Gold Price Forecast: XAU/USD consolidates in a range, just above $1,800 mark

- Gold eases from 13-day top, off intraday low at the latest.

- USD rebound, sluggish sentiment consolidate the heaviest daily jump in over a week.

- US housing data, risk catalysts can entertain traders, Jackson Hole Symposium is the key.

- Gold Weekly Forecast: XAU/USD to stay in consolidation ahead of Jackson Hole

Update: Gold now seems to have entered a bullish consolidation phase and was seen oscillating in a narrow trading band, near two-and-half-week tops touched on Monday. Currently hovering above the $1,800 mark, the risk-on impulse in the markets turned out to be a key factor that acted as a headwind for the traditional safe-haven XAU/USD.

Investors drew comfort after the US Food and Drug Administration (FDA) granted full approval to the Pfizer/BioNTech COVID-19 vaccine. This was evident from a generally positive tone around the equity markets and reinforced by a modest uptick in the US Treasury bond yields, which further capped the upside for the non-yielding gold.

Meanwhile, worries that the fast-spreading Delta variant of the coronavirus could derail the global economic recovery eased fears about an imminent tapering of asset purchases by the Fed. This, in turn, dragged the US dollar further away from a nine-and-half-month high touched on Friday and extended some support to the dollar-denominated commodity.

Investors also seemed reluctant to place any aggressive bets, rather preferred to wait on the sidelines ahead of the Fed Chair Jerome Powell's speech at the Jackson Hole Symposium. Even from a technical perspective, the overnight positive move stalled just ahead of the 100-day and 200-day SMA confluence hurdle. This makes it prudent to wait for some follow-through buying before traders start positioning for any further appreciating move.

Previous update: Gold (XAU/USD) drops 0.17% intraday to $1,802 amid a quiet session ahead of the European markets’ open on Tuesday. The yellow metal jumped the most since August 13 the previous day but lacks the fundamentals to cross the sturdy barrier to the north. That said, the mixed news and a light calendar in Asia add to the gold’s slower grind to the south.

Among the lead leading factors challenging the market sentiment, also underpinning the price pullback, is a lack of clarity over the virus conditions and geopolitical concerns relating to Afghanistan and China. Australia’s covid infections eased from the record top but New Zealand Prime Minister Jacinda Ardern warns over the further spreading of the Delta virus.

On the same line, the UK’s daily hospitalizations jump to the monthly top whereas figures from the US also push the Biden administration to fasten the jabbing. Furthermore, was the US Food and Drug Administration’s full approval of the COVID-19 vaccine developed by Pfizer and BioNTech occupies the line of sentiment-positive catalysts.

On the contrary, the UK’s calling of the emergency videoconference of the Group of Seven (G7) leaders to discuss the Taliban-related issues, as well as hints that the US Securities and Exchange Commission (SEC) will increase hardships for Beijing-based companies’ listing challenge gold buyers. Additionally, chatters surrounding Beijing’s crackdown on technology shares, Sino-American tussles and fears of slowing economic recovery, perceived from early indirection, of China adds barriers to the gold’s upside.

Against this backdrop, the US 10-year Treasury yields gain one basis point to 1.26% whereas the S&P 500 Futures remain mildly bid at the latest. Also, the US Dollar Index (DXY) consolidates the heaviest daily losses in two months around 93.00, by the press time.

Given the light calendar ahead of the speeches from the Jackson Hole Symposium, gold prices may rely on second-tier factors like US data and geopolitics for fresh impulse. However, covid updates and vaccine news gain a little more importance.

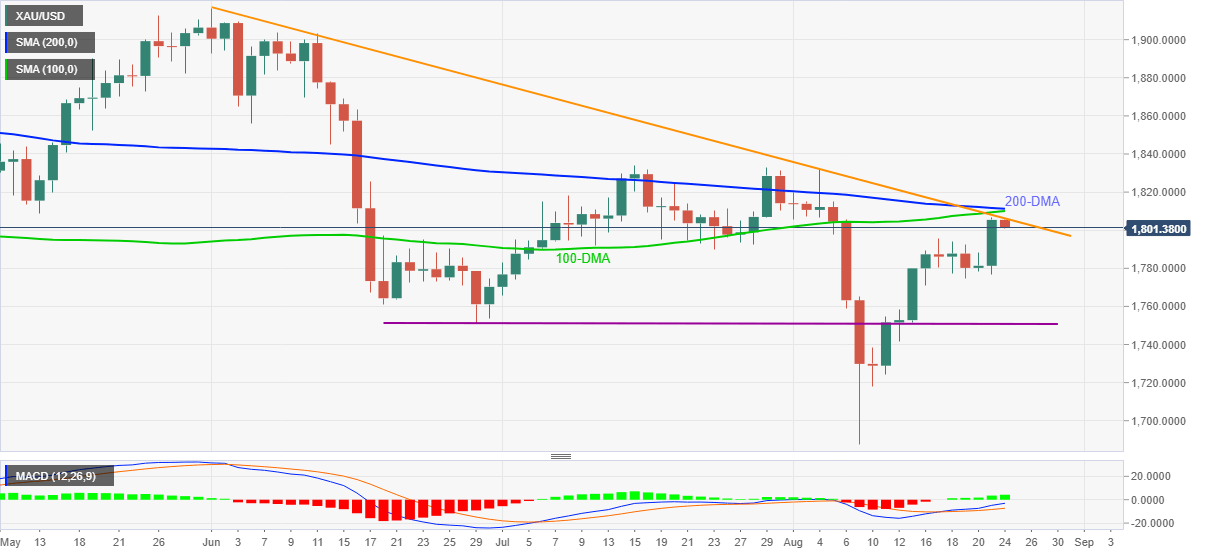

Technical analysis

A three-month-old descending trend line challenges short-term gold upside around $1,806.

However, sustained trading beyond the horizontal area comprising the late June lows, around $1,752-55, coupled with the bullish MACD signals, keep gold buyers hopeful.

In addition to the stated resistance line, 100 and 200-DMAs around $1,810-12 also challenge the gold bulls, a break of which will underpin the rally to the mid-July highs close to $1,835.

Meanwhile, the $1,800 threshold and the latest swing lows around $1,775 can entertain gold sellers during further weakness, ahead of $1,755-52 support.

Though, a clear downside break of $1,752, also breaking the $1,750 round figure, will aim for the monthly low of around $1,688. During the fall, the $1,800 round figure may offer an intermediate halt.

Overall, gold prices remain on the way to recovery but await a strong fundamental to cross the key hurdles.

Gold: Daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.