Gold Price Forecast: XAU/USD stays defensive below $1,750 amid China, Fed concerns

- Gold price poke a three-week-old ascending support line after snapping a four-day uptrend.

- Market sentiment struggles for clear directions amid a light calendar, mixed clues.

- Coronavirus headlines, Fed policymakers’ comments will be helpful for intraday directions.

Gold price (XAU/USD) flirts with the $1,740 support amid a sluggish Asian session on Tuesday, following a downbeat start to the key week. The metal’s latest inaction could be linked to the failures to cross the short-term crucial support line, as well as the mixed signals received from the markets.

Among the key catalysts, comments from the US Federal Reserve (Fed) officials appear to be a major grind for the Gold price.

Richmond Federal Reserve Bank President Thomas Barkin recently mentioned that he supports smaller interest-rate hikes ahead as the central bank moves to bring down too-high inflation. Previously, Cleveland Fed President Loretta Mester marked the need to see several more good inflation reports and more signs of moderation to back the pause in rate hikes. On the same line, St. Louis Fed President James "Jim" Bullard stated that the situation calls for much higher interest rates than what we've been used to. Further, New York Federal Reserve Bank President John Williams said that he believes the Fed will need to raise rates to a level sufficiently restrictive to push down on inflation and keep them there for all of next year. Additionally, Fed Vice Chair Lael Brainard advocated for tighter monetary policy while citing risk-management reasons.

Elsewhere, China refreshed the all-time high daily Covid infections by printing around 40,300 new cases on Monday and justified the government’s status quo on the Zero-Covid policy despite the widespread protests to turn down the same. “Hundreds of demonstrators and police clashed in Shanghai on Sunday night as protests over the restrictions flared for the third day and spread to several cities, with police on Monday stopping and searching people at the sites of weekend protests in Shanghai and Beijing,” reported Reuters.

Amid these plays, S&P 500 Futures print mild gains despite Wall Street’s downbeat closing whereas the US 10-year Treasury yields remain pressured around 3.69% at the latest.

Looking forward, the monthly US Confederation Board’s (CB) Consumer Confidence for November will join multiple speeches from the Fed policymakers to entertain the Gold traders. Though, major attention should be given to the central bankers and the Coronavirus updates.

Technical analysis

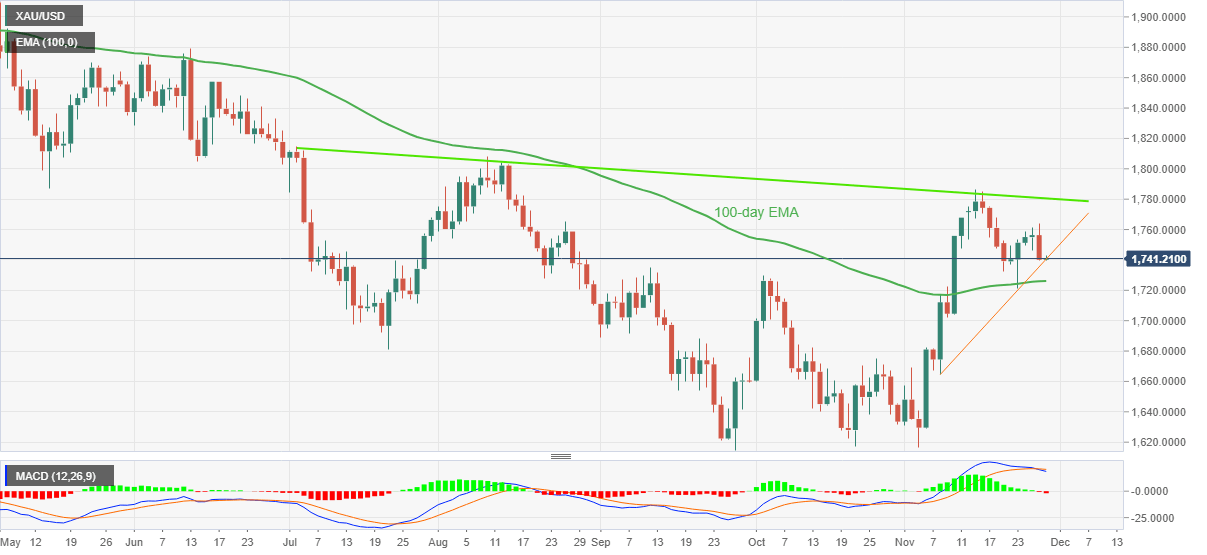

Gold price attacks a three-week-old ascending support line, near $1,740 by the press time, amid the bearish MACD signals.

With this, the yellow metal’s downside break of the stated support line, close to $1,740, immediately precedes the metal’s fall toward the 100-day Exponential Moving Average (EMA) surrounding $1,726.

It’s worth noting, however, that the quote’s weakness past $1,726 won’t hesitate in aiming for the late October swing high surrounding $1,676. That said, the $1,700 threshold could probe the bears during the anticipated fall.

Alternatively, recovery moves could initially aim for the $1,765 hurdle before challenging a downward-sloping resistance line from early July, close to $1,780 at the latest.

If the metal price rally beyond $1,780, the XAU/USD bulls can easily aim for the $1,800 round figure.

Gold price: Daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.