Gold Price is breaking market structure to the downside in this historic bearish cycle

- The Gold Price is offered below critical market structure and the focus in the main is on the downside towards monthly lows of $1,676.86.

- Price pressures are still much too strong to delay Fed rate hikes.

- US dollar could continue to derive support from the fears of a recession at home and away.

The Gold Price (XAU/USD) has been pressured on Thursday due to a rising US dollar and hawkish sentiment surrounding the Federal Reserve which is widely expected to raise the federal funds rate by 75 basis points at its July 26-27 meeting. trading at $1,710.10, the price is 1.47% lower at the time of writing, sliding from a high of $1,736.60 to a low of $1,697.64. Overall, both the technical and fundamental bias has been to the downside.

The break in daily market structure and prospects of a strong US dollar as well as higher yields, which gold does not offer to investors, have weighed on the precious metal. The greenback has tended to strengthen both when the US economy outperforms its peers and also when the US economy looks weak.

Gold Price weighed by Fed sentiment

There are concerns that the Federal Reserve is caught between a rock and hard place, but overall, the Gold Price is being weighed into pre-pandemic levels and there are risks of a significant capitulation event in precious metals. Firstly, US inflation surprised once again to the upside in June, both headline and core measures, with annual inflation jumping to a new four-decade high of 9.1%, up from 8.6% in May. Therefore, supportive of global yields and the US dollar as a headline for gold prices, the market expects that the Fed will be in no rush to signal a pivot from its current path of aggressive rate hikes and is pricing in steeper hikes of 100bs pints for not only in July but September's meeting as well. At the June FOMC meeting, Chair Powell stated that he would need ‘compelling evidence’ that inflation is easing for the Fed to change course, which he defined as ‘a series of falling monthly inflation readings’.

Fears of global recession, support of the US dollar

The US dollar could continue to derive support from the fears of a recession at home and away. Despite the slowing in demand that we are now seeing and the risk of recession, the Fed is clearly more worried about a de-anchoring of inflation expectations, which would be much harder to deal with. A global recession could stem from no other than the second largest economy in the world, China which is battling with Covid infections. Barely six weeks after Shanghai fully lifted a prolonged and harshly enforced lockdown, China's biggest city is again grappling with a surge of the virus.

The worries that the Middle Kingdom could miss its official growth forecast this year have been mingling with recession fears for both the Eurozone and the US. This is expected to continue to play into the hands of the US dollar bulls. The US dollar smile theory has been playing out since the advent of Covid and is sucking up the world's capital.

The greenback’s safe haven function also stems from its use as an invoicing currency and from the significant amounts of USD-denominated debt issued by non-US residents. Simply put, in times of uncertainty various market participants take action to secure their access to USDs. In turn, the pull on the gold price is likely to persist, at least until the Fed’s front-loaded policy tightening cycle is near conclusion.

''There is no way around it, the Fed has an inflation problem on its hands and the USD will continue to remain king of FX,'' analysts at TD Securities argued.

Gold Price expectations from TD Securities

''The single largest speculative cohort in gold appears to be holding a complacent position, with the average trader holding twice their expected position size,'' analysts at TD Securities said.

Key quotes:

''The epicentre of speculative gold markets has shifted away from money managers and towards the often-ignored prop-trader cohort. Their length was accumulated in 2020 and does not appear to be correlated to inflation or Fed narrative, which instead points to some complacency in this legacy position.''

''The latest data suggests that prop-trader bulls were still adding on the dip, as the breadth of traders long grew, but the pressure is building towards a capitulation if prices trade below their pandemic-era entry levels. In a liquidation vacuum, these massive positions are most vulnerable, which suggests the yellow metal remains prone to further downside still.''

