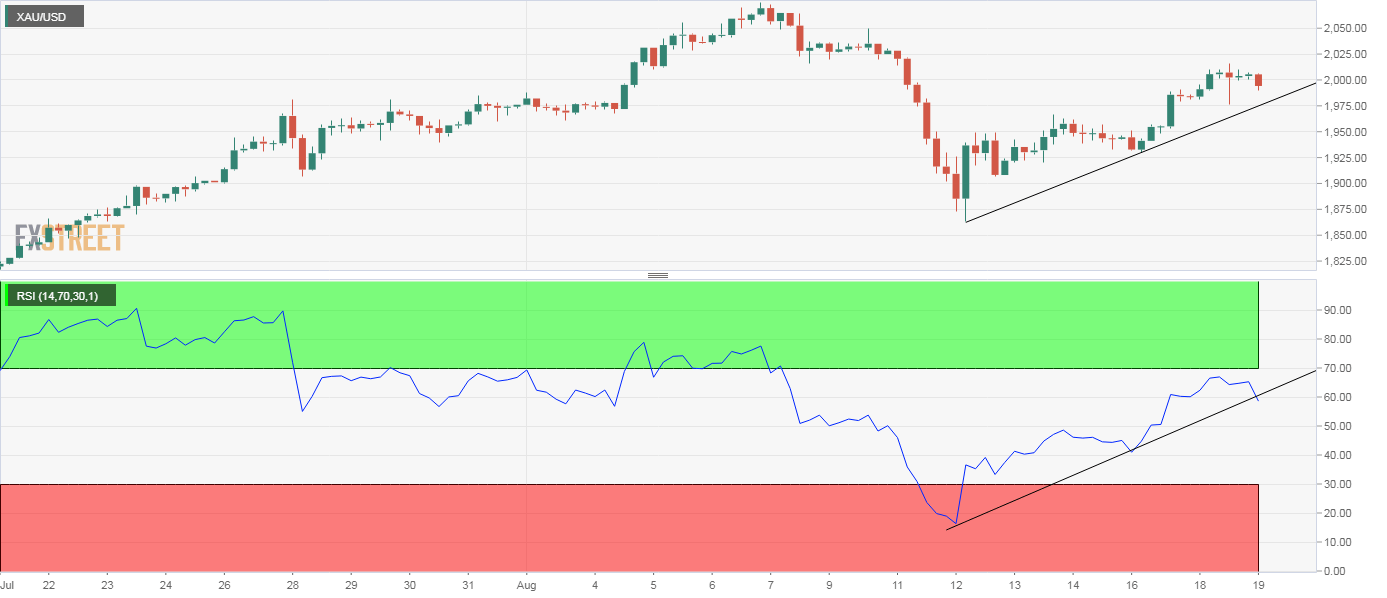

Gold is trading near $1,993 at press time, representing a 0.4% decline on the day. The yellow metal faced rejection at $2,015 on Tuesday. The 4-hour chart relative strength index has dived out of an ascending/bullish trendline. As such, the metal risks extending losses to $1,980. That level is currently housing the trendline rising from Aug. 12 and Aug. 16 lows.

A break below that trendline support would imply an end of the recovery from the Aug. 12 low of $1,863 and could cause some buyers to exit the market, leading to a deeper decline to $1,950. A move above $2,015 is needed to restore the immediate bullish view.

Gold may move as high as $2,300 in the near-term

UBS economist foresees gold’s price rising to $2,300 per ounce in the near-term in the event of an escalation of geopolitical tensions. The yellow metal is trading near $2,000 at press time. Prices fell from $2,075 to $1,863 in the four days to Aug. 12, as the US treasury yields recovered from record lows.

However, despite the recent pullback, UBS is retaining its year-end forecast of $2,000 per ounce. Indeed, with the Federal Reserve continuing to pump unprecedented amounts of liquidity alongside an uptick in inflation, a big pullback in gold looks unlikely.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD retreats from YTD peaks on USD recovery

The mild rebound in the US Dollar is prompting EUR/USD to give back part of its earlier advance—after reaching new 2025 highs around 1.0560—and retreat toward the 1.0520 area, although it still posts decent gains for the day.

GBP/USD clings to daily gains just above 1.2700

Following an initial climb to three-month highs around 1.2750, GBP/USD is now losing some of its upward momentum due to a tepid bounce in the Greenback, while market participants prepare for President Trump's upcoming address to Congress.

Gold retains the $2,900 level amid risk aversion

Further US tariffs and retaliatory measures from countries maintain the trade war narrative well in place, with Gold prices advancing to four-day tops past the $2,920 mark per troy ounce on Tuesday

Cryptomarket falls as US Crypto Strategic Reserve hype fizzles into classic ‘buy the rumor, sell the news’

Bitcoin, Ethereum, Solana, Ripple and Cardano continue their declines for the second consecutive day after their recent upsurge on Sunday. US President Trump’s announcement of the Crypto Strategic Reserve was turned into a short-term “buy the rumor, sell the news” event.

Tariffs, Ukraine and Oil dominate

The US imposed 25% tariffs on Canada and Mexico starting from today, it also imposed another 10% on China. The US also confirmed that it would suspend all military aid to Ukraine.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.