Gold price holds above $2,600 amid risk-off mood, retreating US bond yields and softer USD

- Gold price attracts some haven flows on Friday amid the looming US government shutdown.

- The Fed’s hawkish tilt remains supportive of elevated US bond yields and caps the XAU/USD.

- Traders now look forward to the release of the US PCE Price Index for short-term opportunities.

Gold price (XAU/USD) maintains its bid tone through the first half of the European session on Friday amid the prevalent risk-off mood. Against the backdrop of persistent geopolitical risks and trade war fears, the threat of a US government shutdown drives some haven flows towards the bullion. The global flight to safety leads to a modest pullback in the US Treasury bond yields, which caps the recent US Dollar (USD) rally to a two-year peak and lends additional support to the commodity.

That said, the Federal Reserve's (Fed) hawkish signal that it would slow the pace of rate cuts in 2025 acts as a tailwind for the US bond yields and favors the USD bulls. This, in turn, fails to assist the non-yielding Gold price to capitalize on its intraday positive move back above the $2,600 mark. Traders now look to the US Personal Consumption Expenditure (PCE) Price Index, which might influence the USD price dynamics and drive the XAU/USD later during the early North American session.

Gold price bulls seem non-committed amid the prospects for a slower rate cuts by the Fed

- The US House of Representatives on Thursday failed to pass A spending bill to fund the government, raising the risk of a government shutdown at the end of the day on Friday.

- This comes on top of persistent geopolitical risks and concerns about US President-elect Donald Trump's tariff plans, which, in turn, drive some haven flows towards the Gold price.

- The US Treasury bond yields retreat from a multi-month top, capping the post-FOMC blowout US Dollar rally to a two-year top and lending additional support to the commodity.

- The US Bureau of Economic Analysis reported on Thursday that the economy expanded at a 3.1% annualized pace in the third quarter compared to 2.8% estimated previously.

- Other data on Thursday showed that the number of Americans filing new applications for jobless benefits fell more than expected, to 220K for the week ended December 14.

- This reaffirms the Federal Reserve's hawkish outlook for a slower rate cut path in 2025, which should act as a tailwind for the US bond yields and cap the non-yielding yellow metal.

- Bulls might also refrain from placing aggressive bets ahead of Friday's release of the US Personal Consumption Expenditure (PCE) Price Index – the Fed's preferred inflation gauge.

