- Gold price is getting set for the key event this week.

- US Consumer Price Index's countdown has begun.

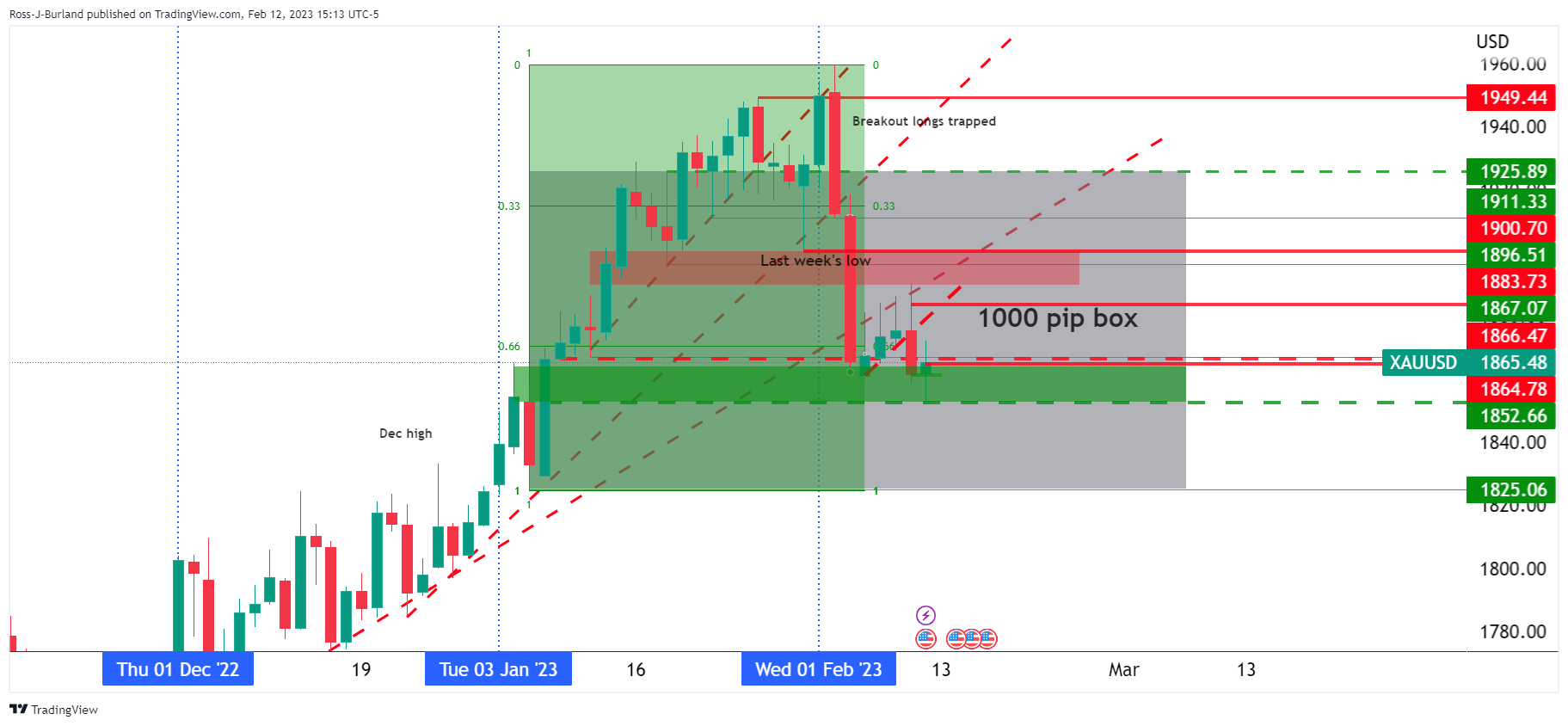

Gold decoupled from the US Dollar's trajectory on Monday, sinking at the same time as the greenback as investors get set for this week's key event in the US Consumer Price Index. However, if the CPI data were to be a dovish outcome, then the Gold price stands to benefit and should the bears be in the market heading into the data, a short squeeze could eventuate as illustrated below.

The price is currently on the front side of the bearish trend following the breakout of the symmetrical triangle on Monday as the following analysis illustrates:

Gold H1 charts

Zoomed in ...

Gold dovish and hawkish biases on US CPI

The price is currently on the front side of the bearish trend following the breakout of the symmetrical triangle on Monday. The move was a continuation of shorts from Thursday's sell-off, Day 1 shorts. The market has since picked up more supply and tested down low in the 100 pip box near $1,850.

There are prospects of a move lower from the 50% mean reversion of the prior bearish impulse while on the front side of the dynamic resistance and ahead of the US CPI data. A target for the bulls would be the opening balance highs near $1,865.

Meanwhile, on an uber-hawkish outcome of the data, the $1,825 target is exposed on a break of $1,850:

If this were to play out off the bat, it would complete that prior analysis thesis as posted over the past few weeks in a running commentary on the market structure:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD turns lower below 1.0350 after German data

EUR/USD comes under mild selling pressure and eases below 1.0350 in the European session on Wednesday. The pair bears the brunt of an unexpected slowdown in the German manufacturing sector, as the nation's Retail Sales data fail to inspire the Euro. Focus shifts to US ADP data and Fed Minutes.

GBP/USD stays defensive below 1.2500 ahead of key US data, Fed Minutes

GBP/USD stays defensive below 1.2500 in the European trading hours on Wednesday, undermined by a risk-off market sentiment and elevated US Treasury bond yields on increased hawkish Fed bets. Traders look to US data, Fedspeak and FOMC Minutes for fresh trading impulse.

Gold price sticks to modest gains; upside seems limited ahead of FOMC Minutes

Gold price (XAU/USD) sticks to modest intraday gains through the first half of the European session on Wednesday, albeit it lacks bullish conviction and remains below the $2,665 resistance zone retested the previous day.

ADP Employment Change set to show US job growth slowing in December, Fed unlikely to alter plans

The ADP Employment Change will likely have a limited impact on financial markets. The US private sector is expected to have added 140,000 new positions in December.

Five fundamentals for the week: Nonfarm Payrolls to keep traders on edge in first full week of 2025 Premium

Did the US economy enjoy a strong finish to 2024? That is the question in the first full week of trading in 2025. The all-important NFP stand out, but a look at the Federal Reserve and the Chinese economy is also of interest.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.