- Gold price is extending its bearish streak at the start of the week.

- Hawkish Federal Reserve commentary and China’s covid woes boost the US Dollar.

- Gold price looks vulnerable following a weekly close below the $1,750 level.

Gold price is testing weekly lows below $1,750, in a negative start to the week. The bright metal is extending its losing streak into a fourth straight trading day this Monday, as the US Dollar continues its recovery momentum, drawing the latest support from broad risk-aversion. Investors remain wary amid China’s covid restrictions and hawkish Fed outlook on the terminal rates. Two covid deaths reported in Beijing combined with a five-day lockdown in Guanzhou has once again spooked markets. Meanwhile, Atlanta Federal Reserve President Raphael Bostic said on Saturday that he feels the Fed's target policy rate needs to rise no more than another percentage point to tackle inflation. Looking ahead, markets await the Federal Reserve November meeting minutes for fresh hints on the central bank’s policy outlook.

Also read: Gold, Chart of the Week: XAUUSD bears are moving in, focus is on $1,750, then $1,720

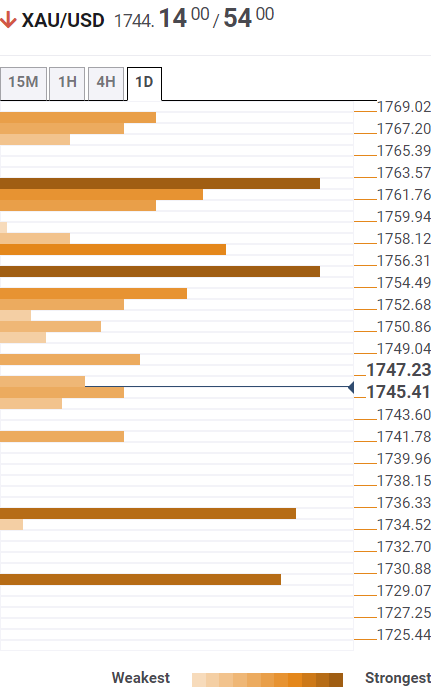

Gold Price: Key levels to watch

The Technical Confluence Detector shows that the gold price is flirting with the SMA10 one-day at $1,745 following a weekly close below the $1,750 psychological barrier.

A breach of the pivot point one-day S1 at $1,742 is likely to open floors for a test of the $1,736 demand area. That zone is the convergence of the pivot point one-day S2 and the pivot point one-week S1.

The last line of defense for gold buyers is seen at $1,730, which is the previous month’s high.

On the flip side, the immediate resistance is aligned at the previous day’s low of $1,748, above which the $1,750 level will be retested.

Acceptance above the latter will threaten the Fibonacci 23.6% one-day resistance at $1,753.

Gold bulls need to take out the powerful resistance at around $1,755, which is the confluence of the Fibonacci 38.2% one-day and SMA50 four-hour.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Japanese Yen rises following Tokyo CPI inflation

The Japanese Yen (JPY) gains ground against the US Dollar (USD) on Friday. The USD/JPY pair pulls back from its recent gains as the Japanese Yen (JPY) strengthens following the release of Tokyo Consumer Price Index (CPI) inflation data.

AUD/USD weakens to near 0.6200 amid thin trading

The AUD/USD pair remains on the defensive around 0.6215 during the early Asian session on Friday. The incoming Donald Trump administration is expected to boost growth and lift inflation, supporting the US Dollar (USD). The markets are likely to be quiet ahead of next week’s New Year holiday.

Gold price remains subdued despite increased geopolitical tensions

Gold edges lower amid thin trading following the Christmas holiday, trading near $2,630 during the Asian session on Friday. However, the safe-haven asset could find upward support as markets anticipate signals regarding the US economy under the incoming Trump administration and the Fed’s interest rate outlook for 2025.

Floki DAO floats liquidity provisioning for a Floki ETP in Europe

Floki DAO — the organization that manages the memecoin Floki — has proposed allocating a portion of its treasury to an asset manager in a bid to launch an exchange-traded product (ETP) in Europe, allowing institutional investors to gain exposure to the memecoin.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.