Gold Price Forecast: XAU/USD suffers altitude sickness around mid-$1,800s ahead of Fed’s Powell

- Gold prices snap four-day uptrend while reversing from a fortnight high.

- Risk-aversion joins firmer US dollar to weigh on metal prices.

- Anxiety ahead of key data/events keeps traders troubled.

Gold (XAU/USD) prices remain pressured around the intraday low near $1,850 as sellers struggle to re-enter amid a risk-off mood during the pre-European session trading on Tuesday.

The metal’s latest weakness could be linked to the fresh concern about the US-China trade war and economic fears relating to China’s GDP growth. Also weighing the precious metal prices are the recently hawkish comments from the Fed policymakers and the market’s anxiety ahead of a busy economic calendar.

Although US President Joe Biden teased relief for China, as far as the Trump-era tariff is concerned, his defense of Taiwan keeps the Sino-American geopolitical tensions alive. Also, US Trade Representative (USTR) Katherine Tai’s statements, who poured cold water on the face of expectations that the Sino-American jitters will be eased soon, at least for the trade concerns, were negatives for gold. The US diplomat said, “We're still working on next actions with China,” while turning down the optimism triggered by US President Joe Biden’s comments suggesting a reversal of the Trump-era tariffs on China.

On a different page, Reuters highlights the covid-led lockdowns in China as the key barrier. “Beijing extended its work-from-home requirement to stem a COVID-19 outbreak, while Shanghai deployed more testing and curbs to hold on to its hard-won "zero COVID" status after two months of lockdown,” said the news. Furthermore, pessimistic growth forecasts for China from JP Morgan and Goldman Sachs add to the gold price weakness. The reason could be linked to China’s status as one of the world’s top gold consumers.

Elsewhere, recently hawkish comments favoring the tighter monetary policy from San Francisco Federal Reserve Bank President Mary Daly and Kansas City Fed President Esther George seem to exert downside pressure on the market sentiment. Furthermore, anxiety ahead of the preliminary readings of the US S&P Global Manufacturing and Services PMIs for May, as well as a speech from Fed Chairman Jerome Powell, also weighs on the risk appetite and the XAU/USD prices.

Amid these plays, the S&P 500 Futures drops 1.21% whereas the US 10-year Treasury yields dropped 2.4 basis points (bps) to 2.835% at the latest.

Moving on, fears of faster monetary policy could help the US dollar to add some more gains if the PMIs manage to print upbeat numbers. For that to happen, Fed’s Powell should refrain from his routine support for 50 bps rate hikes for the next two meetings.

Read: Gold Price Forecast: XAUUSD eyes a sustained move above 21-DMA, focus shifts to Fed Minutes

Technical analysis

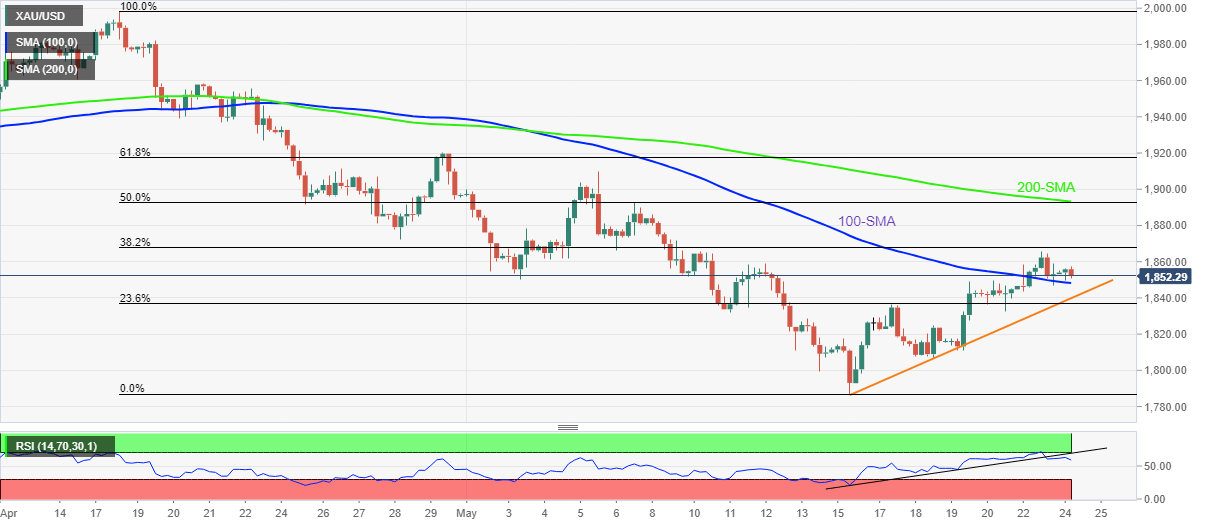

Gold fades bounce off the 100-SMA as RSI (14) diverges from the higher-low formation, portraying a bearish RSI divergence.

Even so, a clear downside break of the 100-SMA and weekly support line, respectively around $1,848 and $1,839, becomes necessary for a gold seller’s conviction.

Meanwhile, a confluence of the 200-SMA and 50% Fibonacci retracement of April 18 to May 16 downside, near $1,894, challenged the gold buyers.

Overall, gold buyers have miles to go before retaking the control.

Gold: Four-hour chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.