Gold Price News and Forecast: Gold stronger USD is a short-term blip – ANZ

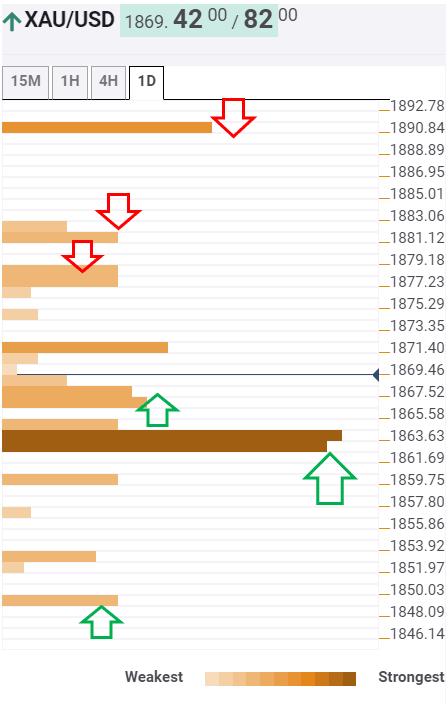

Gold Price Analysis: Holding onto $1862 pivotal for sustained recovery – Confluence Detector

The optimism over US fiscal stimulus and a thaw in the US dollar's rally helped Gold (XAU/USD) recover nearly $30 from two-month lows of $1849. Meanwhile, the yellow metal also cheered concerns about the strength of the US economic recovery, in the wake of the stubbornly high Jobless Claims.

In the day ahead, it remains to be seen if the metal sustains the pullback, as the focus shifts back to the fundamentals, with major central banks' on-hold and the coronavirus resurgence. Let's see how gold is positioned technically heading into the weekly closing. Read more...

Gold: Stronger USD is a short-term blip – ANZ

Investment demand for gold is holding up despite bouts of liquidation, with outflows from gold-backed ETFs increasing. The stronger USD and rising real rates have suppressed investor appetite, but strategists at ANZ Bank believe gold's safe haven appeal will remain strong because of renewed volatility in the equity market and ongoing macro and geopolitical uncertainty. XAU/USD is extending the recovery to $1875 amid the dollar's pullback.

Key quotes: "A stronger USD and fading prospects of a fresh stimulus package before the US election have triggered a sell-off. Nevertheless, all-time low yields, elevated inflation expectations, accommodative central banks and renewed volatility in the equity market all bode well for the sector." Read more...

Gold on the defensive, below $1870 level amid stronger USD

Gold lacked any firm directional bias and seesawed between tepid gains/minor losses, around the $1865-70 region through the early European session.

The XAU/USD failed to capitalize on the previous day's modest rebound from two-month lows and witnessed a subdued/range-bounce price action on the last trading day of the week. Investors remain concerned that the second wave of coronavirus infections could threaten the economic recovery, which, in turn, continued benefitting the US dollar's status as the global reserve currency. A stronger greenback kept a lid on any meaningful upside for the dollar-denominated commodity.

Meanwhile, reports indicated that Democrats in the US House of Representatives are working on a $2.2 trillion coronavirus package boosted investors' confidence. The optimism, however, faded rather quickly and the same was evident from a turnaround in the equity markets, which tends to underpin the safe-haven gold. This, along with a fresh leg down in the US Treasury bond yields, might further contribute to limit any deeper losses for the non-yielding yellow metal, at least for now. Read more...

Author

FXStreet Team

FXStreet