Gold Price technical analysis

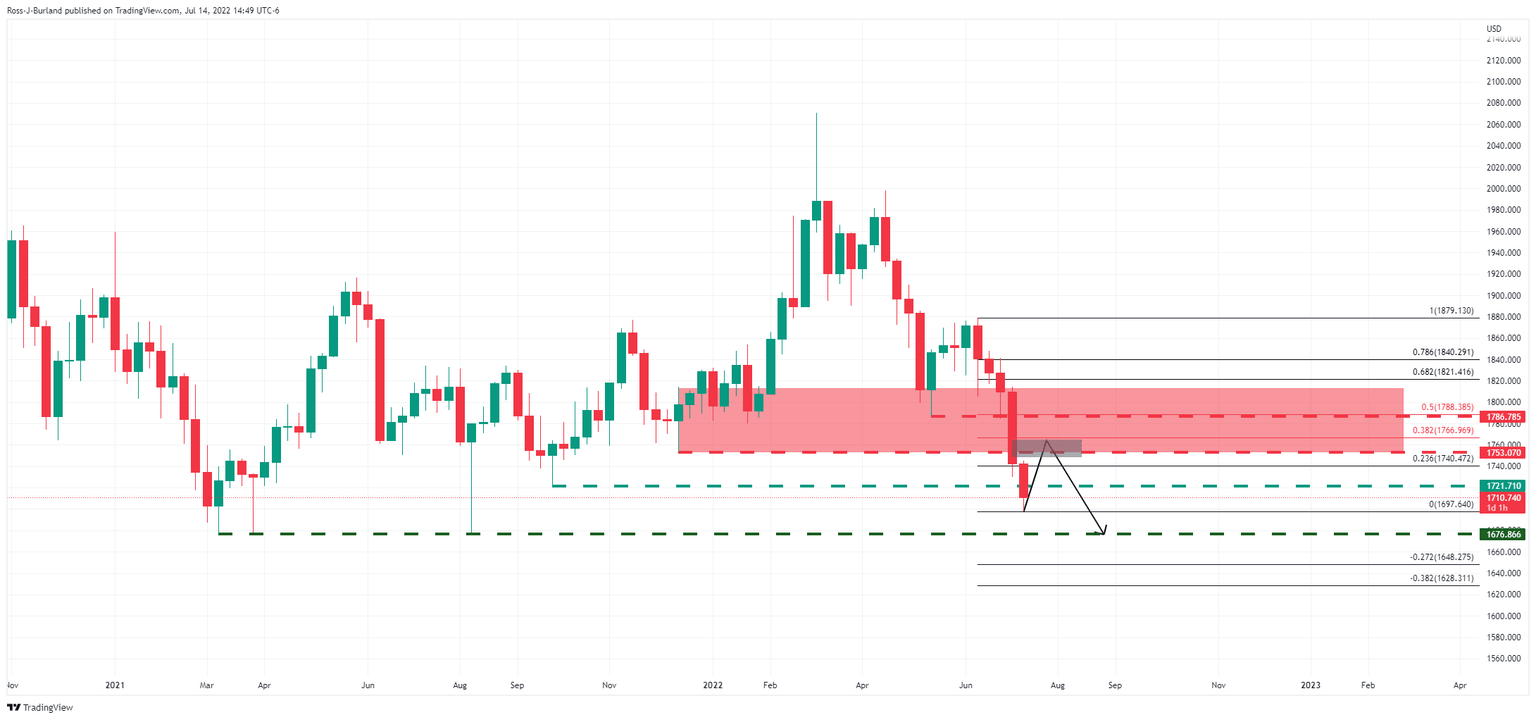

The Gold Price has broken structure on the daily chart although there are prospects of a correction in order to mitigate the imbalance of price above resistance as illustrated above. The downside target, however, is in play.

From a weekly perspective, the price could also be regarded as extended and a correction is arguably feasible at this juncture. There is a price imbalance from the current week's highs to the week commencing June 27 low. This area meets a 50% mean reversion and a 38.2% Fibonacci retracement before then. However, the focus in the main is on the downside towards monthly lows of $1,676.86 as illustrated on the chart above.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.