- Gold could be on the verge of a move into the recent length built in November's rally.

- Bears are lurking at critical resistance as Monday establishes a fresh corrective high.

Despite a firmer US Dollar, the Gold price edged higher on Monday to a fresh three-month high even as US yields moved higher following Friday's US Consumer Price Index miss vs. the expectations. The yellow metal continues to garner demand based on traders betting that the Federal Reserve would ease off on big interest rate hikes following Friday's inflation data.

Despite a hawkish Federal Reserve meeting, whereby the Fed Chair, Jerome Powell, pushed back against the market's reaction to a dovish statement by arguing that the terminal rate could be higher than first anticipated, commodity prices have been staging a rally off year-to-date lows. There are a number of components to the switch in sentiment, including speculation that China will ease its restrictive zero-Covid policies. There had been growing speculation, due to a series of less inflationary outcomes in the US data of late, that a Fed pivot was on the horizon.

Friday's US consumer prices rose 0.4% for the month of October, up 7.7% over the year. This was down from 8.2% year over year in September and 0.2 percentage points below consensus, as was the ex-food and energy reading of 6.3%. This was a welcome report and the market reaction included a 5.5% surge in the S&P 500 and a 26 basis point drop in the 2-year Treasury yield that sent gold through the roof and the greenback off a cliff. Gold traders had already been focused on the rise in money manager short positioning over the last months leading to substantial short covering beyond the $1,720 resistance.

Fed speakers eyed

Meanwhile, risk events for the week ahead will lie with the Fed speakers, US Retail Sales, Chinese activity data, and updates with regard to the COVID noise in Chinese markets. As for Fed speakers, the US Dollar was thrown a lifeline by Fed's Christopher Waller who crossed the wires before the open and said Friday's inflation report was "just one data point," and that markets are "way out in front".

- Will need to see a run of CPI reports to take a foot off the brake.

- Positive that goods prices came down with some moderation in services, but it needs to continue.

- US policy rate is "not that high" given level of inflation.

- Rate hikes so far has not "broken anything.

- The US housing market needed to slow down.

- Signal was to pay attention to the endpoint not the pace of rate increases, and until inflation slows the endpoint is "a ways out".

Consequently, the US Dollar was bid at the start of the week: US Dollar bulls could start to emerge in the opening sessions:

On the other side of the spectrum, Fed Vice Chair Lael Brainard said on Monday that it will soon be appropriate for the Fed to reduce the pace of its interest rate hikes.

A slew more speakers are slated and analysts at TD Securities said ''Fed speakers are likely to push back on the overly dovish market reaction after the October CPI report. Officials will make clear that following the positive news on the inflation front, there must be further evidence of sustained monthly core inflation that is more in line with their 2% target. And given the persistent strength of the labor market, this may take a while.''

As for US Retail Sales, the analysts at TDS said, ''we look for retail sales to accelerate in October, following a largely sideways move in September. Spending was likely boosted by a significant increase in auto sales and the first gain in gasoline station sales in four months. Importantly, control group sales likely rose firmly, while those for bars/restaurants probably retreated following two months of expansions.''

