Gold Price Analysis: Looks to stabilize around $1550 after Fed-led wild ride

Having witnessed a volatile early Asian session, gold (futures on Comex) is stabilizing near the mid-1550s, as investors await fresh catalysts for the next direction in the prices.

The yellow-metal opened with a $45 bullish opening gap this Monday, as traders sold-off the greenback across its main competitors, responding to the surprise rate cut delivered by the US Federal Reserve (Fed) late Sunday.

The dollar sank in tandem with the US Treasury yields, as the demand for the US bonds rose, with markets unwilling to buy into the Fed rate cut decision that is said to cushion the blow of the coronavirus impact on the economy.

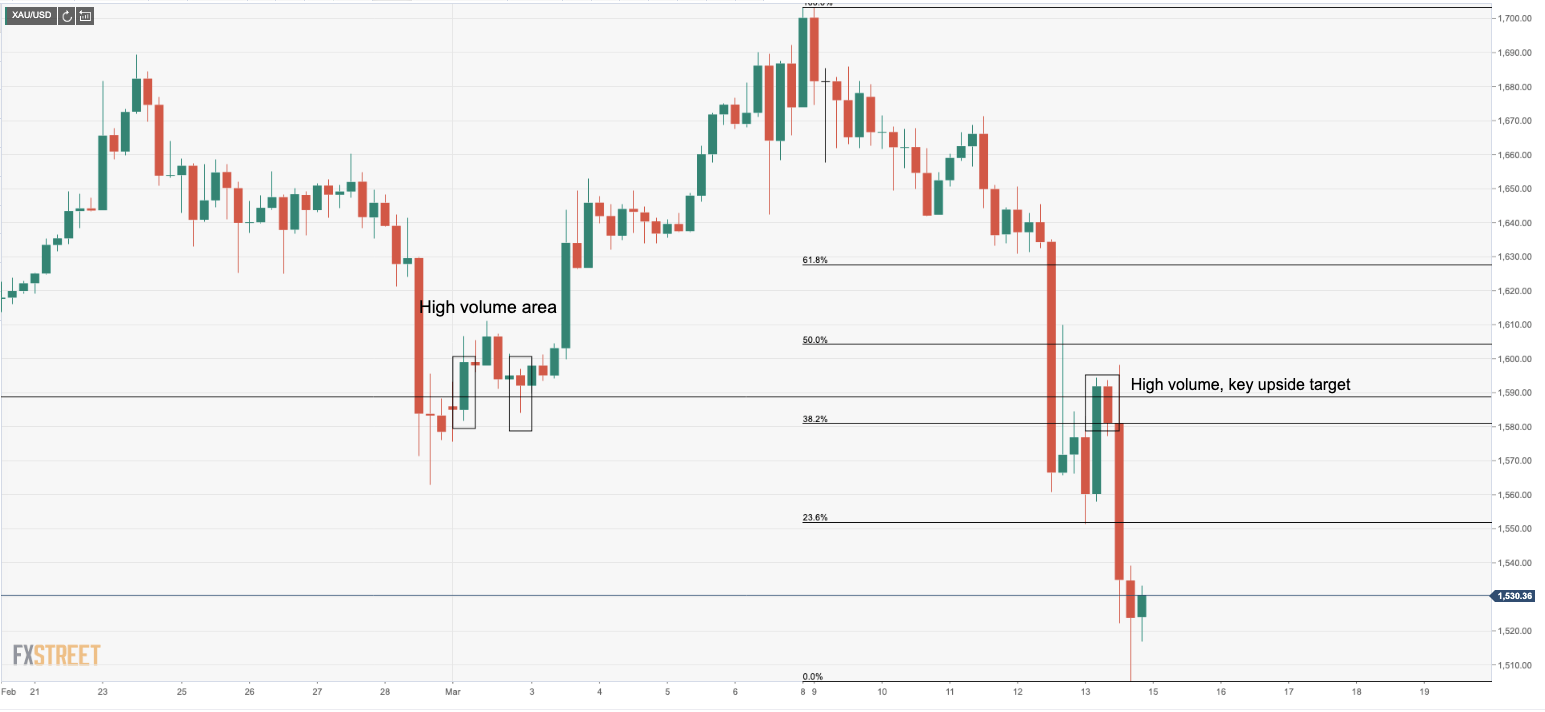

Chart of the week: Gold holds weekly support, eyes a 38.2% Fibo retracement

The return of risk appetite was adverse to gold prices, suffering a flight to cash to pay-up for margin calls mid-week. On Friday, the nail in the coffin came from US President Donald Trump declaring a national emergency and allowing more than $40 billion of FEMA funds to deal with the COVID crisis.

The move sent stocks much higher and US treasuries lower, pressuring yields and the US higher, subsequently taking down gold prices to a weekly support line. Gold reverted to the levels seen during the last bout of liquidity selling in late February, around $1,560/oz and then dropped all the way to a low of $1,504.34/oz (just above the 200-DMA, $1,497) as investors sold winners to generate liquidity and cover losses.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD recovers from two-year lows, stays below 1.0450

EUR/USD recovers modestly and trades above 1.0400 after setting a two-year low below 1.0350 following the disappointing PMI data from Germany and the Eurozone on Friday. Market focus shifts to November PMI data releases from the US.

GBP/USD falls to six-month lows below 1.2550, eyes on US PMI

GBP/USD extends its losses for the third successive session and trades at a fresh fix-month low below 1.2550 on Friday. Disappointing PMI data from the UK weigh on Pound Sterling as investors await US PMI data releases.

Gold price refreshes two-week high, looks to build on momentum beyond $2,700 mark

Gold price hits a fresh two-week top during the first half of the European session on Friday, with bulls now looking to build on the momentum further beyond the $2,700 mark. This marks the fifth successive day of a positive move and is fueled by the global flight to safety amid persistent geopolitical tensions stemming from the intensifying Russia-Ukraine war.

S&P Global PMIs set to signal US economy continued to expand in November

The S&P Global preliminary PMIs for November are likely to show little variation from the October final readings. Markets are undecided on whether the Federal Reserve will lower the policy rate again in December.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.