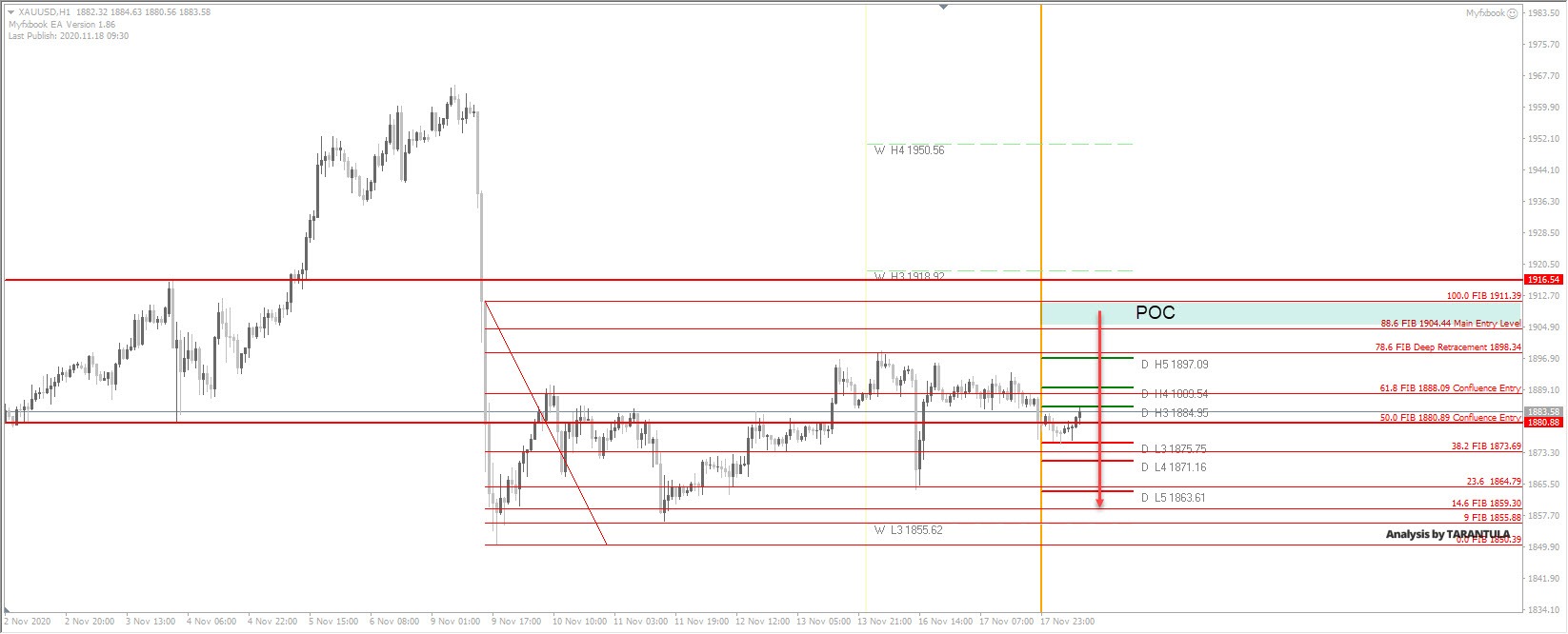

Gold possible rejection off the 88.6 zone

GOLD is still bearish. We can see a strong resistance around 1915 zone and next retracement might be good for sellers.

Gold has been rejecting off the 1900 zone quite lot. We should see another drop if the price gets within the POC 1904-1911. Additonally, we can spot a double top / W H3 camarilla pivot at 1916. In case of rejection watch for 1880 followed by 1860 and 1855. Bears are still winning and GOLD can be bullish only if the market moves above 1920 on intraday timeframe. Read more...

Gold look for more downside to come

The chart below shows Gold in a complex correction. We are looking for one more push lower below $1800 if we are to continue the overall bull market. Complex corrections are normally time-consuming, the chart below shows we have been in a range since 7 August 2020.

The impulsive move lower after the completion of wave (x) has given us a high probability that the move lower has started and will continue. The yellow zone is the 61.8 Fibonacci retracement level of the move lower. We can look for more selling pressure around that area. The move lower will be invalidated if we break above the wave (x). Read more...

Gold spot volatility is decreasing in the consolidation phase

Gold meets strong resistance at 1896/1899. A break above 1901 however targets 1907/08, perhaps as far as 1916/18,. Further gains meet resistance at 1921/23.

Shorts at 1896/1899 target 1886/84 & minor support at 1879/75 (& we bottomed exactly here yesterday). If we continue lower look for 1868/66, perhaps as far as 1860/58 & 1855. A break below support at the September low at 1848/47 is a sell signal initially targeting 1835. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD: Strong resistance lies at 0.6300

The marked sell-off in the US Dollar allowed AUD/USD to regain strong upside traction and reach multi-day highs in the area just below the key 0.6300 barrier at the beginning of the week.

EUR/USD: Bulls need to clear 1.0400 on a convincing fashion

In line with the rest of the risk-associated complex, EUR/USD managed to regain marked buying pressure and flirted with the area of three-week highs around 1.0430 on Monday.

Gold remains focused on all-time highs

Gold stays in positive territory above $2,700 on Monday as the improving risk mood makes it difficult for the US Dollar to find demand. Markets await US President Donald Trump's speech at the inauguration ceremony.

Solana Price Forecast: Are US traders dumping Bitcoin and XRP for SOL?

Solana (SOL) price stabilized near the $250 support level on Monday, having declined 10% from its all-time high over the last 24 hours.

GBP/USD stays defensive below 1.2200, awaits Trump 2.0

GBP/USD struggles to gain traction and trades slightly below 1.2200 in the second half of the day on Monday. Markets' nervousness ahead of US President-elect Donald Trump's inauguration drag the pair lower despite a broadly weaker US Dollar.

Trusted Broker Reviews for Smarter Trading

VERIFIED Discover in-depth reviews of reliable brokers. Compare features like spreads, leverage, and platforms. Find the perfect fit for your trading style, from CFDs to Forex pairs like EUR/USD and Gold.

-637412994383933656.png)