- Gold price bounce after defending key support around $1798 once again.

- Markets remain cautious ahead of the crucial Fed decision.

- Gold bears await break below 100-day SMA at $1,796

Update: Gold maintained its bid tone through the early European session and was last seen trading near the top end of its daily range, around the $1,805 region. The risk-off impulse in the markets – as depicted by a generally negative tone around the equity markets – continued acting as a tailwind for the safe-haven precious metal. Investors remain worried about the potential economic fallout from the fast-spreading Delta variant of the coronavirus. This, along with China's regulatory crackdown, further took its toll on the global risk sentiment.

However, a combination of factors kept a lid on any runaway rally for gold, at least for the time being. The US dollar was back in demand amid a modest uptick in the US Treasury bond yields. This, in turn, was seen as a key factor that capped gains for the dollar-denominated commodity. Investors also seemed reluctant to place any aggressive bets ahead of the key event risk – the conclusion of a two-day FOMC monetary policy meeting. The outcome will assist market participants to determine the near-term trajectory for the non-yielding gold.

Even from a technical perspective, gold has been oscillating in a range over the past one week or so. Given the recent failure near the very important 200-day SMA, this further makes it prudent to wait for strong follow-through buying before positioning for any further appreciating move.

Previous update: Gold price is rising back above $1800, defending the key support area around $1798 amid a cautious market mood heading into the Fed decision. The sell-off in the Chinese stocks seems to have paused, offering some support to the Asian indices, although surging covid cases in Asia remain a drag on the investors’ sentiment. A retreat in the US Treasury yields and the risk-off mood is boding well for gold price. Meanwhile, the US dollar holds the lower ground amid downbeat US Durable Goods data and pre-Fed repositioning.

All eyes remain on the Fed decision, as markets bet on a hawkish signal from the world’s most powerful central bank. The Fed is expected to hint at a likely taper starting off from the final quarter of this year.

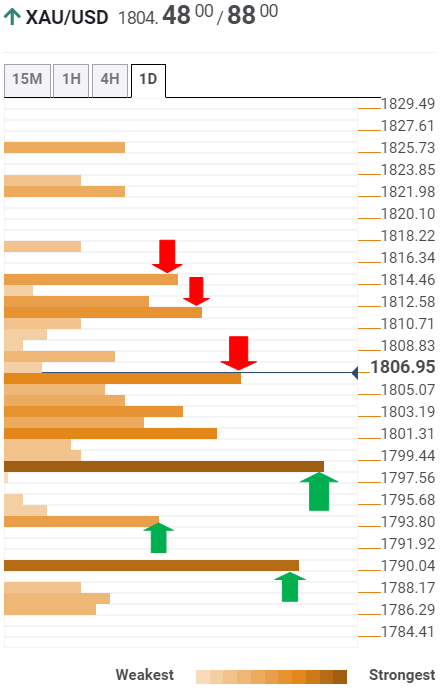

Gold Price: Key levels to watch

The Technical Confluences Detector shows that gold has managed to defend powerful support around $1798, which is the convergence of the Fibonacci 61.8% one-day, Fibonacci 23.6% one-week and SMA100 one-day.

Acceptance below that level could revive the bearish interests, calling for a test of the previous day’s low at $1794.

Further south, the intersection of the previous week’s low and Fibonacci 23.6% one-month at $1791 will be a tough nut to crack for gold bears.

Alternatively, if the buyers need to find a strong foothold above the key resistance at $1805 to unleash further upside. That level is the confluence of the previous day’s high and Bollinger Band one-hour Upper.

The relevant upside target appears at $1812, where the SMA10 one-day, Fibonacci 61.8% one-week and the pivot point one-day R2 merge.

The bulls will then look to take out the Fibonacci 38.2% one-month at $1814.

Despite the renewed bids, it's going to be a bumpy ride for gold bulls.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays near 1.1350 after mixed EU data

EUR/USD remains on the back foot, trading near 1.1350 in the European trading hours on Tuesday. The data from the Eurozone showed that Industrial Production expanded by 1.1% in February. On a negative note, ZEW Survey - Economic Sentiment slumped to -18.5 in April from 39.8.

GBP/USD battles 1.3200 after UK jobs data

GBP/USD is defending minor bids near the 1.3200 mark in the early European session on Tuesday. The latest data from the UK showed that Unemployment Rate steadied at 4% in the quarter to February while Average Earnings disappointed, weighing negatively on the Pound Sterling.

Gold price bulls retain control amid trade jitters, Fed rate cut bets and weaker USD

Gold price (XAU/USD) maintains its bid tone through the first half of the European session on Tuesday and currently trades around the $3,230 area, well within striking distance of the all-time peak touched the previous day.

Canada CPI expected to hold steady in March ahead of BoC policy decision

Statistics Canada will release the March Consumer Price Index report on Tuesday. Annualised inflation is expected to have held steady at 2.6%, matching the February reading. Market players anticipate a monthly advance of 0.7%, easing from the previous 1.1%.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.