Gold Price Forecast: XAUUSD extends the rebound above $1,850, US ADP eyed

- Gold Price remains supported above 21 DMA, with eyes on $1,870.

- Risk-on flows down the dollar alongside the yields, favor XAUUSD bulls.

- US ADP jobs beat may revive aggressive Fed tightening bets, cap gold’s rebound.

Gold Price is building on the previous rebound from ten-day lows of $1,829, as bulls remain in total control in the European session.

The bright metal continues to benefit from the persistent concerns over surging inflation globally, which could temper the economic outlook. Further, the renewed US-Sino trade concerns and the ongoing Russia-Ukraine crisis keep the sentiment around the traditional safe-haven buoyed.

Dollar weakness is another factor weighing on gold. European markets are finding some comfort from the retreat in oil prices, amid hopes for a concerted effort to increase supply, which has helped lift the overall market mood and triggered a fresh bout of broad US dollar selling.

The US Treasury yields are also on a retreat across the curve, further weighing on the greenback. The pullback in the US rates could be associated with the profit-taking slide after the benchmark 10-year US yields faced rejection just below the key 3% level.

Gold traders now look forward to the US ADP Jobs data for fresh dollar valuations. A print above the expected 300K figure in May could bring the aggressive Fed tightening expectations back to the fore, which could check the renewed upside in the bullion.

The main event risk this week, however, remains the May month US Nonfarm Payrolls data, which will be eagerly waited for the next direction in the USD-priced metal.

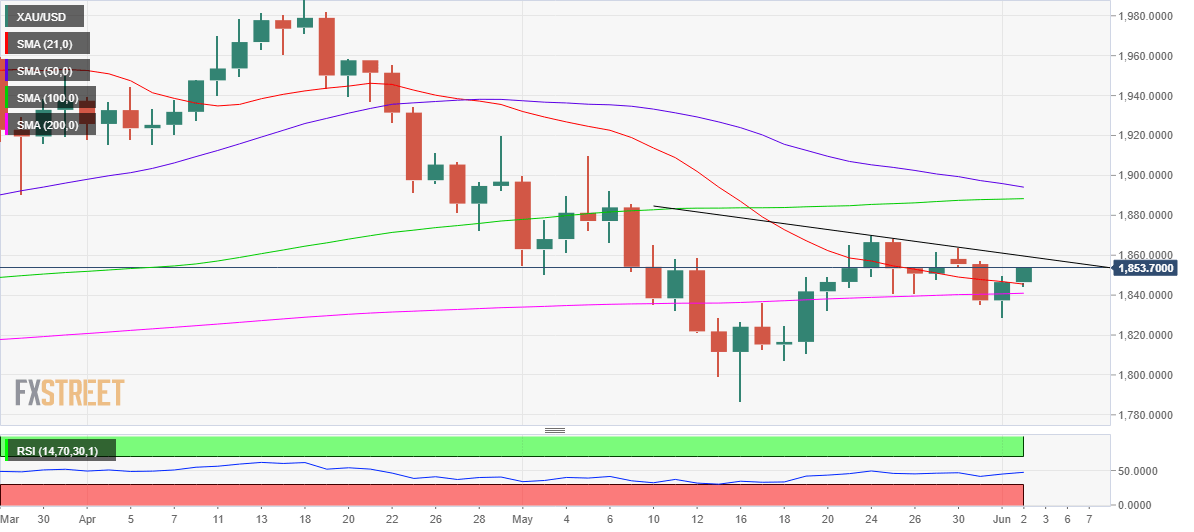

Gold Price: Daily chart

The next key resistance level is seen at $1,860, a descending trendline. A firm break above will call for a retest of the previous week’s high of $1,870.

Also read: Gold Price Forecast: XAUUSD in search of a clear direction, awaits NFP

The 14-day Relative Strength Index (RSI) is sitting just beneath the midline, suggesting that recovery attempts are likely to remain shallow and sellers could jump in on the bounce.

A breach of the 21 DMA at $1,845 once again will expose the 200 DMA support of $1,841, below which the previous day’s low of $1,829 will be put to test.

Gold Price: Additional levels to consider

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.