Gold price clings to gains as Fed sees longer-term declining inflation trend intact

- Gold price extends its recovery in a holiday-shortened week.

- The US PPI rose strongly in January but this was put down to seasonally adjusted fluctuations.

- Fed Bostic sees two rate cuts this year commencing from summer.

Gold price (XAU/USD) continues its winning spell for the third session in a row on Monday despite waning expectations of rate cuts by the Federal Reserve (Fed) before the June monetary policy meeting. The precious metal maintains strength even though sticky Consumer Price Index (CPI) and Producer Price Index (PPI) data for January have prompted prospects of persistent core Personal Consumption Expenditure price index (PCE) data.

Investors believe that the reasoning behind higher Gold price is less significant PPI data for January as prices moved up due to some seasonal adjustment problems. In addition to that, Fed policymakers have considered the surprise rise in the latest consumer price inflation data as a one-time blip, emphasizing the longer trend, which indicates that inflation is moving decisively down.

Meanwhile, the forecast from Atlanta Federal Reserve Bank President Raphael Bostic that progress in underlying measures of inflation could allow the Fed to start reducing interest rates from summer has eased opportunity cost of holding non-yielding assets such as Gold.

Daily Digest Market Movers: Gold advances for third session

- Gold price advances strongly to $2,020 as the US Dollar remains under pressure, although hotter-than-anticipated PPI data for January has cooled down expectations of rate cuts for May monetary policy meeting by the Federal Reserve.

- The CME FedWatch tool indicates that trades see a steady interest rate decision in the March and May monetary policy meetings. The Fed is expected to cut interest rates by 25-basis points (bps) in the June policy meeting.

- Stronger consumer price inflation and PPI data for January have pushed back expectations of Fed rate-cuts before June.

- Sticky price pressures have bought more time to the Fed to reassess the need of rate cuts. Premature rate cuts could dent the efforts yet made in taming inflation from its historic highs to where it is now by flaring it up again.

- Higher-than-projected CPI and PPI data have deepened fears of escalating core PCE price index data for January – the preferred gauge for Fed policymakers for preparing monetary policy remarks.

- Atlanta Fed Bank President Raphael Bostic said he was a little surprised by recent inflation data, but broader progress in the fight against inflation has opened doors for rate cuts in the summertime.

- However, Raphael Bostic reiterated the need for good inflation data in the coming months to be convinced that inflation is truly falling. Bostic sees two rate cuts in 2024.

- Meanwhile, the US Dollar Index (DXY), which gauges the Greenback’s value against six rival currencies, rebounds from 104.10 amid uncertainty due to a holiday-truncated week in the US economy. The US markets will remain closed on Monday because of President’s Day.

- This week, investors will focus on the Federal Reserve Open Market Committee (FOMC) minutes for January’s policy meeting, which will be released on Wednesday.

- The FOMC minutes will provide a detailed explanation behind keeping key rates unchanged in the range of 5.25%-5.50% in January and fresh outlook on interest rates.

- Apart from that, investors will focus on the preliminary S&P Global Manufacturing PMI for February, which will be published on Thursday.

