Gold Price Forecast: XAU/USD tumbles below $1850 on elevated US bond yields

- Gold price stumbles 0.37% on Monday courtesy of higher US Treasury bond yields.

- US Factory Orders dropped less than estimates though market players ignored it.

- Traders are eyeing the appearance of the US Federal Reserve Chair Jerome Powell at the US Congress.

- Gold Price Analysis: Downward biased in the near term.

Gold price slides 0.26% or $3.00 a troy ounce in the North American session as UST bond yields recover some ground turning positive a headwind for the non-yielding metal. The US economic calendar ahead of next week’s Tuesday inflation figures would be busy, led by Fed speakers and employment data. At the time of typing, the XAU/USD exchanges hands at $1850.57 after hitting a daily high of $1858.33.

Gold falls as US T-bond yields climbed

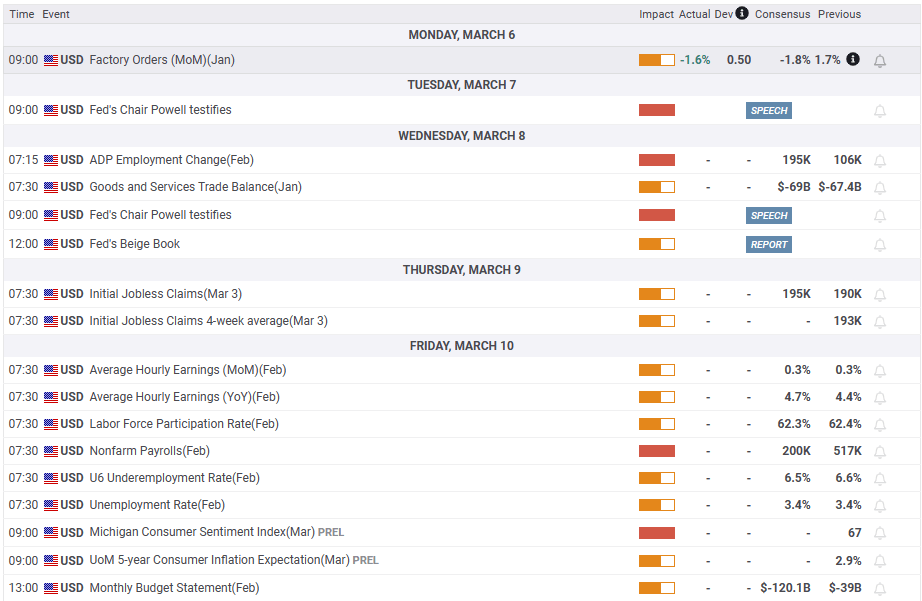

US equities reflect a risk-on impulse in the financial markets. A tranche of data from the United States (US), namely Factory Orders for January, dropped less than the -1.8% MoM estimated, at a -1.6% fall. The report from the US Commerce Department showed improved shipments and manufactured goods, snapping two straight months of declines.

In the meantime, the US Dollar (USD) failed to gain traction following the report, as shown by the US Dollar Index (DXY) falling 0.28%, at 104.232. Contrarily, US Treasury bond yields, mainly the 10-year, is up one bps at 3.967%, a headwind for Gold prices.

XAU/USD’s price would likely remain volatile as market participants prepared for the US Federal Reserve (Fed) Chairman Jerome Powell’s speech at the US Congress on March 7 and 8. Market participants estimate a hawkish stance, echoing some of the messages spread by his colleagues. Investors expect that Powell would reiterate the Fed’s commitment to curb inflation and emphasize the need to go higher for longer.

In addition to Jerome Powell’s appearance at the congress, XAU/USD traders are eyeing US employment data. The prior month’s US Nonfarm Payrolls report crushed estimates of 200K, creating more than 500K jobs in the economy. For February, market analysts expect an increase of just 200K compared to last month’s data. Upbeat data would send XAU/USD extending its losses, as further labor market tightening would warrant higher rates in the US economy, so it could be slowed down to curb inflation.

In the meantime, traders anticipate that the US Federal Reserve will hike 25 bps at the upcoming March meeting. However, recent Federal Reserve’s hawkish commentary, and US data, had put a 50 bps increase in the table, as two officials expressed a more hawkish stance than expected.

