Gold Price Forecast: XAU/USD slips towards $1,700 inside bullish channel, US inflation eyed

- Gold price retreats from a fortnight top, snaps two-day uptrend.

- China’s return, cautious mood ahead of US CPI favor XAU/USD pullback.

- US inflation expectations, cautious optimism surrounding broad economic transition underpin bullish bias.

- Yields ease from multi-day high, equities/stock futures remain mildly bid.

Gold price (XAU/USD) takes offers to refresh intraday low around $1,721, snapping a two-day uptrend after refreshing a fortnight high. It’s worth noting that the yellow metal’s weakness during Tuesday’s Asian session takes clues from the market’s cautious mood ahead of the key US inflation data, as well as mixed concerns surrounding China.

Headlines from the Financial Times (FT) suggest mixed views over US President Joe Biden’s chip plan that challenges China to seem to weigh on the XAU/USD buyers. On the same line, Chinese President Xi Jinping’s aim to reassert Beijing’s influence during the first foreign trip after covid-led lockdowns underpins the cautious mood as it could escalate the US-China tension.

It’s worth noting that China’s return from the long weekend and its status as among the world’s biggest gold consumers highlight a cautious mood, as well as profit-booking, during the Asian session.

Alternatively, hopes of softer inflation appear to defend the XAU/USD bulls. That said, US Consumers saw inflation at 5.75% over the next 12 months in August, down from July’s 6.2%, as well as the lowest since October 2021, as per the New York Fed's monthly consumer expectations survey details released on Monday. Further data shared by Reuters suggest that the three-year inflation expectations marked the slowest pace since late 2020 while averaging 2.8% versus 3.2% reported in July.

Against this backdrop, the US 10-year Treasury yields retreat from a three-month high, down two basis points (bps) to 3.34%. Even so, S&P 500 Futures and the stocks in the Asia-Pacific zone print mixed performance by the press time.

Looking forward, US Consumer Price Index (CPI) data for August, expected to ease to -0.1% MoM versus 0.0% prior, will be important for fresh clues. Should the data renew reflation woes, the further downside of the XAU/USD can’t be ruled out.

Technical analysis

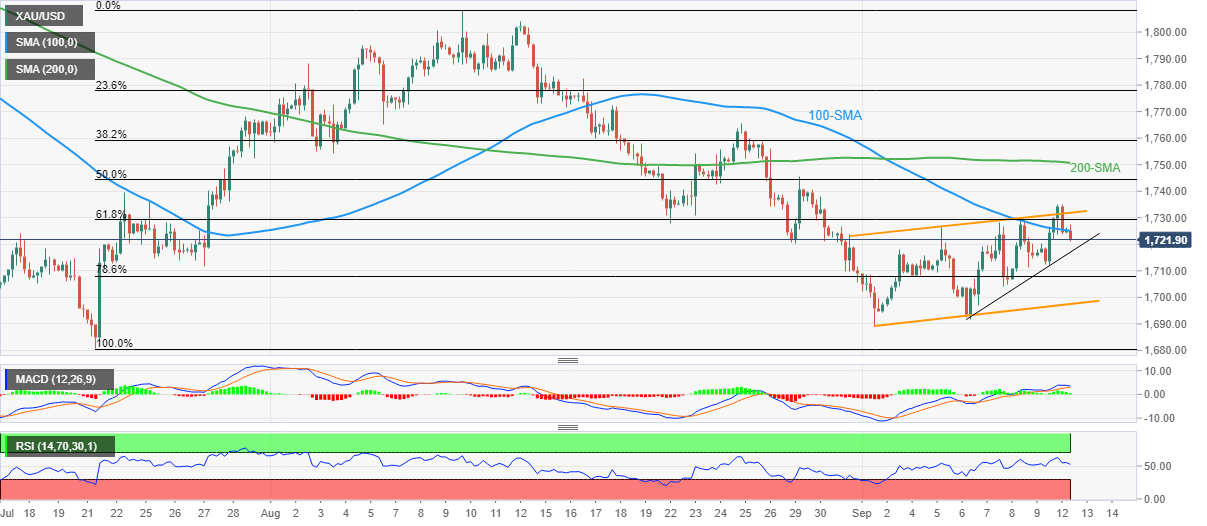

Gold price drops back below the 100-SMA while reversing from a one-week-old ascending trend channel’s resistance line. The pullback moves join the impending bear cross of the MACD and RSI retreat to keep sellers hopeful.

However, a one-week-old support line, near $1,717, restricts the immediate downside of the XAU/USD, a break of which could direct bears towards the stated channel’s support line, close to $1,697 at the latest.

It’s worth noting that the gold price weakness past $1,697 won’t hesitate to challenge the yearly low surrounding $1,680.

Meanwhile, recovery moves will initially jostle with the 100-SMA level of $1,725 before challenging the aforementioned channel’s top, around $1,733 by the press time. Following that, a run-up towards the 200-SMA level surrounding $1,750 can’t be ruled out.

Overall, the gold price may witness further downside but the room towards the south is limited.

Gold: Four-hour chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.