Gold Price Forecast: XAUUSD treads water around $1,740 amid USD strength

- Gold Price trades on the defensive after Friday’s positive close.

- US NFP beat trigger two-way businesses in the yellow metal.

- XAUUSD hovers near nine-month lows, with eyes on US inflation.

Gold Price is moving back and forth in a familiar range around the $1,740 level, as the US dollar sees fresh buying at the start of the week. Investors digest Friday’s stellar US Nonfarm Payrolls report while assessing the Fed rate hike expectations.

The US economy added 372,000 jobs in June vs. expectations of 268,000 addition while the Unemployment Rate steadied at 3.6%. The solid US labor market offered a tailwind to the aggressive Fed tightening expectations, keeping the sentiment around the dollar buoyed.

Moreover, the risk-off mood in Asian trading, with the renewed concerns over Chinese covid lockdowns and their impact on global growth, added to the greenback’s strength.

Although the retreat in the US 10-year Treasury yields from multi-day highs helps cushion the downside in the bright metal. Persistent risk-off flows boost the safe-haven appeal of the American government bonds, dragging yields lower.

Meanwhile, markets grieve over the shocking assassination of the former Japanese Prime Minister Shinzo Abe. Further, a sense of caution prevails ahead of the critical US inflation data due later this week, which leaves gold bulls in the back seat.

In the meantime, the Fed sentiment and recession fears will continue to influence the broader market theme, eventually impacting the dollar valuations and gold price action. The US economic calendar remains light on Monday; therefore, the focus will be on the Fed official Williams speech.

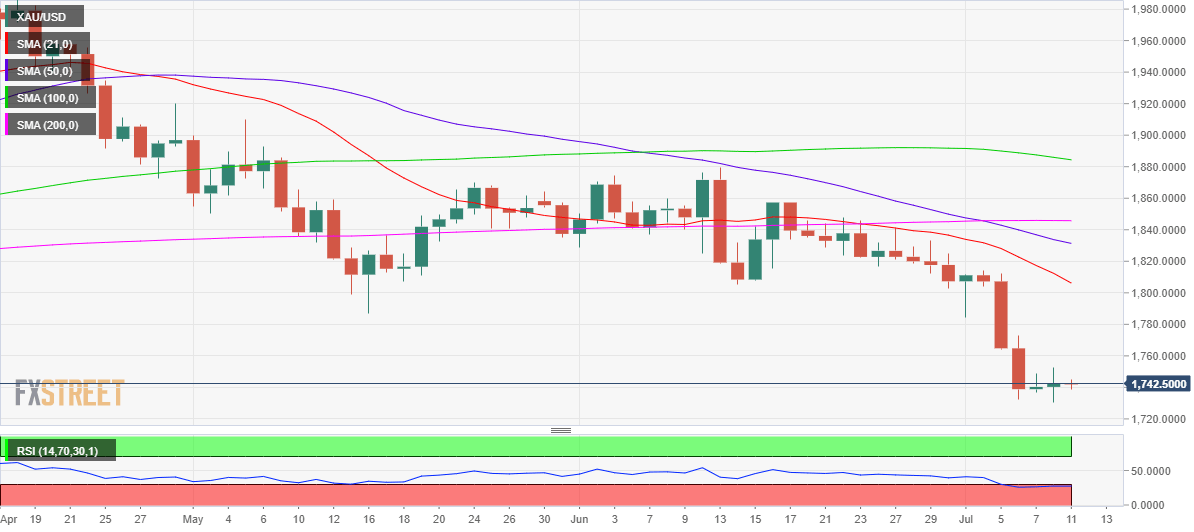

Gold Price: Daily chart

“On the upside, $1,765 (former support, static level) aligns as the first technical resistance ahead of $1,790 (former support, static level). On the downside, $1,730 (July 8 low) forms interim support ahead of $1,720 (static level) and $1,700 (psychological level),” FXStreet’s Senior Analyst, Eren Sengezer explained in his gold weekly forecast.

Gold Price: Additional levels to consider

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.