Gold soars as investors price in Fed rate cuts on soft US data

- Gold climbs, spurred by weak US economic data and rising Fed rate cut expectations.

- FOMC Minutes: readiness to hike rates if inflation persists, but current policy seen as restrictive.

- ISM shows contracting US services activity; labor market data reveals higher unemployment claims, decreased private hiring.

- Attention turns to Friday's Nonfarm Payrolls, with US markets closed Thursday for Independence Day.

Gold price surged over 1% on Wednesday after softer-than-expected economic data from the United States increased bets that the Federal Reserve (Fed) could cut interest rates by September. In the meantime, the latest FOMC meeting minutes showed that “several participants” were ready to lift rates if inflation remained elevated. At the time of writing, XAU/USD trades at $2,356 above its opening price.

The Fed’s minutes showed that most participants estimated that the current policy is restrictive but had opened the door for rate increases. Policymakers acknowledged the economy is cooling and could react to unexpected economic weakness.

In addition, US business activity in the services sector contracted after hitting its highest level since August 2023, according to the Institute for Supply Management (ISM). This and weaker jobs data, as the number of Americans filing for unemployment benefits rose and private companies hired fewer workers than foreseen, sparked a repricing of Fed interest rate cuts.

Labor market data surprisingly came in softer following Tuesday’s stronger-than-expected JOLTS report. Trader focus shifts to Friday’s Nonfarm Payrolls (NFP) report as US markets will be closed on Thursday due to Independence Day.

Daily digest market movers: Gold shines and climbs on soft US data

- On Tuesday, Powell remarked that the disinflation process has resumed but emphasized the need for further progress before considering any interest rate cuts. He added, “Because the US economy is strong and the labor market is strong, we have the ability to take our time and get this right.”

- US jobs data for June, led by the ADP Employment Change, came in at 150K, missing estimates of 160K and down from May's 157K.

- US Initial Jobless Claims for the week ending June 29 rose to 238K, surpassing estimates of 235K and the previous reading of 234K.

- June's ISM Services PMI dropped sharply to 48.8, its lowest since May 2020 and the fastest decline in four years, signaling recessionary conditions.

- According to the CME FedWatch Tool, odds for a 25-basis-point Fed rate cut in September are at 66%, up from 63% on Tuesday.

- December 2024 fed funds rate futures contract implies that the Fed will ease policy by just 38 basis points (bps) toward the end of the year.

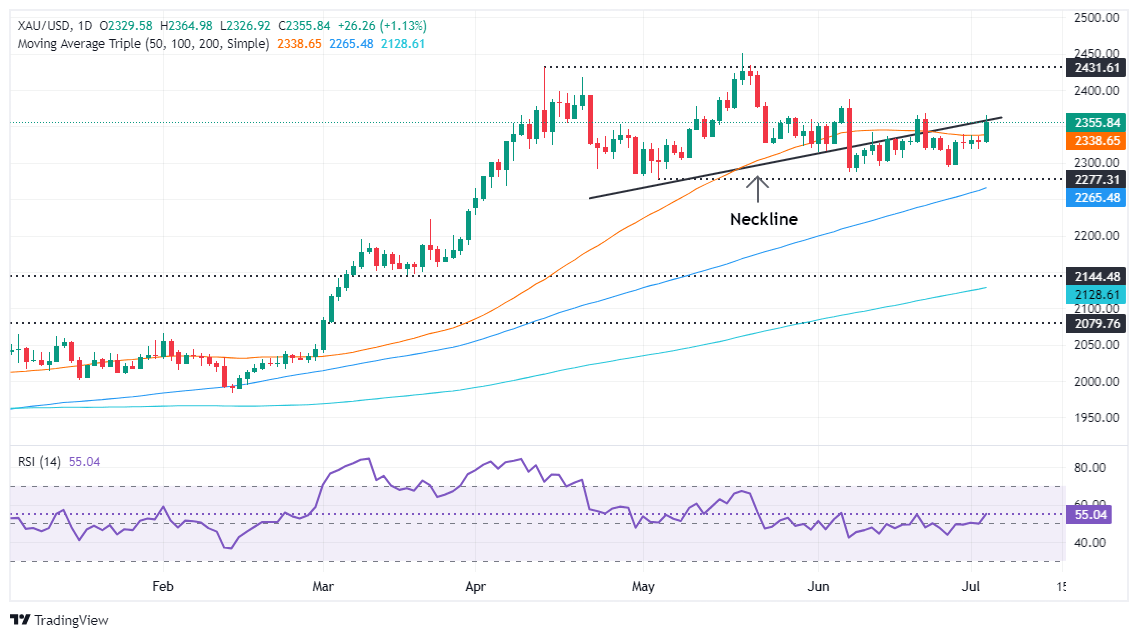

Technical analysis: Gold price fluctuates near Head-and-Shoulders neckline

The Gold price uptrend is set to continue and is testing the neckline of a Head-and-Shoulders chart pattern that has emerged since April 2024.

From a price action perspective, XAU/USD is downwardly biased in the near term, but the overall trend is bullish and is intact. This is further confirmed by momentum as the Relative Strength Index (RSI) is bullish.

If the Gold price clears the pattern’s neckline, that would sponsor a leg up to $2,400 and invalidate the Head-and-Shoulders chart structure. This would pave the way for further gains and expose the year-to-date high of $2,450.

Conversely, if sellers push the spot price below $2,350, further downside is seen near $2,300. If successful, the next demand zone would be the May 3 low of $2,277, followed by the March 21 high of $2,222.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.