Gold Price Forecast: XAU/USD retreat post-Fed minutes as Greenback hits new high

- Gold slumps to two-week low after Fed minutes show no dovish tilt, despite acknowledging inflation progress.

- XAU/USD struggles with over 1% loss as US Dollar Index surges 1.11%, reflecting robust USD performance.

- Market eyes upcoming US ADP Employment data, Jobless Claims, and PMIs, with focus on December's Nonfarm Payrolls report.

Gold price slid during the last hour on Wednesday after the US Federal Reserve (Fed) released December’s meeting minutes, which didn’t deliver any dovish hints. Therefore, the Greenback resumed to the upside and reached a new 11-day high before retracing somewhat. At the time of writing, XAU/USD is trading at $2040 per troy ounce, down by more than 0.90%.

Gold prices to remain pressured as Fed officials didn’t discussed about rate cuts

The minutes suggest most of the Fed officials see rates are likely or near their peak, though “a number of participants highlighted uncertainty around how long restrictive policy would need to be maintained.” Even though participants observed progress on inflation, core services are still elevated. It should be said that several participants might want to keep rates at current levels longer than they currently anticipate.

Given the backdrop, Gold slumped to a new two-week low at around $2030.30 before jumping $6.00, to $2036, but it remains changing hands with losses of more than 1%. At the same time, the US 10-year Treasury bond yield fell two basis points, though it clings to the 3.90% threshold, while the US Dollar (USD), as measured by the US Dollar Index (DXY), gains 1.11%, sits at 102.45.

Earlier, economic data revealed by the Institute for Supply Management (ISM) showed that Manufacturing activity remained at a recessionary level for 14 straight months, while the JOLTS report revealed by the US Department of Labor showed the jobs market is cooling down.

Meanwhile, expectations for rate cuts by the Fed remained unchanged for December 2024, with market players betting the US central bank would slash rates by more than 150 basis points.

Ahead of the week, the US economic docket will feature the ADP Employment Change report, followed by Initial Jobless Claims and Flash PMIs revealed by S&P Global; all the data will be announced by Thursday. After that, Gold traders' focus will shift towards the December Nonfarm Payrolls report.

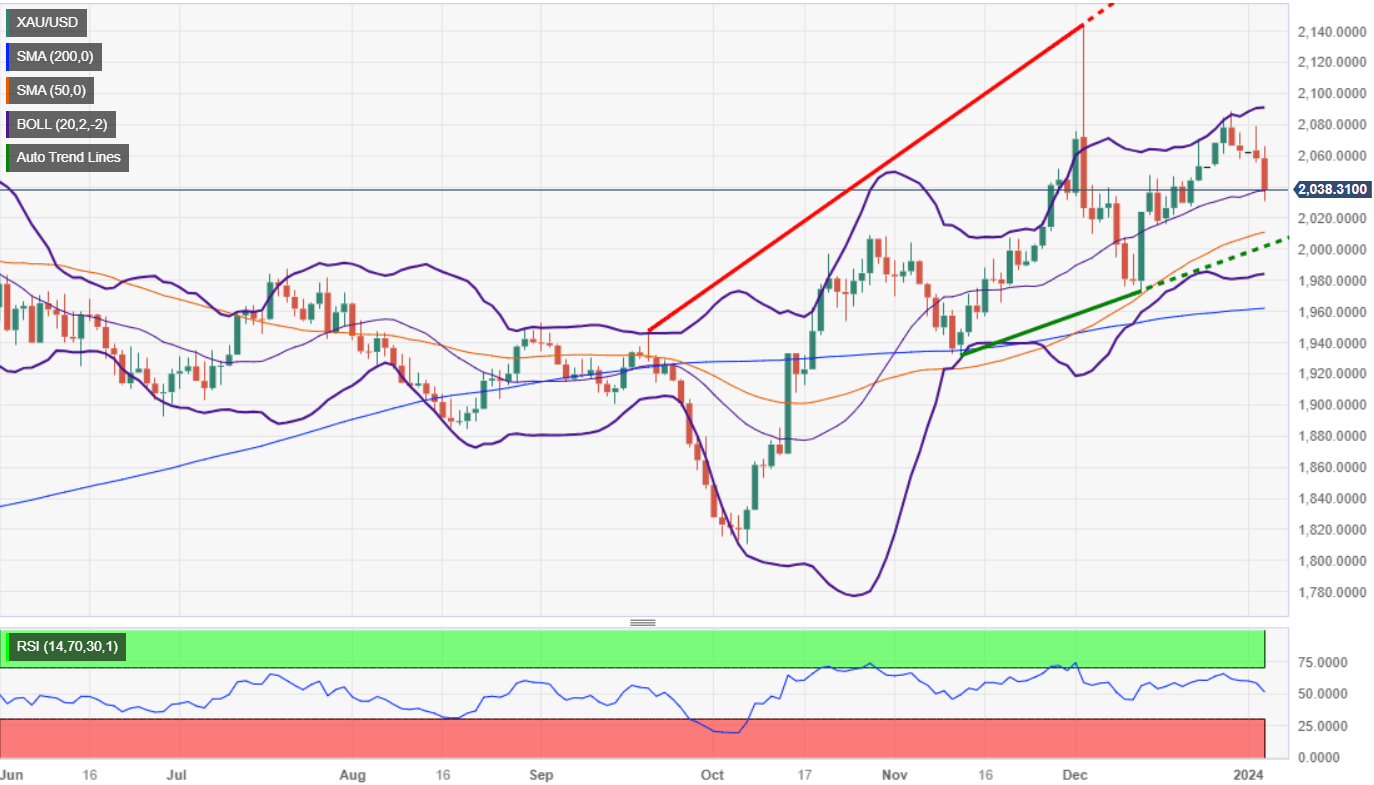

XAU/USD Price Analysis: Technical outlook

Even though the technical picture suggests the yellow metal remains bullish, a drop below the confluence of the October 27 cycle high of $2009.42 and the 100-day moving average (DMA) around that area would pave the way for testing the $2000 threshold. A breach of the latter would expose the December 13 swing low of $1973.13.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.