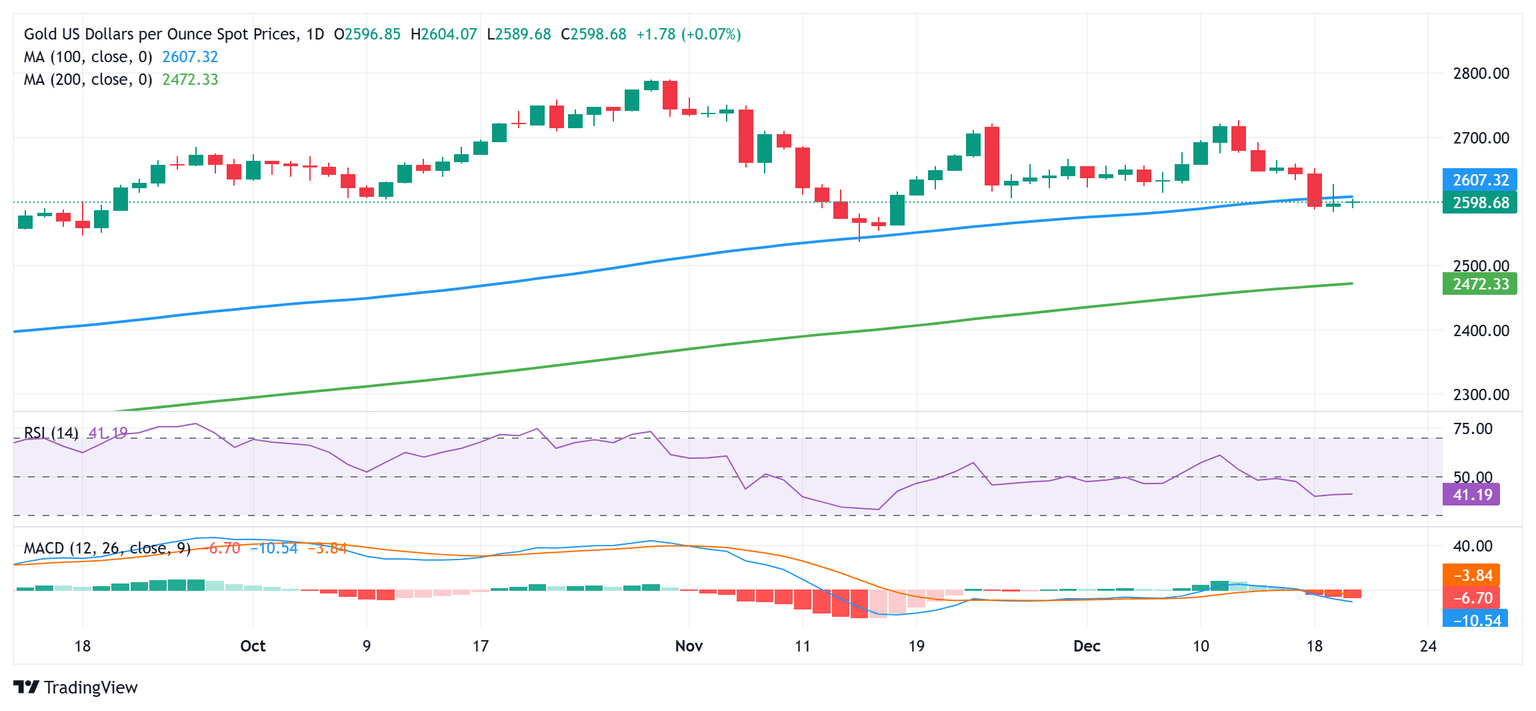

Gold price might continue to attract sellers near $2,625, or the overnight swing high

From a technical perspective, the post-FOMC slump below the 100-day Simple Moving Average (SMA) was seen as a fresh trigger for bearish traders. Moreover, oscillators on the daily chart have been gaining negative traction and suggest that the path of least resistance for the Gold price is to the upside. Hence, any subsequent move up might continue to face immediate resistance near the overnight swing high, around the $2,626 region. Some follow-through buying, however, might trigger a short-covering rally and lift the XAU/USD to the next relevant hurdle near the $2,652-2,655 supply zone. A sustained strength beyond the latter could negate the negative bias and pave the way for additional gains.

On the flip side, the monthly low, around the $2,583 region touched on Thursday, could protect the immediate downside, below which the Gold price could drop to the $2,560 area en route to the $2,537-2,536 zone or the November swing low. The downward trajectory could extend further towards the $2,500 psychological mark before the XAU/USD eventually drops to the very important 200-day SMA support, currently pegged near the $2,472 region.

US Dollar PRICE This week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 1.16% | 0.95% | 2.05% | 1.09% | 1.93% | 2.27% | 0.46% | |

| EUR | -1.16% | -0.16% | 0.99% | -0.00% | 0.93% | 1.17% | -0.64% | |

| GBP | -0.95% | 0.16% | 1.04% | 0.15% | 1.09% | 1.31% | -0.48% | |

| JPY | -2.05% | -0.99% | -1.04% | -0.96% | -0.12% | 0.23% | -1.49% | |

| CAD | -1.09% | 0.00% | -0.15% | 0.96% | 0.88% | 1.16% | -0.63% | |

| AUD | -1.93% | -0.93% | -1.09% | 0.12% | -0.88% | 0.24% | -1.55% | |

| NZD | -2.27% | -1.17% | -1.31% | -0.23% | -1.16% | -0.24% | -1.79% | |

| CHF | -0.46% | 0.64% | 0.48% | 1.49% | 0.63% | 1.55% | 1.79% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.