Gold Analysis: breaks resistance levels

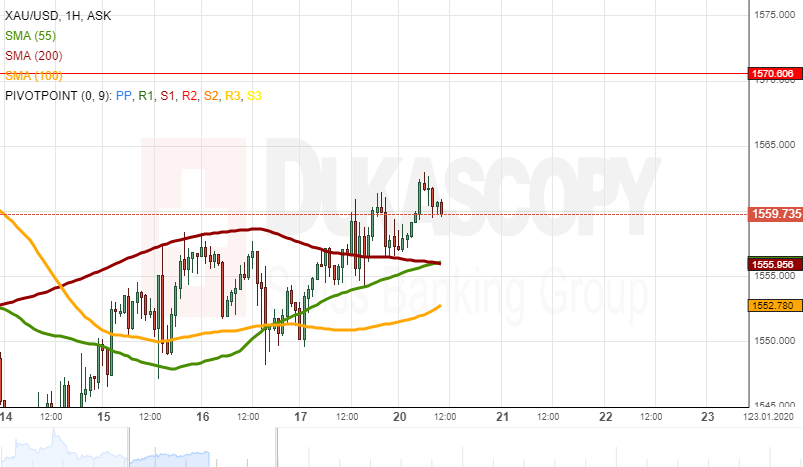

On Friday, gold's price broke off the hourly simple moving averages. On Monday, there was a surge that started when the rate bounced off the support of the 200-hour SMA.

In general, the pair had no technical resistance as high as the pivot point at 1,570.00. In theory, the price should reach for this level. Read more...

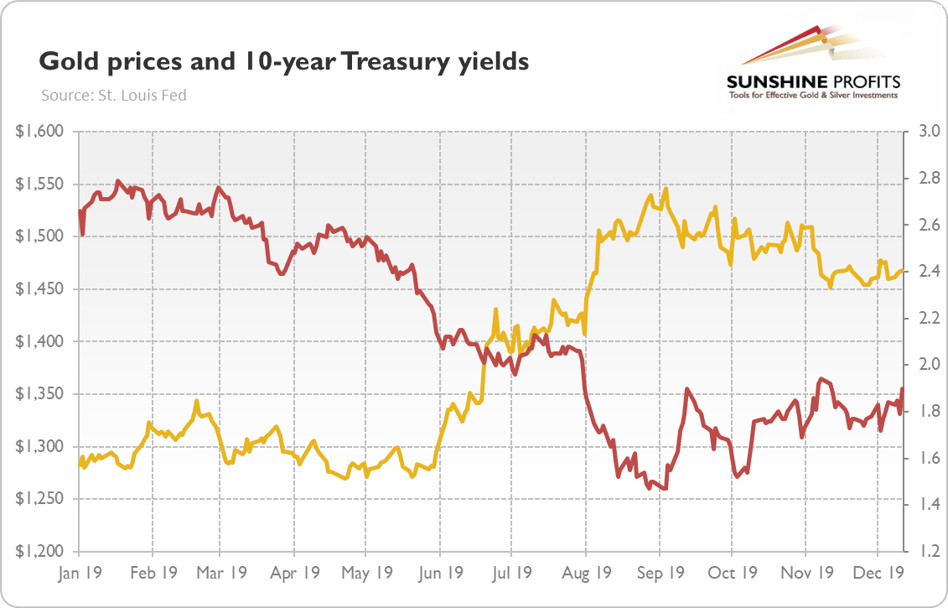

10 Economic Trends That Will Shape the US and Gold Market in 2020

Will 2020 turn out better than 2019 for the yellow metal? Gold prices don’t move in a vacuum – the macroeconomic situation definitely plays a key fundamental role. In today’s article, we’ll present the macroeconomic outlook for 2020 and you’ll learn whether the fundamentals are likely to become more or less friendly toward gold in 2020.

What will 2020 be like? Well, as a leap year, it will be for sure longer than 2019, but the rest is a mystery. However, let’s point out a few important trends that will shape the U.S. economy and the gold market this year. Read More

