Gold rallies above $2,370 as traders await crucial US Nonfarm Payrolls report

- Gold climbs 0.54% and reaches a two-week high of $2,378.

- Higher-than-expected US jobless claims weaken US Dollar and stabilize Treasury yields.

- Traders focus on upcoming Nonfarm Payrolls; forecasts suggest 185,000 new jobs with a 3.9% Unemployment Rate.

Gold hit a two-week high of $2,378 on Thursday after the US Bureau of Labor Statistics (BLS) announced weaker-than-expected jobs data that kept US Treasury bond yields virtually unchanged, a tailwind for the golden metal. The XAU/USD trades at $2,369, registering a gain of 0.54% after bouncing off weekly lows of $2,320.

US jobs data was one of the main drivers of the day after the BLS revealed that the number of Americans filing for unemployment benefits exceeded the consensus and the previous week's reading. In addition, the European Central Bank (ECB) decided to cut interest rates, which sent US Treasury yields climbing before paring its earlier gains.

The US 10-year benchmark is set to print weekly losses yet retreated from a daily high of 4.32% to 4.285% following the ECB’s decision. In the meantime, the US Dollar Index, which measures the Greenback’s performance against a basket of six currencies, dropped 0.12% to 104.14.

Following the latest US employment data, traders' focus shifts to Friday's May Nonfarm Payrolls report. Estimates suggest the economy will add 185,000 people to the workforce, above April’s 175,000. The Unemployment Rate is expected to be 3.9%, and Average Hourly Earnings are projected to remain unchanged at 3.9%.

Daily digest market movers: Gold price capitalizes on falling US Treasury yields

- US Initial Jobless Claims for the week ending May 31 rose by 229,000, above estimates of 220,000 and the previous reading of 221,000

- ADP Employment Change revealed that private US hiring in May rose by 152K, below estimates of 175K and missing April’s 188K.

- Softer-than-expected Nonfarm Payrolls data could increase the odds of rate cuts by the Federal Reserve.

- Data from the Chicago Board of Trade (CBOT) revealed that traders expect 39 basis points (bps) of interest rate cuts toward the end of 2024 via the December fed funds rate futures contract.

- According to the CME FedWatch Tool, traders are currently pricing in a 57% chance of a rate cut in September.

- Last week, the US Core Personal Consumption Expenditure Price Index (PCE), the Fed’s preferred inflation gauge, stabilized, boosting hopes for potential rate cuts.

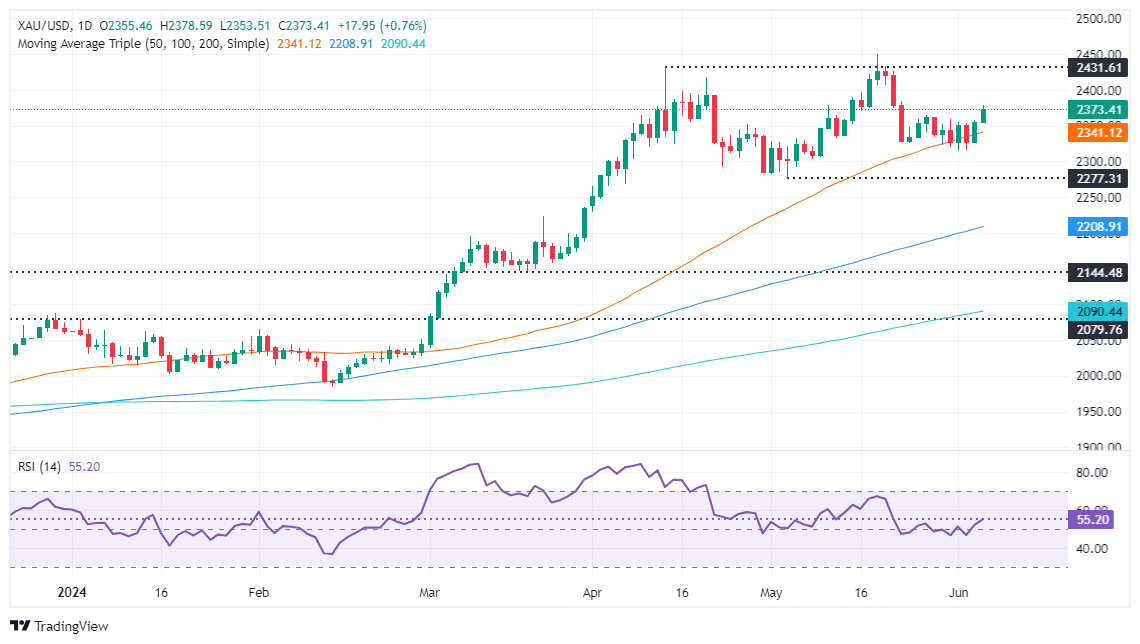

Technical analysis: Gold price shedges higher above $2,350

Gold extended its rally after consolidating within the $2,320 to $2,360 region, but buyers cracking the top of the range opened the door for further gains. Momentum remains on the buyers' side as the Relative Strength Index (RSI) remains bullish.

On further strength, XAU/USD's next resistance would be $2,400, followed by the year-to-date high of $2,450. Conversely, if Gold slips below $2,350, the next support would be the 50-day Simple Moving Average (SMA) of $2,337. The next stop would be the May 8 low of $2,303, followed by the May 3 cycle low of $2,277.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.