- The Gold Price is attempting a recovery from within negative territory.

- The ECB Vice-President de Guindo’s hawkish tilt and elevated global bond yields were Gold’s headwind.

- Fed chair Powell and ECB governor Largarde are now stealing the show.

The Gold Price is attempting to recover from the lows posted at the start of the North American day at $1,936. Federal Reserve Chair Jerome Powell's appearance at an International Monetary Fund panel is being monitored closely by traders as are comments from the European Central Bank's governor, Christine Lagarde.

So far, there has been no reaction to comments from either central banker. Both have been delivering much of the same rhetoric surrounding both their nation's economies and interest rate policies.

Also read: Fed Chair Powell: Reiterates plan to get interest rates “expeditiously” to neutral

Also read: Fed Chair Powell: 50 bps rate hikes are on the table for the upcoming meetings

As for Lagarde, she explained that the meeting in June is ‘key’ for the end of APP and the potential rate path, adding that they need to wait on data before deciding on what to do next. The ECB is watching the value of the euro closely but Lagarde said that they are not targeting the FX rate.

Meanwhile, the euro has been a driving force in the forex space and has impacted the US dollar and the Gold Price on Thursday. The incumbent French President Emmanuel Macron's election debate was favoured in the polls, supporting the single currency. Additionally, the euro climbed to a more than one-week high on Thursday against the dollar after a spate of hawkish comments from European Central Bank officials raised bets that eurozone interest rates will rise soon.

Joachim Nagel, president of Germany's Bundesbank, joined a chorus of policymakers in saying the ECB could raise interest rates at the start of the third quarter. More on this below, but the money markets, which had eased rate hike bets following last Thursday's ECB meeting, are now pricing in a 20 basis point (bps) rise by July and over 70 bps of tightening by year-end. That would take benchmark interest rates above zero for the first time since 2013 and this is offering support for the euro weighing down DXY which has printed a low of 99.818 on the day.

ECB's hawkish comments spurred a jump in global bond yields

During the European session, the ECB Vice-President Luis de Guindos expressed that a rate hike in July is possible, while he sees no reason why APP could not end by July. On those remarks, the EUR/USD appreciated, while the German 10-year bund is approaching near 1% at the time of writing. Consequently, US Treasury yields jumped, led by the 10-year benchmark note, which bounced seven basis points, sits at 2.913%

In the meantime, yields on 10-year Treasury Inflation-Protected Securities (TIPS) remain negative at -0.08 bps after turning positive on Tuesday. If real yields (US 10-year nominal yields minus inflation expectations) keep rising, it could weigh on the non-yielding metal, which correlates negatively with the former. Additionally, the greenback recovered some ground, up 0.14%, and was last seen at 100.489, also a headwind for the yellow metal.

Aside from this, the Russia-Ukraine backdrop appears to influence market sentiment less than before. Russia reported the capture of Mariupol, while the Russian President Vladimir Putin ordered the cancellation of plans to storm the besieged Azonvstal plant in Mariupol. At the same time, the Ukraine Deputy PM demands Russia a humanitarian corridor for civilians in Azonvstal.