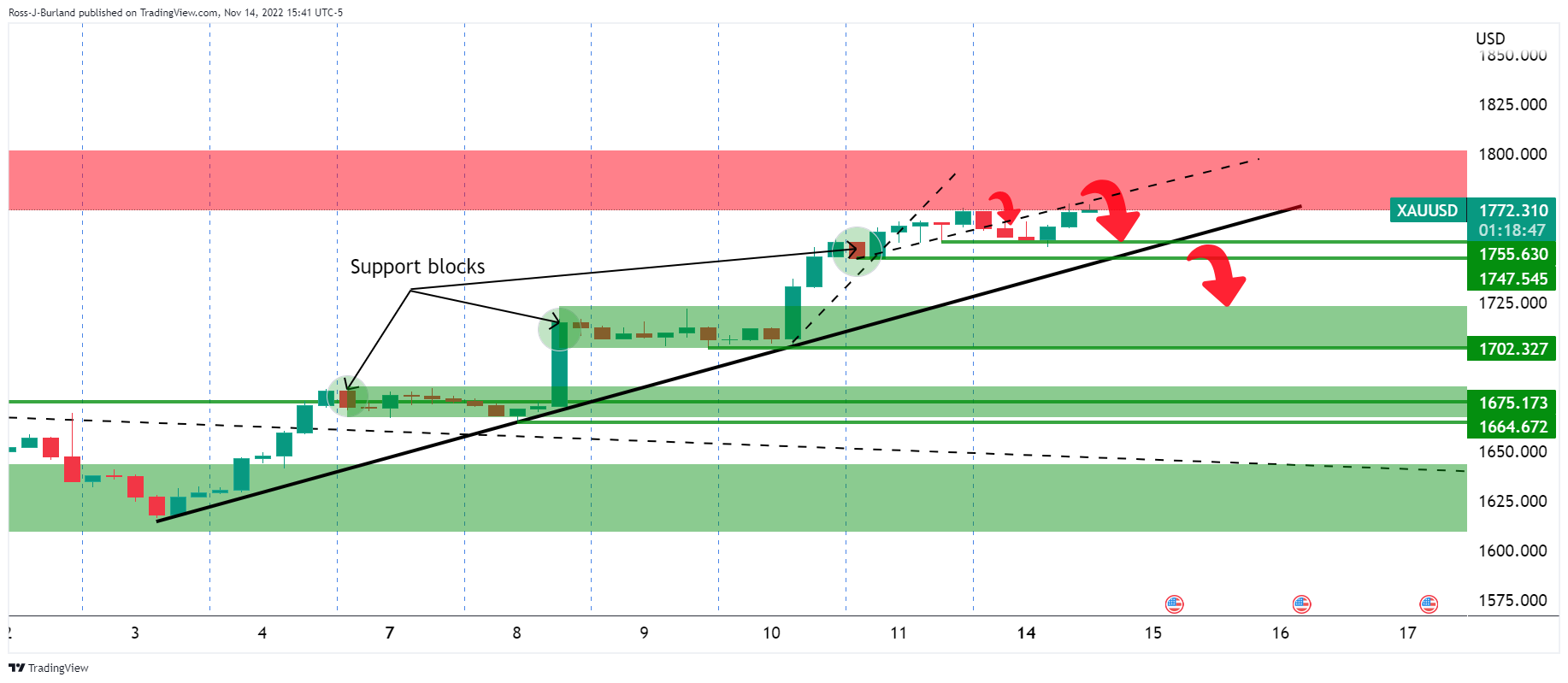

Gold technical analysis

As per the start of the week's pre-open analysis, Gold, The Chart of the Week: XAUUSD bears licking their lips, watching for lower timeframe distribution, the yellow metal bears are lurking with the price on the backside of the now broken trendlines (counter trendlines):

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD holds positive ground above 0.6900 ahead of Chinese PMI data

The AUD/USD pair extends its upside to around 0.6910 during the early Asian session on Monday. The rising bets for another oversized interest rate cut by the Federal Reserve in November weigh on the US dollar. The Chinese Purchasing Managers Index reports for September are due later on Monday.

EUR/USD: Buyers maintain the pressure ahead of critical US employment data

The EUR/USD pair ended a mostly uneventful last week trading near the 1.1200 mark, still battling to conquer the level. It managed to post a fresh 2024 high of 1.1213 mid-week, but sellers around it have rejected EUR/USD once again.

Gold: Prospects of Fed rate cuts, geopolitical tensions underpin bullish impulse

Gold clinched its third consecutive week of gains, reaching a fresh all-time high on Thursday. If bullish momentum persists, immediately to the upside emerges the $2,700 mark. Fed rate cut bets, geopolitical tensions continue to support the yellow metal.

Week ahead: NFP on tap amid bets of another bold Fed rate cut

Investors see decent chance of another 50bps cut in November. Fed speakers, ISM PMIs and NFP to shape rate cut bets. Eurozone CPI data awaited amid bets for more ECB cuts. China PMIs and BoJ Summary of Opinions also on tap.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.