- Gold price takes offers to renew intraday low, reverses from monthly top.

- US dollar traces sluggish yields, dicey market sentiment ahead of US CPI for July.

- Softer US inflation can join technical details to favor XAU/USD bulls targeting $1,805.

Gold price (XAU/USD) reverses the from the monthly top, snapping two-day uptrend, as the sellers attack the $1,790 mark during early Wednesday morning in Europe. In doing so, the precious metal portrays the market’s anxiety ahead of the US inflation statistics, amid increasing hawkish bets on the US Federal Reserve’s (Fed) next move.

Other than the pre-CPI caution, the fears of economic slowdown also weigh on the XAU/USD prices. That said, fears of economic slowdown escalated after Russia announced a stoppage of oil flow, due to a halt in the Druzhba pipeline supplying the black gold. “Russia reportedly suspended oil flows via the southern leg of the Druzhba pipeline, amid transit payment issues,” said Reuters.

On the other hand, chatters that the US tax, climate and health-care bill won’t be able to tame recession woes, as per JP Morgan, also weigh on the bullion prices. “The bill passed the Senate on Sunday and is headed for the House on Friday, puts a slimmed-down version of President Joe Biden’s domestic agenda on a path to becoming law after a year of Democratic infighting that the White House was unable to control,” said analysts from the US bank per Bloomberg.

Elsewhere, firmer prints of the second-tier US data and hawkish Fedspeak also played their role in marking the risk-off mood and challenging the XAU/USD buyers.

On Tuesday, US Nonfarm Productivity improved to -4.6% during the second quarter (Q2), -4.7% expected and -7.4% prior, whereas the Unit Labor Cost increased to 10.8% from 12.7% prior and 9.5% market consensus during the said period. Additionally, St. Louis Fed President James Bullard said on Tuesday that he wants rates at 4% by the end of the year. This joins recently firmer interest rate futures suggesting nearly 70% odds favoring the 75 basis points (bps) of a Fed rate hike in September.

Against this backdrop, the US 10-year Treasury yields struggle to extend the previous day’s rebound to 2.79%, around 2.786% by the press time. Also portraying the sluggish market is the S&P 500 Futures that remains unchanged at 4,125 at the latest, despite Wall Street’s losses.

Moving on, the US CPI, expected to ease to 8.7% from 9.1% on YoY, as well as the CPI ex Food & Energy which is likely to rise from 5.9% to 6.1%, will be crucial for gold traders to clear directions.

Technical analysis

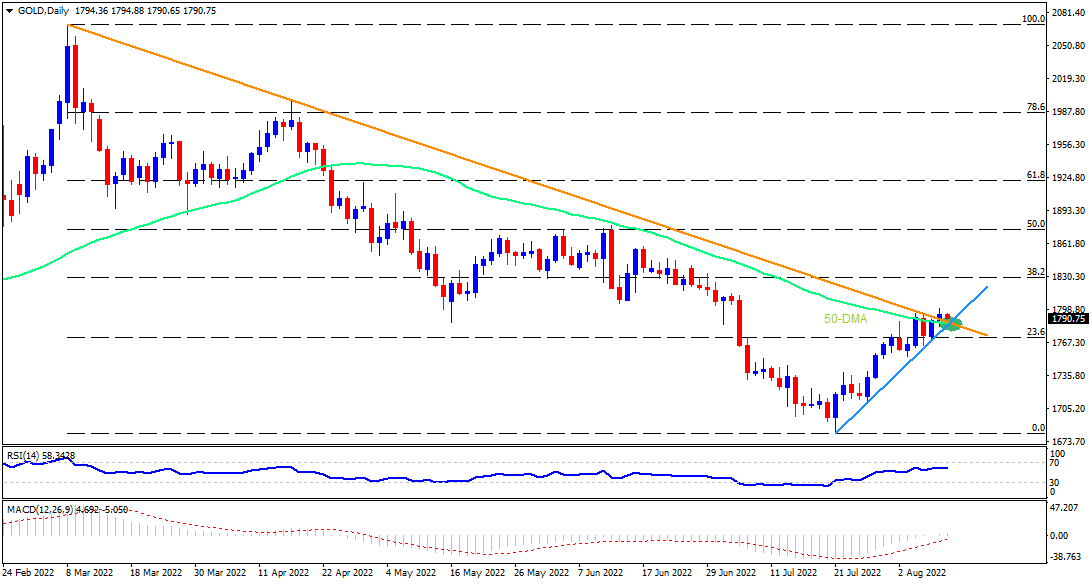

Gold price remains above the $1,785 support confluence despite the recent pullback from a one-month-high. Also teasing the XAU/USD buyers is the firmer RSI (14), not overbought, as well as bullish MACD signals.

That said, the 50-DMA joins the previous resistance line from March and a three-week-old ascending trend line to highlight the $1,785 as crucial support, a break of which could quickly drag the metal prices towards the previous weekly low near $1,754.

On the contrary, June’s bottom surrounding $1,805 could lure XAU/USD buyers during the quote’s fresh upside moves. Following that, the 38.2% and 50% Fibonacci retracement levels of the March-July downturn, close to $1,830 and $1,875 in that order, might gain the gold bull’s attention.

Overall, gold is likely to remain firmer until the quote stays beyond $1,785.

Gold: Daily chart

Trend: Further upside expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD bounces off 1.1300, Dollar turns red

After bottoming out near the 1.1300 region, EUR/USD now regains upside traction and advances to the 1.1370 area on the back of the ongoing knee-jerk in the US Dollar. Meanwhile, market participants continue to closely follow news surrounding the US-China trade war.

GBP/USD regains pace, retargets 1.3200

The now offered stance in the Greenback lends extra support to GBP/USD and sends the pair back to the vicinity of the 1.3200 hurdle, or multi-day highs, amid a generalised better tone in the risk-linked universe on Monday.

Gold trades with marked losses near $2,200

Gold seems to have met some daily contention around the $3,200 zone on Monday, coming under renewed downside pressure after hitting record highs near $3,250 earlier in the day, always amid alleviated trade concerns. Declining US yields, in the meantime, should keep the downside contained somehow.

Six Fundamentals for the Week: Tariffs, US Retail Sales and ECB stand out Premium

"Nobody is off the hook" – these words by US President Donald Trump keep markets focused on tariff policy. However, some hard data and the European Central Bank (ECB) decision will also keep things busy ahead of Good Friday.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.