Gold Price technical analysis

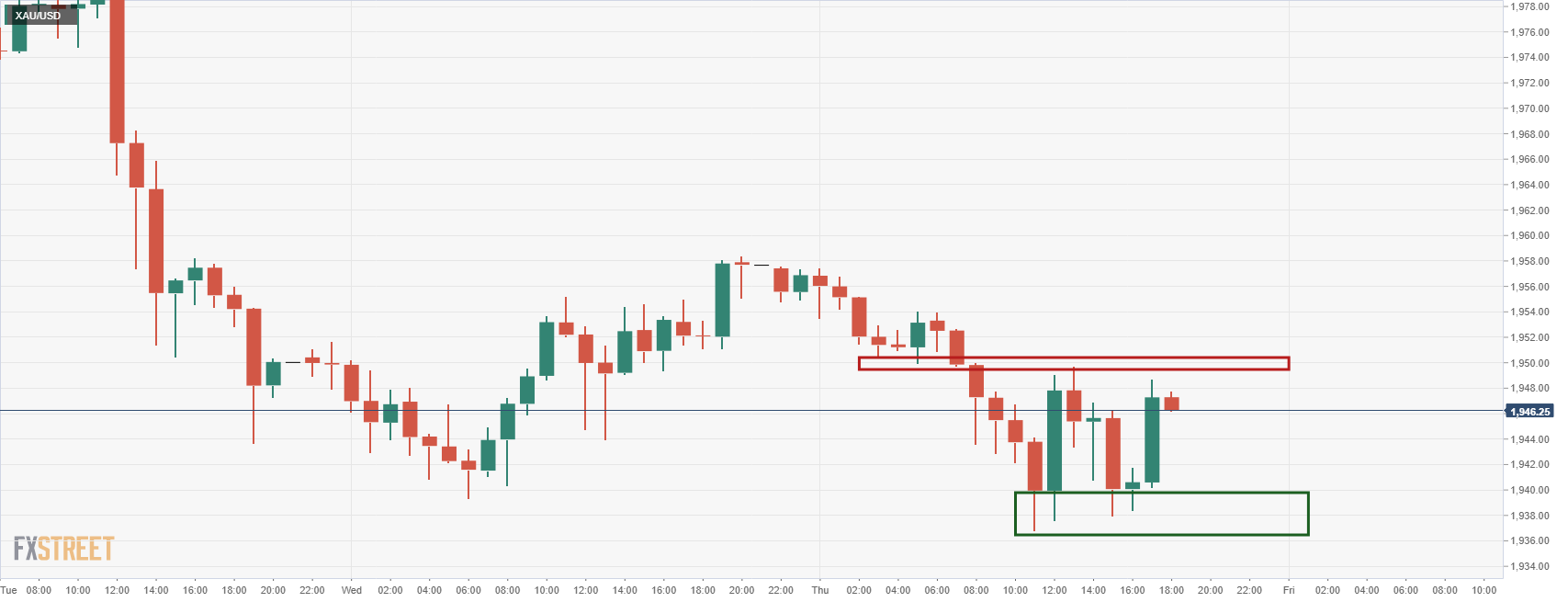

As the day goes by, the Gold Price (XAUUSD) is holding in a key support territory just shy of the 50-day moving average (DMA), around $1936.12. This is an area with the confluence of the trendline drawn from February 2022 lows. Bulls are stepping in at this point as per the hourly chart:

On Wednesday, XAUUSD jumped from that area and pushed near $1950, but failure at the latter and the Relative Strength Index (RSI) turning bearish (49.89 as of writing) opened the door for further losses

Therefore, XAUUSD’s first support would be the confluence of the 50-DMA and the upslope trendline drawn from February 2022 lows around $1935-40. A breach of the latter would expose the psychological $1900 mark, followed by March’s monthly lows around $1889.91.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD bounces off lows, retests 1.1370

Following an early drop to the vicinity of 1.1310, EUR/USD now manages to regain pace and retargets the 1.1370-1.1380 band on the back of a tepid knee-jerk in the US Dollar, always amid growing optimism over a potential de-escalation in the US-China trade war.

GBP/USD trades slightly on the defensive in the low-1.3300s

GBP/USD remains under a mild selling pressure just above 1.3300 on Friday, despite firmer-than-expected UK Retail Sales. The pair is weighed down by a renewed buying interest in the Greenback, bolstered by fresh headlines suggesting a softening in the rhetoric surrounding the US-China trade conflict.

Gold remains offered below $3,300

Gold reversed Thursday’s rebound and slipped toward the $3,260 area per troy ounce at the end of the week in response to further improvement in the market sentiment, which was in turn underpinned by hopes of positive developments around the US-China trade crisis.

Ethereum: Accumulation addresses grab 1.11 million ETH as bullish momentum rises

Ethereum saw a 1% decline on Friday as sellers dominated exchange activity in the past 24 hours. Despite the recent selling, increased inflows into accumulation addresses and declining net taker volume show a gradual return of bullish momentum.

Week ahead: US GDP, inflation and jobs in focus amid tariff mess – BoJ meets

Barrage of US data to shed light on US economy as tariff war heats up. GDP, PCE inflation and nonfarm payrolls reports to headline the week. Bank of Japan to hold rates but may downgrade growth outlook. Eurozone and Australian CPI also on the agenda, Canadians go to the polls.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.