XAU/USD Technical analysis

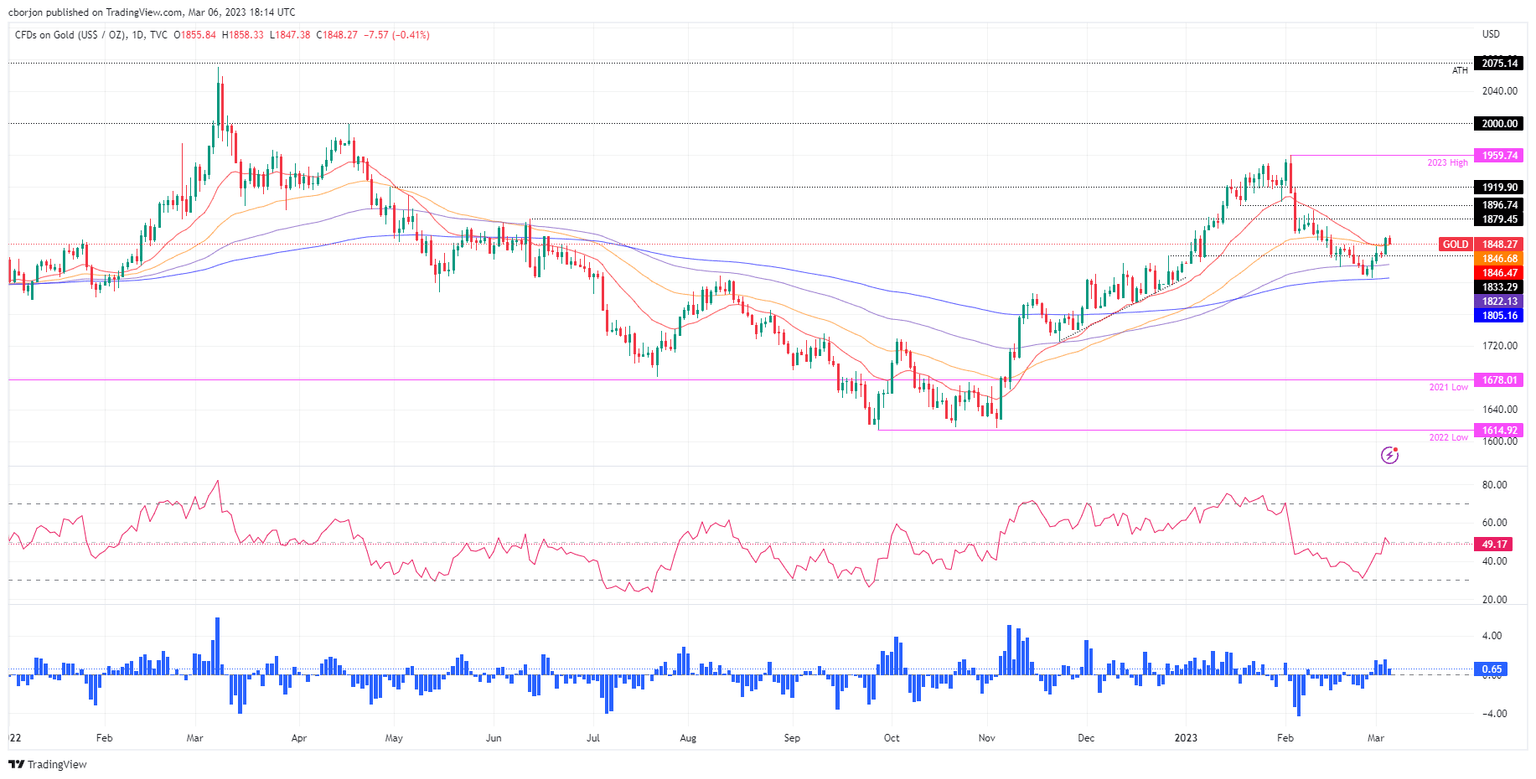

From a daily chart perspective, XAU/USD is neutral to upward biased once it conquered the 20 and 50-day Exponential Moving Averages (EMAs). Nevertheless, as UST bond yields aim north, Gold is taking its toll, retreating below the $1850 area. Furthermore, the Relative Strength Index (RSI) exceeded the 50-midline before turning bearish. Therefore, in the short term, the XAU/USD path of least resistance is downwards.

Gold’s first support would be the confluence of the 20/50-day EMAs at $1846.00. Once cleared, XAU/USD would get towards the March 3 daily low of $1835.51, followed by the 100-day EMA at $1822.15 and the 200-day EMA at $1805.16.

What to watch?

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.