Gold Price Forecast: XAU/USD surges on weak US jobs data, warranting less aggressive Fed

- US Bureau of Labor Statistics showed that job openings for July came in at 8.827M, well below the expected 9.465M, while Consumer Confidence deteriorated.

- The CME FedWatch Tool shows a reduced likelihood of a Fed rate hike in September, now at just 13.5%, while odds for a November hike stand at 43.3%.

- Market participants are eyeing the US Nonfarm Payrolls report for August and other key economic indicators from the US, which could trigger further volatility in gold prices.

Gold price advances almost 1% as the Greenback (USD) gets battered across the board, undermined by falling US Treasury bond yields after data prompted investors to cut bets on additional rate hikes by the US Federal Reserve (Fed). Hence, XAU/USD is trading at $1,937.89 a troy ounce after hitting a daily low of $1,914.57.

XAU/USD rises to $1,937.89 amid lower odds for a September Fed rate hike and falling US Treasury yield

Data released by the US Bureau of Labor Statistics (BLS) indicated a substantial miss in Job Openings for July, falling far short of the estimated 9.465 million at 8.827 million and below June’s 9.165 million. This, coupled with a decline in the quits rate, suggests reduced confidence among Americans regarding their prospects for finding a new job.

Concurrently, additional data revealed that the Consumer Confidence poll by the Conference Board (CB) depicted a worsening sentiment, as evident in August’s report. The figures stood at 106.1, notably below the projected 116 and July’s 114, underlining consumers’ growing sense of unease. Dana Peterson, the chief economist at the Conference Board, said, “Consumers were once again preoccupied with rising prices in general and for groceries and gasoline in particular.”

It’s worth noting that the labor market in the US is gradually easing, albeit not at the pace initially anticipated by the Federal Reserve. Powell’s comments regarding the tightness of the job market, which supported rate hikes, might be set aside for the September meeting. Nonetheless, the approaching US Nonfarm Payrolls report for August, estimated at around 170,000 jobs, advises a cautious approach. An unexpected increase could incite volatility within financial markets as traders scale back their expectations for additional Federal Reserve rate hikes.

The CME FedWatch Tool odds for a rate hike to the 5.50%-5.75% range at the September meeting are lowering, at 13.5%, while for the November meeting, remain at around 43.3%.

Consequently, the buck remains soft, as shown by the US Dollar Index (DXY). The DXY, which measures the buck’s value vs. a basket of six currencies, remains at 103.433, dropping 0.53%. Factors like traders expecting a less aggressive Fed are reflected by falling US bond yields, which undermined the US Dollar.

Across the pond, the US ADP Employment Change for August and PCE Prices for the second quarter (Q2) 2023 are expected.

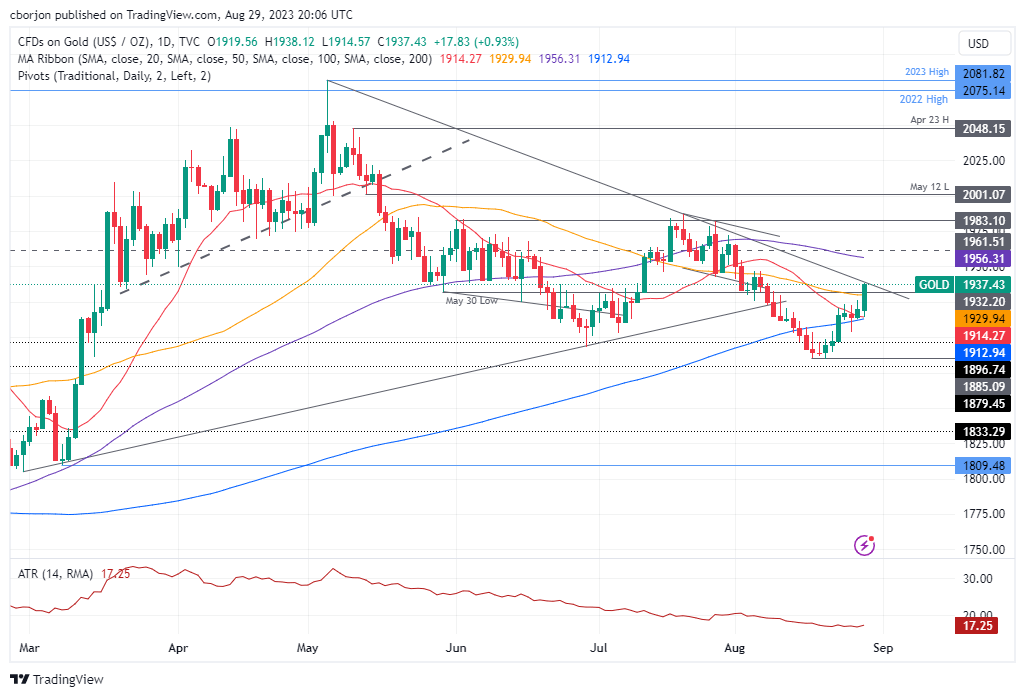

XAU/USD Price Analysis: Technical outlook

From a technical perspective, the Gold price seems set to test the 100-day Simple Moving Average (DMA) at $1,956.31 after reclaiming the 20 and 50-DMAs. Nevertheless, it should be said XAU/USD is testing a four-month-old downslope resistance trendline, previously tested on July 27; however, the non-yielding metal, unable to crack it, dropped to fresh 5-month lows of $1,885.09. A breach of that level would expose the 100-DMA. Otherwise, first support emerges at the 50-DMA at $1,929.94, followed by the 20-DMA at $1,914.30, before challenging the 200-DMA at $1,912.94.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.