Gold Price Forecast: XAU/USD steadies around $1,850 as DXY baffles on stable US inflation ahead

- Gold price is struggling to hold itself above $1,850.00 ahead of US inflation.

- Firmer US NFP and inflation expectations are compelling for a 50 bps rate hike next week.

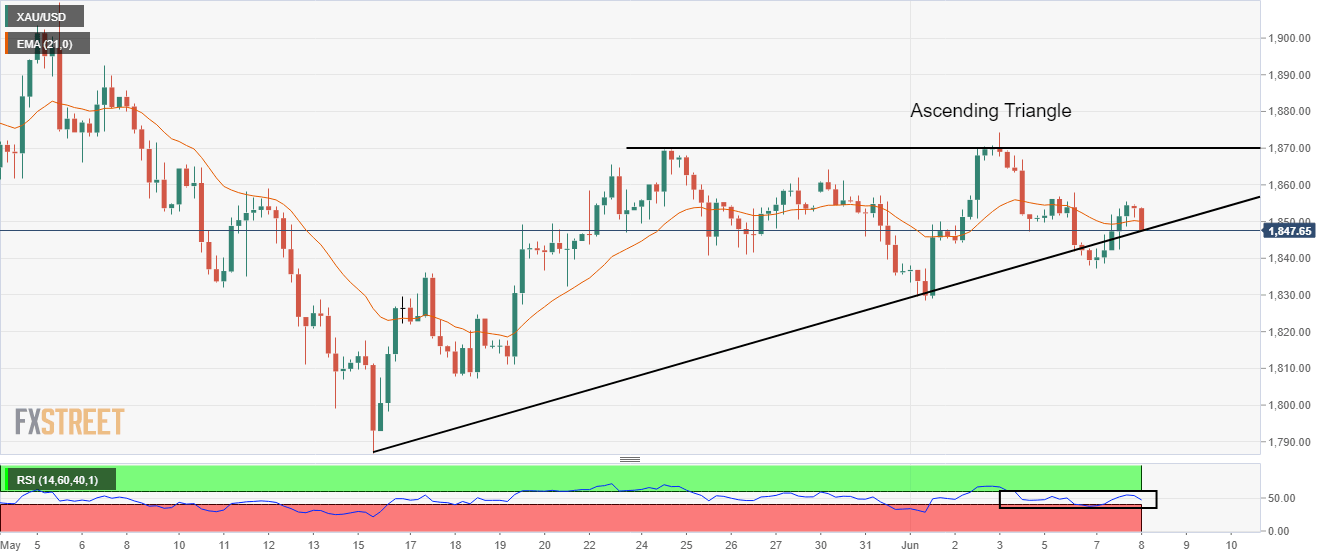

- An Ascending Triangle formation is indicating a consolidation ahead.

Gold price (XAU/USD) is displaying back and forth moves in the Asian session. The precious metal is oscillating in a $2 range after a pullback move from Tuesday’s high at $1,855.64. The mega event of the US inflation this week is going to insert extreme volatility in the FX domain as May inflation figures will have a significant impact on the stance to be adopted by the Federal Reserve (Fed) next week.

Considering the upbeat US Nonfarm Payrolls and above 8% annual inflation figure, Fed chair Jerome Powell may dictate an aggressive interest rate policy. No doubt, higher price pressures are eating the paychecks of households in the US, which seeks exclusive attention from the Fed. Therefore, a consecutive rate hike announcement of 50 basis points (bps) by Fed Powell will be an optimal decision to keep up the fight against inflation.

Meanwhile, the US dollar index (DXY) is facing barricades around its critical resistance at 102.48. A rebound in the positive market sentiment on Tuesday trimmed the DXY’s appeal and underpinned the risk-perceived currencies. For an upside move, the DXY needs to violate Tuesday’s high at 102.84.

Gold technical analysis

On a four-hour scale, XAU/USD is trading in an Ascending Triangle chart pattern whose upward sloping trendline is placed from May 16 low at $1,786.94 while the horizontal resistance is plotted from May 24 high at $1,869.69. The 21-period Exponential Moving Average (EMA) at $1,850.00 is overlapping with the gold prices, which signals a consolidation ahead. Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in the 40.00-60.00 range, which confirms topsy-turvy moves in upcoming sessions.

Gold four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.