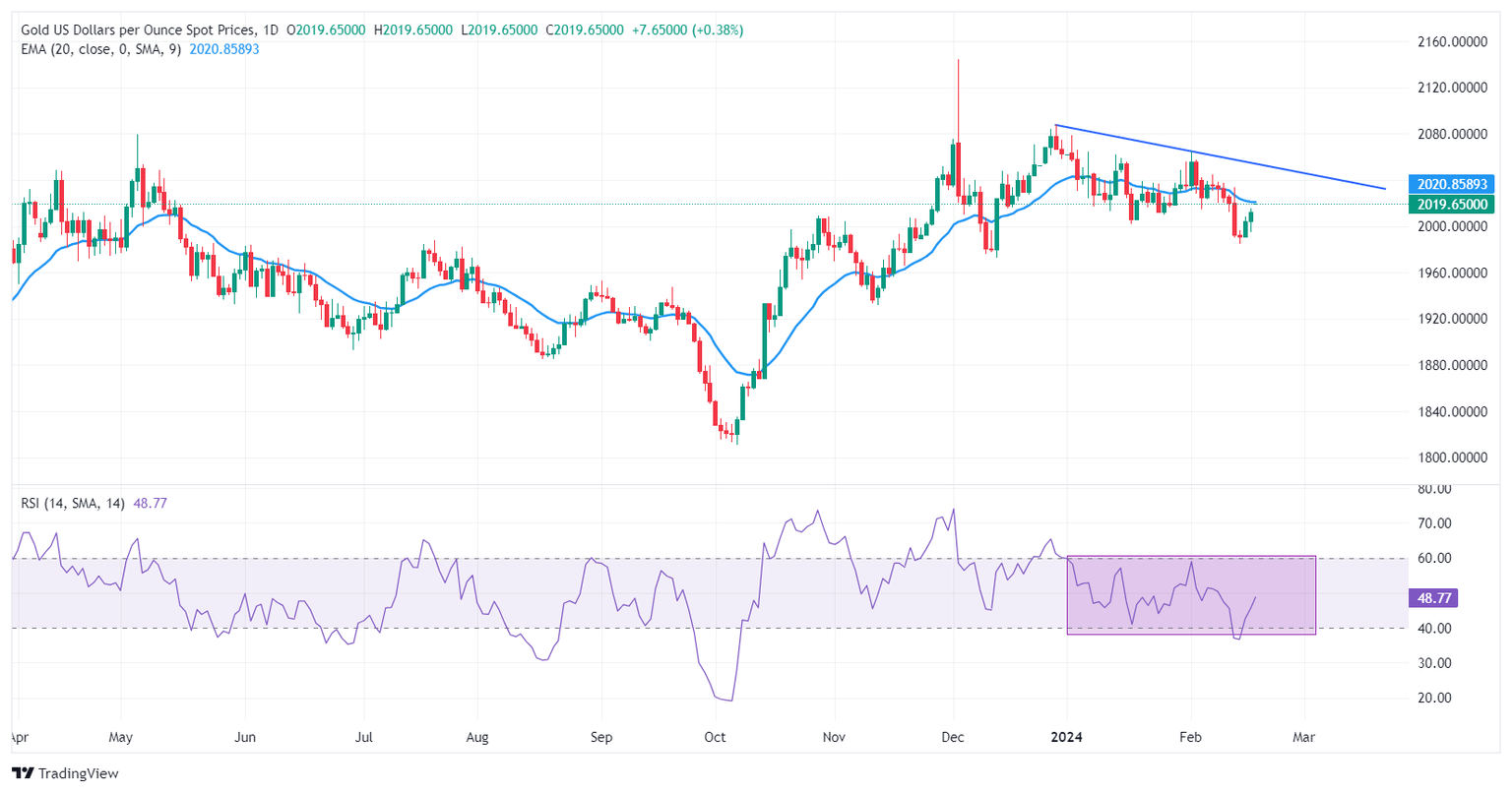

Technical Analysis: Gold price rebounds to near 20-day EMA around $2,020

Gold price extends its recovery for the third straight trading session even though the Fed is maintaining its hawkish rhetoric due to sticky price pressures. The precious metal reverses to the 20-day Exponential Moving Average (EMA), which trades around $2,022. The outlook for the Gold price could turn bullish if it manages to sustain above the 20-day EMA.

The downward-sloping trendline from December 28 high at $2,088 may continue to act as a barrier for the Gold price. The 14-period Relative Strength Index (RSI) oscillates in the 40.00-60.00 range, which shows a sideways outlook for the Gold price.

Inflation FAQs

What is inflation?

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

What is the impact of inflation on foreign exchange?

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

How does inflation influence the price of Gold?

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it.

Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.