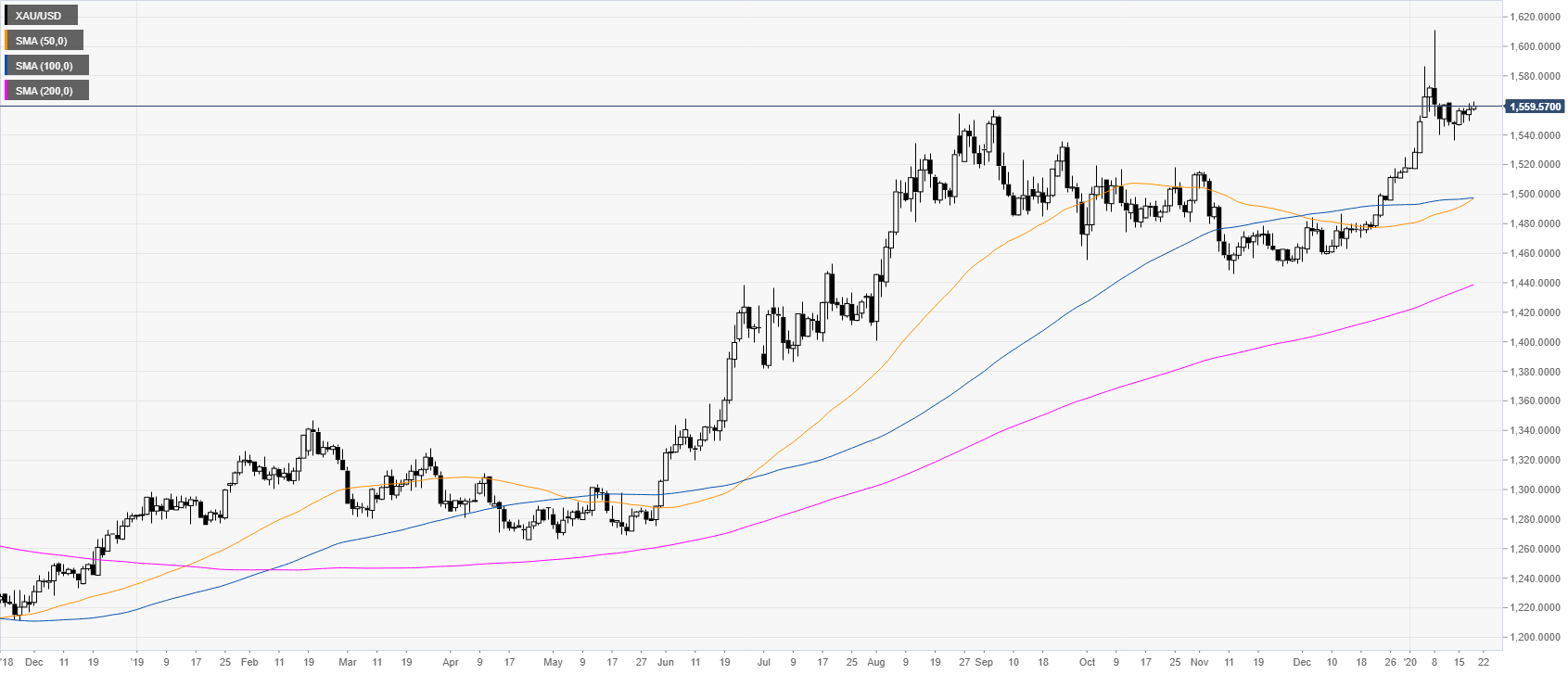

Gold New York Price Forecast: XAU/USD bulls facing the 1563 resistance in the New York session

XAU/USD is trading in an uptrend above the main daily simple moving averages (SMAs). After a failure at the 1600 mark earlier in the month, the metal is regaining strength once again.

Gold is currently limited by the 1563 resistance as the metal is evolving in a bullish channel above the main SMAs. A break above the resistance can see the metal appreciating towards the 1570 and 1580 resistance levels. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD: Extra consolidation appears on the cards

AUD/USD set aside a two-day recovery past the 0.6300 hurdle and came under pressure on Wednesday, always in response to US tariff fears and the marked bounce in the Greenback.

EUR/USD: Further downside could retest the 200-day SMA

EUR/USD accelerated its losses and retested lows near the 1.0740 zone on the back of the stronger US Dollar and persistent jitters surrounding potential tariffs on EU imports as soon as next week.

Gold remains slightly offered just above $3,000

Gold is trading in a narrow range on Wednesday but continues to hold firm just above the $3,000 mark. The precious metal is drawing support from upbeat sentiment in the broader commodities space, buoyed by Copper’s surge to a fresh all-time high earlier in the day.

Crypto Today: SHIB, DOGE and PEPE enter $6B gains as BTC aims at $90k

Cryptocurrency market capitalization dips 1.3% to hit $2.9 trillion on Tuesday, with market indicators showing capital rotation toward memecoins.

Sticky UK services inflation shows signs of tax hike impact

There are tentative signs that the forthcoming rise in employer National Insurance is having an impact on service sector inflation, which came in a tad higher than expected in February. It should still fall back in the second quarter, though, keeping the Bank of England on track for three further rate cuts this year.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.