Gold Price Forecast: XAU/USD sees a downside towards $1,700 on lower consensus for US Inflation

- Gold price is expected to drop to near $1,700.00 on a breakdown of Ascending Triangle.

- Lower consensus for US CPI is resulting in a sell-off in the precious metal.

- The headline US CPI is seen lower at 8.1% vs. 8.5% reported earlier.

Gold price (XAU/USD) is witnessing a steep fall after refreshing intraday’s low at $1,712.96. The precious metal is facing a sell-off heat to lower consensus for the US Consumer Price Index (CPI). The yellow metal is expected to continue its vulnerable performance and will decline towards the psychological support of $1,700.00.

As per the market estimates, the US inflation will land at 8.1%, 40 basis points lower than the prior release. The households in the US economy are facing the headwinds of soaring price pressures for a prolonged time. They are forced higher payouts on similar quantities purchased. As gasoline prices have fallen dramatically and the rising interest rates by the Federal Reserve (Fed) have started doing their job perfectly now, price pressures are experiencing exhaustion signals.

It is worth noting that gold is considered an inflation-hedged asset and a lower consensus for inflationary pressures is forcing the market participants to ditch the yellow metal.

Meanwhile, the US dollar index (DXY) has turned sideways as a lower consensus for the headline CPI figure will force the Fed policymakers to trim their hawkish tone.

Gold technical analysis

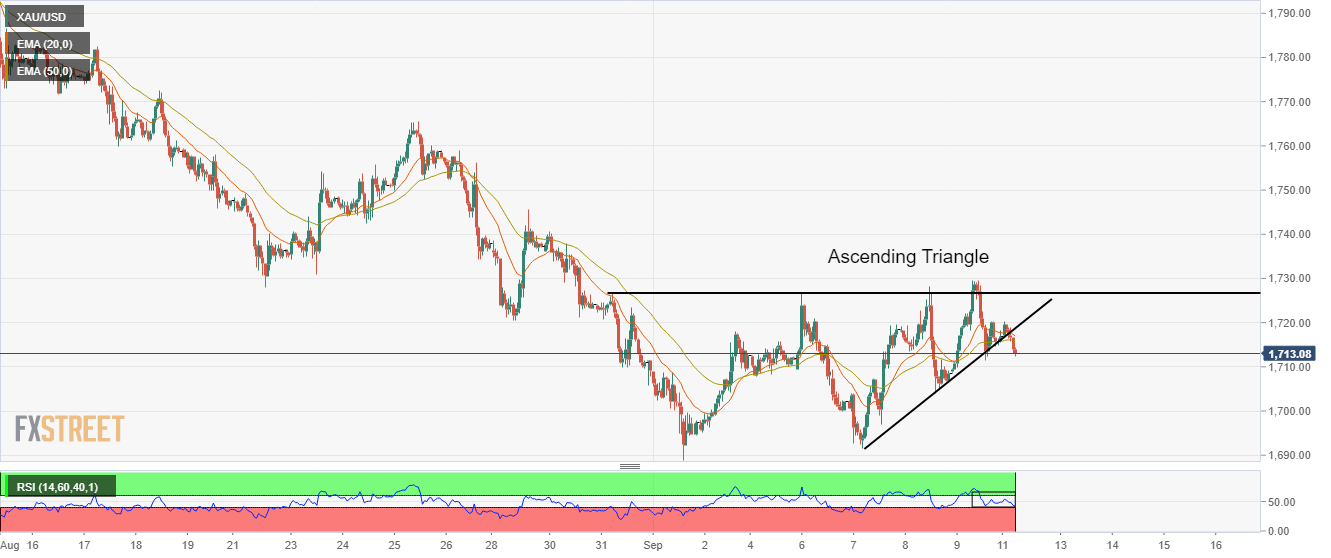

Gold price has dropped below the Ascending Triangle pattern whose upward-sloping trendline is placed from Wednesday’s low at $1,694.31 while the horizontal resistance is August 31 high at $1,726.62. The 20-and 50-period Exponential Moving Averages (EMAs) are overlapping to each other, which indicates a sideways move ahead.

Also, the Relative Strength Index (RSI) (14) is oscillating in a 40.00-60.00 range, which supports a consolidation ahead.

Gold hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.