Gold Futures: Further upside appears limited

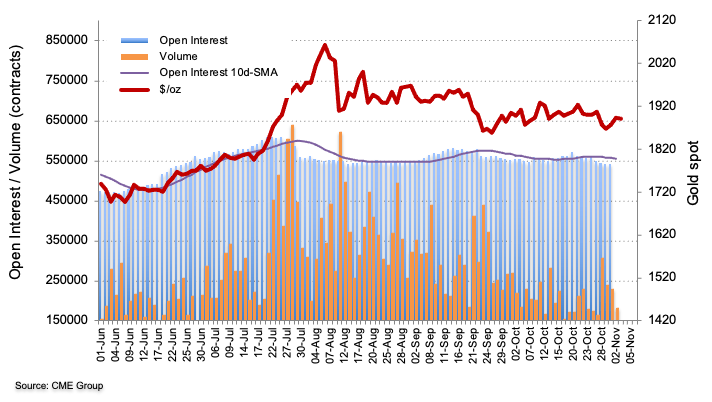

Open interest in Gold futures markets extended the downtrend for yet another session on Monday, this time by just 114 contracts in light of preliminary readings from CME Group. Volume, in the same line, decreased for the third consecutive session, now by around 48.3K contracts.

Gold met support around $1,860/oz.

The positive performance of Gold prices at the beginning of the week was on the back of shrinking open interest and volume, leaving the likeliness of further upside somewhat limited in the very near-term. That said, initial contention now emerges at the October’s low at $1,860 per ounce. Read more...

Gold Price Analysis: XAU/USD looks firmer and closer to $1,900/oz

Gold prices reverse the initial bearishness and refocus on the upside, trading at shouting distance from the key barrier at the $1,900 mark per ounce troy. The better tone surrounding the precious metal tracks the upbeat sentiment in the broad risk complex, all so far propped up by the renewed selling pressure in the dollar ahead of the US elections.

Indeed, traders appear optimistic on a Biden win and the potential “blue wave” that it is supposed to follow. Under this scenario, bets of another coronavirus stimulus bill remain high as well as a more market-friendly approach to the US-China trade dispute. Read more...

Gold Price Analysis: XAU/USD trades with modest losses, focus remains on US elections

Gold edged lower through the Asian session, albeit lacked any strong follow-through and remained well within the striking distance of multi-day tops set earlier this Tuesday.

The precious metal stalled its recent recovery move from one-month lows ahead of the $1900 mark and witnessed a modest pullback during the first half of the trading action on Tuesday. The prevalent upbeat market mood – as depicted by another day of strong gains in the US equity futures – was seen as a key factor weighing on traditional safe-haven assets, including gold. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD falls as Wall Street turns red

EUR/USD turned bearish as Wall Street gives up and major indexes turn red. The pair trades near a fresh weekly low in the 1.0460 price zone. Earlier in the day, the European Central Bank trimmed interest rates as expected, and the United States published discouraging employment and inflation-related data.

GBP/USD dips below 1.2700 as US Dollar surges on risk aversion

GBP/USD finally broke below the 1.2700 mark in the American session, as sentiment shifted to the worse, following dismal US employment and inflation-related data. The poor performance of stocks and an uptick in Treasury yields boost demand for the US Dollar.

Gold could extend its corrective slide

XAU/USD fell towards $2,680 and remains under pressure as investors diggest US figures and the European Central Bank monetary policy announcement. Inflation in the US at wholesale levels rose by more than anticipated in November, according to the latest Producer Price Index release.

-637336005550289133_Medium.jpg)

Chainlink surges amid World Liberty purchase, Emirates NBD partnership and CCIP launch on Ronin network

Chainlink price surges around 15% on Thursday, reaching levels not seen since mid-November 2021. The rally was fueled by the Donald Trump-backed World Liberty Financial purchase of 41,335 LINK tokens worth $1 million on Thursday.

Can markets keep conquering record highs?

Equity markets are charging to new record highs, with the S&P 500 up 28% year-to-date and the NASDAQ Composite crossing the key 20,000 mark, up 34% this year. The rally is underpinned by a potent mix of drivers.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.