- Gold Price is struggling around the $1,850 area amid risk-off markets.

- Record high inflation rate in the Euro area re-ignites growth concerns.

- USD holds the bounce with yields, XAUUSD’s range play likely to extend.

Gold Price is adding to the previous losses while keeping its range around the $1,850 psychological level. The precious metal feels the heat from a broad US dollar rebound amid a sharp upturn in the Treasury yields. Markets remain in a risk-off mode, underpinning the dollar’s haven demand. The ongoing upsurge in oil prices and record-high inflation in the Euro area have re-ignited global growth worries, as central banks remain on a tightening spree. Against this backdrop, gold price is finding some comfort, limiting its move lower. Traders now look forward to the US Nonfarm payrolls release for a fresh direction in XAUUSD.

Also read: Gold Price Forecast: XAUUSD looks south amid firmer yields, 200-DMA at risk?

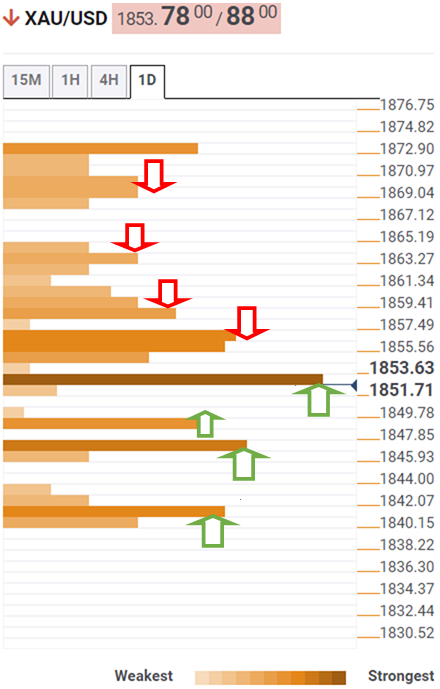

Gold Price: Key levels to watch

The Technical Confluences Detector shows that the Gold Price is gyrating around the $1,851 critical barrier, which is now acting as strong support. That price is the convergence of the Fibonacci 61.8% one-week, SMA50 four-hour and the pivot point one-day S1.

If that breaks then the next safety net appears at the pivot point one-day S2 at $1,848.

Further south, the pivot point one-month S1 at $1,846 will challenge the bullish commitments.

The last line of defense for gold bulls is seen at $1,841, the confluence of the SMA200 one-day, the previous week’s low and the pivot point one-week S3.

On the upside, bulls need a firm break above the $1,856 supply zone, where the SMA5 one-day, Fibonacci 23.6% one-day and the previous high four-hour collide.

The next bullish target is aligned at $1,859, the Fibonacci 38.2% one-day and one-week.

The Fibonacci 23.6% one-week at $1,863 will guard the additional upside, opening doors for a test of the previous week’s high of $1,870.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD holds positive ground above 0.6900 ahead of Chinese PMI data

The AUD/USD pair extends its upside to around 0.6910 during the early Asian session on Monday. The rising bets for another oversized interest rate cut by the Federal Reserve in November weigh on the US dollar. The Chinese Purchasing Managers Index reports for September are due later on Monday.

EUR/USD: Buyers maintain the pressure ahead of critical US employment data

The EUR/USD pair ended a mostly uneventful last week trading near the 1.1200 mark, still battling to conquer the level. It managed to post a fresh 2024 high of 1.1213 mid-week, but sellers around it have rejected EUR/USD once again.

Gold: Prospects of Fed rate cuts, geopolitical tensions underpin bullish impulse

Gold clinched its third consecutive week of gains, reaching a fresh all-time high on Thursday. If bullish momentum persists, immediately to the upside emerges the $2,700 mark. Fed rate cut bets, geopolitical tensions continue to support the yellow metal.

Week ahead: NFP on tap amid bets of another bold Fed rate cut

Investors see decent chance of another 50bps cut in November. Fed speakers, ISM PMIs and NFP to shape rate cut bets. Eurozone CPI data awaited amid bets for more ECB cuts. China PMIs and BoJ Summary of Opinions also on tap.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.