Gold Price Forecast: XAUUSD drops below the 200-DMA at around $1830s

- The gold spot is falling due to broad US dollar strength and steady US real yields.

- US Industrial Production expànded at a lower rate than in April, showing that the US economy is slowing.

- Gold Price Forecast (XAUUSD): To consolidate amid the lack of a catalyst.

Gold spot (XAUUSD) drops courtesy of a buoyant greenback, which is staging a comeback after printing losses of 1% on Thursday, trimming some of those despite that US Treasury yields fall for the second straight day in the week. At the time of writing, XAUUSD is trading at $1839.20 and losses 0.97%.

US Real yields remain steady, weighing on Gold Prices

Sentiment remains positive as US equities recover some ground. The US Dollar Index, a measure of the buck’s value, advances 0.83%, sitting at 104.666. in the meantime, the US 10-year Treasury yield drops to 3.229%, for a loss of seven basis points.

In the meantime, US 10-year TIPS (Treasury Inflation-Protected Securities), a proxy for real yields, is down one basis point, sitting at 0.665%, a headwind for the yellow metal.

Elsewhere, the US economic calendar featured May’s Industria Industrial Production, which expanded by 5.8% YoY, lower than April’s reading at 6.3%, adding signs of an economic slowdown. “The pace at which everything is changing is quite alarming,” according to WSJ sources. They said that the economy still stands on fairly solid ground to withstand inflation, supply-chain issues, and rising interest rates.

Earlier in the day, the Minnesota Fed’s President Neil Kashkari commented that he supported 75 bps in June and could support another in July. He added that a prudent strategy might be to continue with 50 bps increases. St. Louis Fed President James Bullard said a soft landing is feasible if the post-pandemic shift is done well.

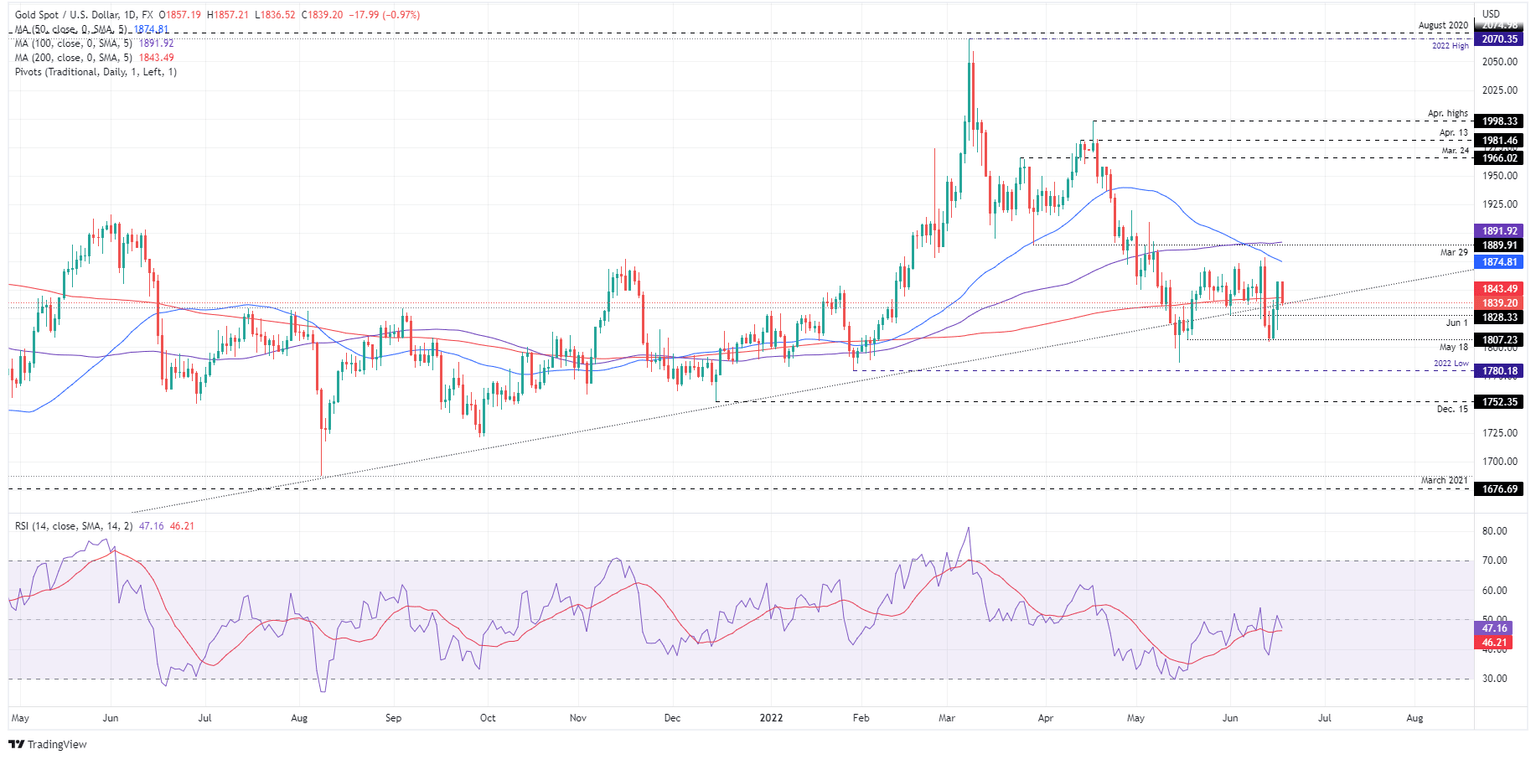

Gold Price Forecast (XAUUSD): Technical outlook

The XAU/USD is in consolidation amidst the lack of a catalyst that could propel the yellow metal prices either way. At the time of writing, XAU/USD sits below the 200-day moving average (DMA), which lies at $1843.48. That would open the door for consolidation in the $1800-$1850 range, where the non-yielding metal remained throughout the last week.

A daily close of XAU/USD beneath the 200-DMA would expose the Jun 1 daily low at $1828.33. A break below would open the door for a May 18 test at a $1807.23 cycle low. Once broken, a fall to $1800 is next.

Upwards, XAU/USD’s first resistance would be the 200-DMA. If XAU bulls achieve a daily close above it, a move towards the 50-DMA at $1874.80 is on the books. Once cleared, the XAU/USD following resistance level would be the 100-DMA at $1891.92.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.