Gold Price News and Forecast: XAU/USD breaks pattern

Gold Price Forecast: 21-DMA support holds the key for XAU/USD amid firmer yields

Gold (XAU/USD) rallied as high as $1790 in the Asian trading on Thursday but gave up gains to reached fresh ten-day lows at $1756 after the US Treasury yields hit the highest levels in over two weeks on better-than-expected US Q1 GDP data. The US economy expanded at 6.4% in Q1 on an annualized basis, outpacing expectations of a 6.1% growth. The US weekly Jobless Claims data also came in stronger, reflecting strengthening post-pandemic economic recovery. Risk-appetite improved on the renewed economic optimism that weighed on the safe-haven US dollar, helping stage a modest recovery in gold. However, markets turned cautious, as concerns over rising yields resurfaced, which collaborated with gold’s rebound. Read more...

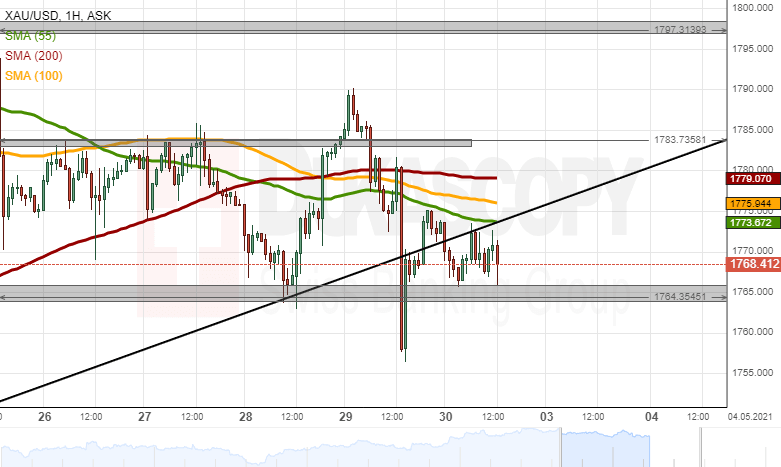

XAU/USD analysis: Breaks pattern

On Thursday, the XAU/USD exchange rate plunged by 312 pips or 1.74%. A breakout occurred through the lower boundary of an ascending channel pattern during Thursday's trading session.

Given that a breakout has occurred, the commodity is likely to continue to edge lower during the following trading session. The possible target for sellers could be near yesterday's low at 1755.00. However, technical indicators suggest on the daily time-frame chart that the precious metal could gain strength against the US Dollar within this session. Read more...

Gold Price Analysis: Three reasons why strong physical demand won’t stop XAU/USD falling – CE

Recent data have highlighted the strength of the rebound in physical demand for gold, especially in India and China. But strategists at Capital Economics don’t think this poses much of a risk to their forecast for the gold price to fall this year.

“Consumer demand has historically been strong after a period of falling prices, reflecting the more price-sensitive nature of these purchases. The upshot is that consumer demand for gold responds to changes in the price (often driven by external factors) much more than the gold price responds to changes in consumer demand. So the recent rise in consumer demand is a symptom of a lower gold price, rather than a reason to think it will rise again.” Read more...

Author

FXStreet Team

FXStreet